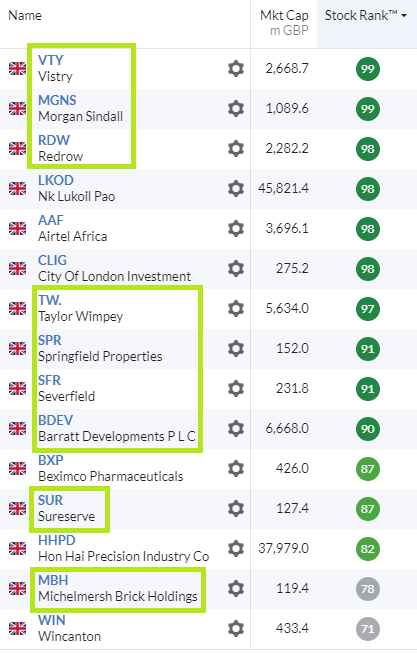

My SIF stock screen continues to deliver results that are heavily weighted towards the UK housebuilding and construction sector. In more than five years running this model portfolio, I don’t think I’ve ever seen such a concentrated set of results.

At the time of writing, nine of the 15 stocks which qualify for the screen are involved in construction or supplying building materials to the UK domestic market:

As SIF already owns shares in Persimmon (LON:PSN), I don’t intend to add any of these other stocks to the portfolio at this time. But this unusual concentration of stocks does make me wonder about the outlook for this sector. Right now, many construction-related shares look cheap and appear to have rosy outlooks. Will this still be true in 6-12 months? I’m not entirely convinced.

As always, I’m looking for new stocks to add to SIF. Excluding the nine construction-related stocks I’ve highlighted above leaves me with six potential candidates.

Two of these are foreign firms and two - Airtel Africa (LON:AAF) and Beximco Pharmaceuticals (LON:BXP) - are already in SIF. This leaves me with two remaining candidates, logistics group Wincanton (LON:WIN) and small cap fund manager City of London Investment (LON:CLIG) (I hold).

Wincanton (LON:WIN): big faller

I looked at Wincanton in August and concluded that the wafer-thin balance sheet did not truly satisfy my screening rules. I also highlighted the group’s slim profit margins and ongoing pension deficit recovery payments. Although I think that Wincanton is a market-leading business in operational terms, as an investment it’s a stock I’d only buy at a low valuation.

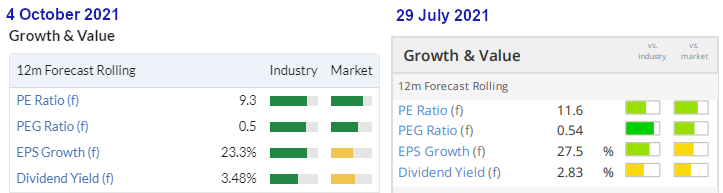

As it happens, Wincanton’s share price has fallen by nearly 20% since I wrote about the stock in August. This has brought the stock’s rolling forward P/E multiple down from 11.6 to 9.3. The rolling forecast dividend yield has risen from 2.8% to 3.5%.

If this de-rating continues I might be tempted to take a look at this stock. Although the logistics sector is facing well-known problems with driver shortages and rising costs, Wincanton said in September that…