With a general election looming here in the UK, it seems like a good week to focus on a company that generates most of its profit outside its home market.

In simple terms, FTSE 250 member Aggreko (LON: AGK) can be thought of as a company that rents out big generators to provide electricity in places where none (or not enough) is available from power grids.

In reality, the business is a bit more sophisticated than this. It supplies diesel and gas-fired generators, heating and cooling solutions, plus equipment such as loadbanks and battery systems.

Clients include emerging market power utilities, natural resources firms, remote communities and organisers of large events, such as the Olympics (Aggreko will power the Tokyo 2020 Olympics). The company also gets involved in disaster recovery situations and has a growing renewables business.

The global diversity of these operations may seem attractive, but it isn’t without risk. Recent years have seen Aggreko run into problems collecting payments from clients in markets such as Venezuela, Yemen and parts of Africa. Aggreko is also exposed to cyclicality in the oil and mining sectors, which hurt the business in 2015/16.

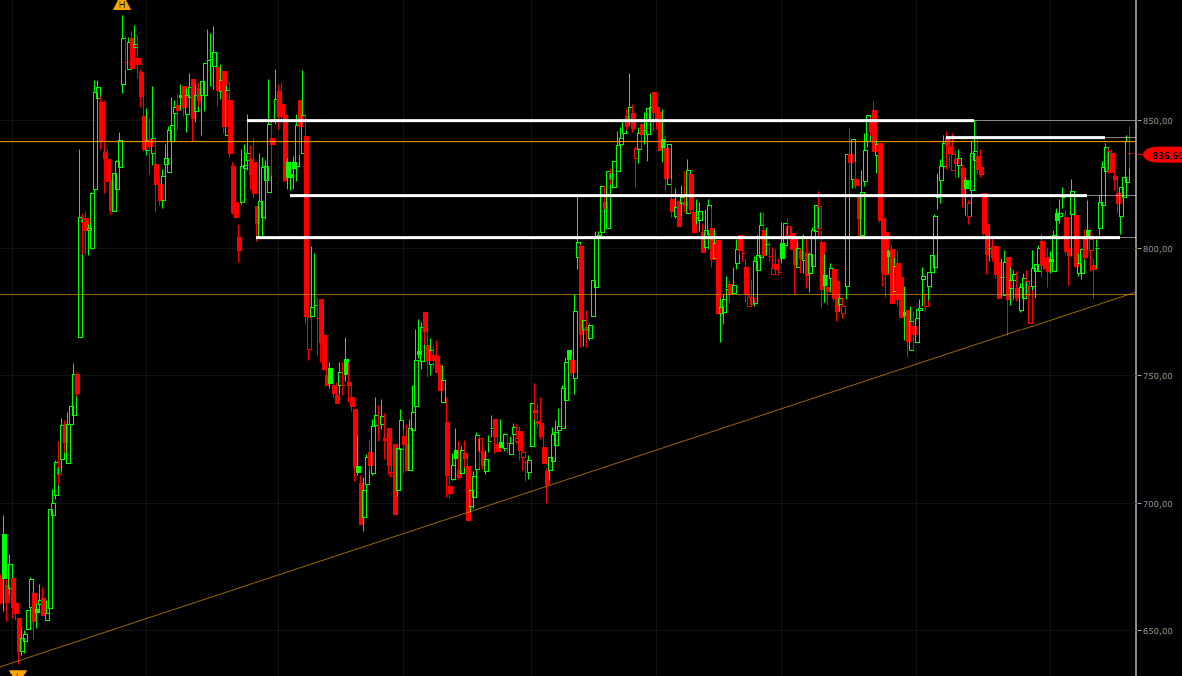

The firm’s shares remain more than 60% below the 2,200p+ highs seen under former CEO Rupert Soames in 2012, when the emerging market growth story drove the stock to record highs. The business is viewed more soberly by the market these days.

Despite this, I think that Mr Soames’ successor Chris Weston has made good progress resolving legacy problems and restructuring the business to reflect its greater maturity.

The right time to buy?

The screen-based stock selection system I use for the SIF folio often comes up with stocks that are new to me. But I’ve been following Aggreko’s turnaround for some time. I’ve come close to buying the shares on a number of occasions.

I suspect that I’ve missed the lows, but what I have seen over the last year is clear evidence that Mr Weston’s efforts are delivering improved margins, higher returns and decent cash generation. The outlook for the year ahead also seems positive, so I’m keen to find out more and to decide whether to pull the trigger on this stock.

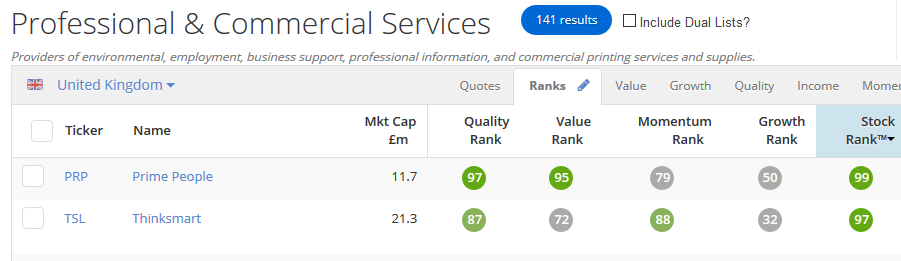

Incidentally, I should point out that Aggreko has been selected from the results of the relaxed version of my…