It’s been a while since I’ve owned a banking stock in SIF. But I feel that there are some attractive valuations in this sector at the moment, so I’m happy to be able to have a look at a lesser-known banking stock this week.

Secure Trust Bank (LON:STB) is a recent addition to the results of my buying screen. This £220m West Midlands-based bank is not a company that I’ve ever owned or researched in detail, but my initial impressions are favourable.

Secure Trust uses a traditional savings and loan banking model. Savings are collected from retail customers and loaned to retail and business clients through a mix of asset-backed, property and vehicle loans. The bank has 1.5m customers, £2bn in customer deposits and £2.4bn in loans.

Until 2016, Secure Trust was controlled by AIM-listed private bank Arbuthnot Banking. However, Arbuthnot sold a 33% stake in STB in 2016, ceding control of the business. Arbuthnot has continued to sell down its stake since that time and now controls just 4.4% of STB stock.

Why I’m interested

I’m looking at Secure Trust Bank for the SIF folio because it passes all my screening tests, and does not duplicate any of the portfolio’s existing stocks. But I’m glad to have the opportunity to do this, because I believe that last year’s crash has left some of the UK’s smaller listed banks trading at attractive levels.

Recent years have seen specialised lending banks such as Paragon Banking, OneSavings Bank, Close Brothers (disclosure: I hold) and Secure Trust generating much higher returns on equity than the big FTSE 100 banks.

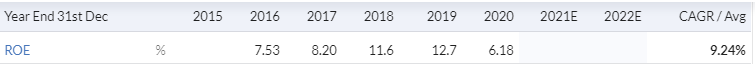

In this case, the Stockopedia data indicate that Secure Trust has generated an average return on equity of 9.2% since 2015, including 2020.

In contrast, Lloyds has averaged just 5.2%. Barclays has achieved an average RoE of just 2.4%, despite (because of?) its legion of highly-paid investment bankers.

I suspect the smaller banks’ lack of PPI liabilities account for some of this differential. But I think that another reason for their outperformance is that these more specialised banks can lend money more profitably than their mainstream rivals.

We can get a feel for this by comparing the banks’ net interest margins. This banking metric compares the interest rates on funding…