Most FTSE 350 companies especially appear to go out of their way to cluster their half-year results in the same few weeks of the summer and also on the same few days of each week (Tuesday-Thursday).

I don’t know why corporate bosses are so keen to engage in such groupthink, but I guess there’s safety in numbers. This schedule also ensures that execs’ weekends are not ruined by preparing results or dealing with their aftermath. For hard-pressed analysts and investors faced by a tidal wave of results, it’s not such a favourable setup.

Moving on, last week’s review of Morgan Sindall’s half-year report seemed to generate some interest. So this week I’m going to continue my review of recent results from SIF portfolio stocks with a look at the latest numbers from FTSE 250 temporary power group Aggreko.

Aggreko (LON: AGK)

(Original coverage: 10/12/2019)

The SIF Folio’s rules-based decision in December to buy shares in temporary power provider Aggreko has turned out to be historically badly timed. Since then, the world economy has slumped, triggering a slump in energy demand. Major events such as the Olympics have been postponed. And the oil and gas sector - an important client - has crashed.

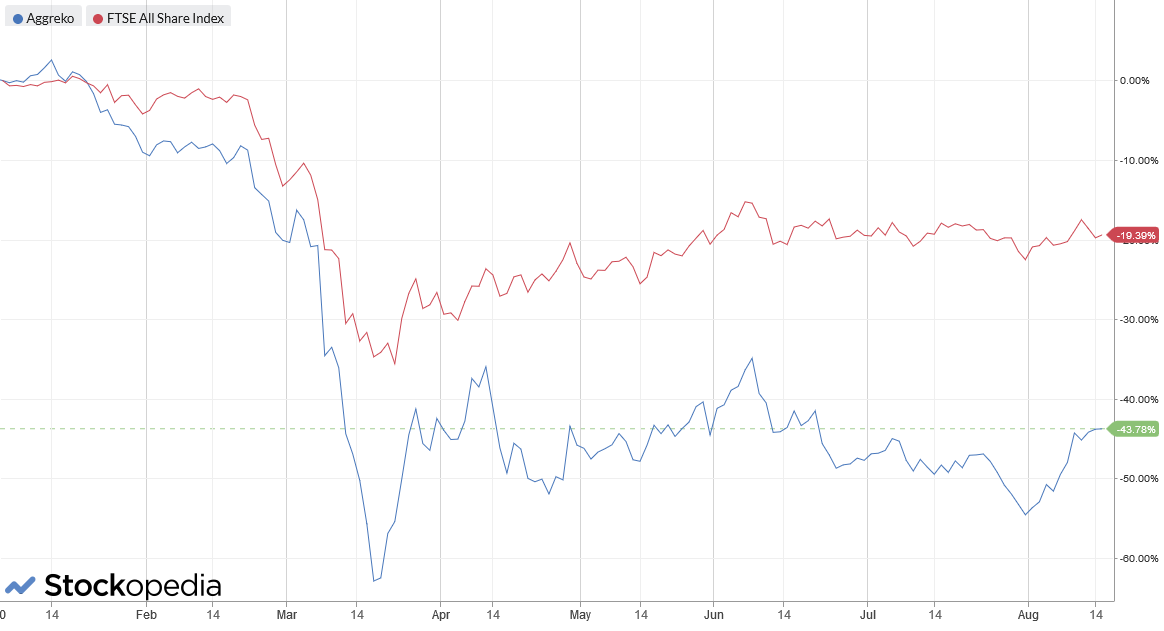

Of course, none of these was obvious in December. But the result is that the folio’s holding in Aggreko is down by more than 40%. The shares have not participated in the general market recovery seen since March. Investors appear to be pricing in a prolonged slump in demand for the firm’s hire fleet of generators:

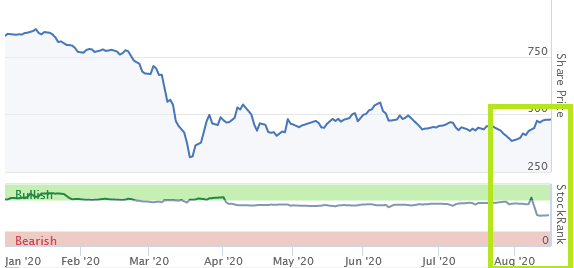

Stockopedia’s algorithms have also cooled on the stock this year. Aggreko’s StockRank was cut again after the algorithms digested its half-year results:

So what can we learn from Aggreko’s half-year figures for the six months to 30 June? I think they show a mixed picture.

Underlying performance: The firm’s continuing operations aren’t doing too badly despite the varying impact of COVID-19 across different sectors.

Revenue down by 12% to £667m

Underlying operating profit down 15% to £64m

Underlying pre-tax profit down by 13% to £47m

Impairment charges totalling £181m

Statutory pre-tax loss of £134m for the half-year period

Dividend - the interim dividend has been cut from 9.4p to 5p per share

Net debt reduced from £584m at 31 December 2019 (1x EBITDA) to £499m at the end…