It looks like parts of the UK could face regional lockdowns in the coming days and weeks. Other European countries are also suffering a second wave of coronavirus - in some cases more severe than the first time round.

Against this backdrop, I’d imagine that it takes a certain confidence to reinstate dividend payments and restore staff to full working hours. These measures were announced by recruitment group Robert Walter (LON: RWA) last week, when it reported an improved third-quarter performance and a net cash balance equivalent to 46% of its market cap.

Recruitment is a notoriously cyclical business and most decent listed firms operate with plenty of cash. But the tone of the group’s third-quarter update did seem encouraging to me. I’m also attracted to the group’s sizable exposure to the Asia Pacific region, which has historically provided around 40% of net fee income.

Asia was hit first by coronavirus and I’m pretty sure it will be the first region to recover. Walters’ commentary supports this view, noting “early signs of improvement particularly across our Asia Pacific business”.

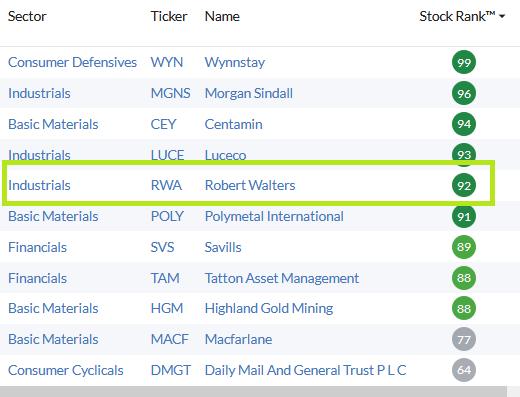

I haven’t been able to add a stock to my rules-based SIF Folio for four weeks. This allows me to consider stocks from my relaxed screening results, which you can see here. This screen takes a slightly more lenient view on valuation and growth to broaden the opportunity set for the portfolio.

With a StockRank of 92, Robert Walters comes close to the top of my relaxed screen’s results and doesn’t hit any diversification issues. I’m attracted to the idea that the company could provide UK investors with early exposure to an Asian recovery. This week I’m going to take a closer look at these shares as a potential buy.

Cash-backed value

Recruitment stocks tend to look cheap and be cash generative, and Robert Walters is no exception:

It’s worth noting that the company’s book value is bolstered by a lot of cash. The half-year balance sheet showed cash and equivalents of £133.4m, offset by just £14.4m of borrowing. Although the statutory net debt figure of £46.8m includes £72m of lease liabilities, I don’t see these as a concern given that the group remains profitable and cash generative.

Robert Walters also scores highly on another key metric which forms part of the ValueRank…