My stock screen store cupboard is almost bare once again this week. But there is one new contender which could fit into my rules-based SIF portfolio.

AIM-listed Tatton Asset Management (LON:TAM) describes itself as “powering the UK’s leading financial advisers”. What this firm does is to provide discretionary fund management, a range of IFA support services and mortgage provision for IFAs. In short, it’s a complete ‘back end’ for financial advisers.

Graham looked at Tatton’s 2018 results here and a later trading statement here, where he flagged up strong growth.

The firm has just published an audited set of results for the year ending 31 March 2020, so now seems an ideal time to take a fresh look at this stock, which has performed well in the interim.

So far, so good

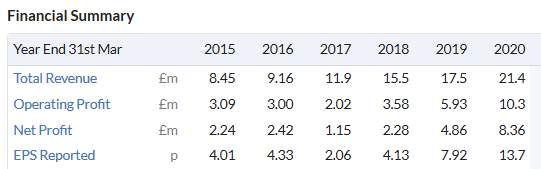

Back in 2018, Graham commented that as Tatton only floated in 2017, he feared a post-IPO mishap. It’s a common phenomenon, but so far these fears have proved unfounded:

One reason for the continued strong growth may be the presence of founder-management. TAM is led by founder and chief executive Paul Hogarth, who floated the company in 2017. Despite selling a chunk of shares in the IPO, he retains an 18.9% holding and is the firm’s largest shareholder.

We can see this information with Stockopedia’s excellent new(ish) major shareholder feature (on the Accounts menu):

The other major shareholders are all well-known institutional names. I’m encouraged to see this £160m firm already has a strong following in the City. This impression is reinforced by the make-up of the board. Tatton’s chairman, Roger Cornick, was previously chairman of (then) FTSE 100 firm Aberdeen Asset Management.

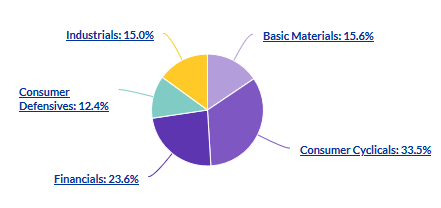

Is there space for Tatton Asset Management in the SIF Folio? At first glance, the portfolio already appears to have a big allocation to financials:

This allocation to the financial sector currently contains three stocks. The first two of these are pawnbroker H&T Group and German commercial property group Sirius Real Estate. I’m confident there’s no overlap with these.

However, the third of my existing financials is business broker K3 Capital. This is a recent addition that bears some similarities to TAM, with high margins…

.jpg)