UK housebuilders' have enjoyed a decade-long run of government subsidies and policy support aimed at propping up prices. Whenever there’s been any risk of the market grinding to a halt or - heaven forbid - prices falling, the government has pumped in some cash.

With no apparent irony, measures such as Help to Buy, the stamp duty holiday and now the Chancellor’s 95% mortgage guarantee are billed as helping affordability. As far as I can see, all they actually do is inflate prices and increase buyers’ ability to make highly-leveraged purchases.

From what I can see the main beneficiaries are the big housebuilders. Companies such as FTSE 100 group Persimmon (LON:PSN) have been able to generate a 30% return on capital in recent years. That seems exceptional to me, given the semi-commoditised nature of their products.

I covet the cash-backed 8% dividend yield available from stocks such as Persimmon. But I’m concerned about the unpredictable nature of government incentives and the wider risk of a housing market crash.

However, in my role as the virtual manager of the rules-based SIF fund, I’m not allowed to take subjective macro views on stocks. I must follow the numbers.

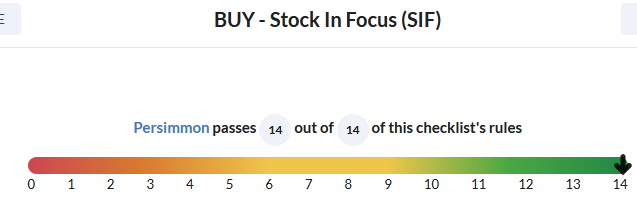

The numbers tell me that Persimmon passes all of my screening tests with flying colours.

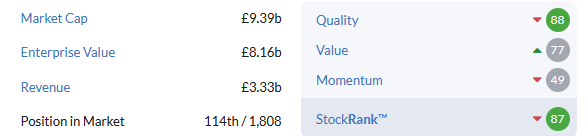

Stockopedia’s algorithms rank the the stock highly too, although with some possible weakness in momentum:

Should I add the stock to SIF this week? I’ve been taking a closer look at this housebuilder’s factor scores to understand more.

Value: profits vs assets

Persimmon’s ValueRank of 77 suggests the shares may be quite affordably valued. This seems to be true when the shares are valued relative to last year’s pandemic-hit earnings and dividend:

2020 P/E: 14.7

2020 dividend yield: 3.8%

Earnings yield (EBIT/EV): 9.6%

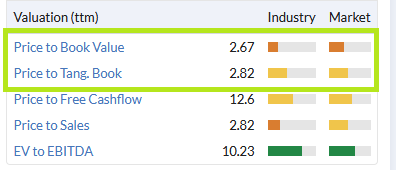

However, this is essentially a property company, so I think it’s important to look at asset-backed measures of value. Here the picture is more mixed.

Net asset value per share was 1,102.7p at the end of 2020. With the shares trading at c2,900p,this gives the stock a price/book ratio of 2.7. This valuation may be justified by Persimmon’s high profit margins, but I can’t forget the cyclical risk here.

I would say the stock looks fully priced relative to assets, a view echoed by Stockopedia’s valuation graphic: