We’re now approaching the end of the half-year results season. In the past, I’ve not covered results from companies in my rules-based SIF portfolio. In keeping with my hands-off approach, I’ve usually avoided any review of a stock’s performance until the end of its nine-month holding period.

However, I’m considering providing additional coverage of the performance of shares while they are still in the portfolio. There are a couple of reasons for this.

The first is that many companies have faced unprecedented challenges and headwinds this year. There’s a real sense of uncertainty about how many businesses are performing, something that’s not always true.

The second reason is that my approach is becoming somewhat more active than in the past. For example, I’ve recently introduced a stop-loss rule and also have a policy of selling after a profit warning.

I know that many of you follow company news quite closely, so I’d be interested to hear your views on this - should I provide more consistent coverage of news from stocks in SIF?

This week I’m going to trial this new format by taking a look at last week’s half-year results from construction group Morgan Sindall. This FTSE 250 stock fell by more than 50% in February and March, as investors feared the worst. Four months later, most parts of the business are back in operation. I think it’s a good time to take a fresh look.

Morgan Sindall (LON:MGNS): still a sector winner?

(Original buy report: 03/03/2020)

I’ve been following this construction and regeneration group since I held the shares in SIF in 2017, when it delivered a total return of 59% in nine months. I don’t expect a repeat performance this time round - Morgan Sindall’s share price has fallen by nearly 30% since I bought the shares for the portfolio in early March.

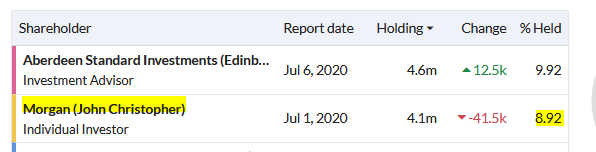

However, I remain of the view that this firm is one of the best operators in this sector. I’m in no doubt that one reason for this is the presence of owner-management -- founder John Morgan remains in the hot seat and controls 9% of the stock.

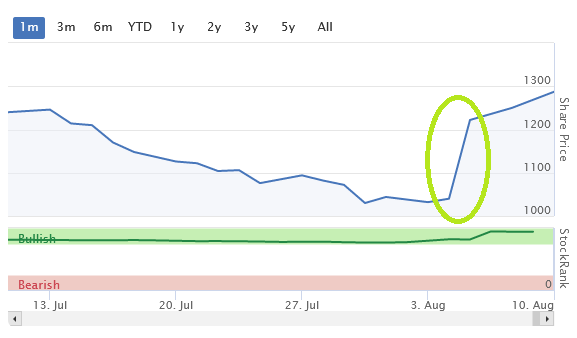

Last week’s half-year results received a warm reception, lifting the stock 17.5% in one day and boosting the firm’s StockRank to 94: