My SIF portfolio now has 17 holdings, which is the highest for some time. Although I’m still short of my preferred limit of 20, adding new companies is getting difficult. Many - if not all - of the stocks in the results of my buy screen are either in the portfolio already or are sector duplicates of those which are.

The most notable example of this is in the housebuilding sector. SIF already holds Persimmon, but my screening results now include Vistry, Taylor Wimpey and Barratt Developments. Construction group Morgan Sindall - which does some housebuilding - also appears.

I’m not sure if there’s some significance to having so many stocks from the same sector appear in my results. Time will tell, I guess. But I’m casting my net wider for new ideas. One stock which comes very close to qualifying for the SIF screen is legal and professional services group Gateley Holdings (LON:GTLY).

A double-bagger IPO

Gateley can trace its origins back to the 1970s, when it was a conventional partnership law firm. This situation changed in 2015 when the company took advantage of a change in UK law to abandon its equity partnership structure and become a publicly-listed company.

According to a statement on the company’s website, “a traditional partnership can encourage partners to pursue short term wins over all else without the scrutiny that being a listed business brings”.

I have to admit I’m not convinced by this argument. I always thought the benefit of an equity partnership was that it led to a sense of long-term responsibility, since partners were ultimately liable for all the firm’s mistakes.

Moving on, what I can say for sure is that Gateley’s IPO has - so far - delivered very acceptable returns for shareholders. The stock has risen by around 130% since Gateley’s flotation in 2015 and recovered rapidly from last year’s crash:

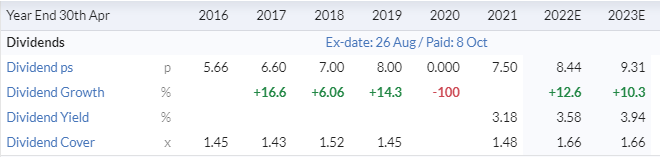

The shares have also paid a useful, progressive dividend over the same period:

Since its flotation, Gateley has continued to expand through organic growth and a series of acquisitions. Although about 90% of revenue still comes from legal work, bolt-on deals have included tax advisers, business psychologists and various property specialists.

In 2019, Gateley said it had achieved 30 years of…