This week I’m turning to a company that’s crossed my radar in the past, but not made it into the SIF portfolio. Renew Holdings (LON:RNWH) is a mid cap construction and engineering group.

I’d normally be sceptical about such stocks, as many have a history of low margins and periodic mishaps. But Renew operates in five specialist sectors, with a heavy bias towards essential infrastructure and regulated markets:

Rail - a wide range of essential maintenance services

Infrastructure - mobile telecoms and road network

Energy - primarily nuclear

Environmental - water infrastructure, flood alleviation and coastal defence.

Specialist building - an odd mix, including upmarket London residential refurbishments and scientific laboratories

It’s clear that much of this business is both essential and indirectly underwritten by the public sector. A number of subscribers have previously suggested to me that this business is less cyclical and higher quality than more generalist peers. Long-term shareholders have certainly done well, as the stock has 12-bagged since March 2009.

Renew comes within a whisker of passing all of my screening tests, so I’ve decided to take a closer look at this business this week.

Renew Holdings: a special case?

Although construction is generally cyclical, Renew Holdings operates in sectors with defensive characteristics. Most of its activities continued unabated last year, as they were viewed as essential. One exception was the firm’s nuclear decommissioning work, but this was merely delayed, not lost.

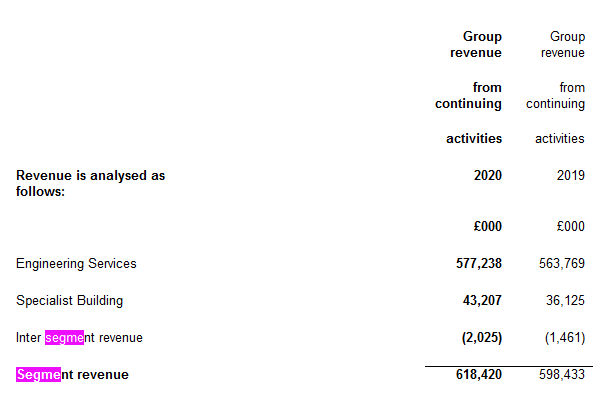

I’d like to know more about the revenue and profit generated in different parts of the business. Unfortunately, Renew does not segment its revenue to reflect its five major operating sectors. Instead, revenue and profits are split into just two segments, engineering services and specialist building. This snapshot from the 2020 results shows that 93% of revenue came from engineering services last year:

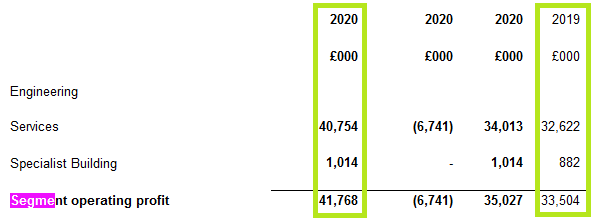

The profit split is even more extreme. Last year, 97% of operating came from engineering services. Performance in 2019 was similar:

I could probably find more granular detail on revenue if I spent time drilling into the accounts of the group’s operating subsidiaries. However, that level of analysis does not form part of the process I use for the SIF folio, so I’ll proceed without this information.

For now, I’ll just work on the assumption that the vast majority of income comes from infrastructure-type work in…

.jpg)