I take a fairly relaxed approach to diversification in my SIF folio. My focus is mainly on ensuring that the companies I select don’t duplicate my exposure to particular markets.

For example, the main reason why I ruled out Polar Capital a couple of weeks ago was because SIF already holds Tatton Asset Management. Although the two companies aren’t direct equivalents, their share price performance appears to have been closely correlated in recent years.

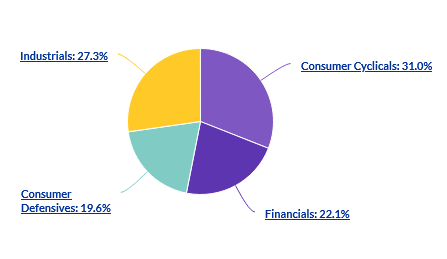

I don’t have a fixed target for the number of different sectors I want to include in the portfolio, but if pushed I’d suggest that four out of the 10 high level sectors would probably be the minimum that I’m comfortable with.

Unfortunately, the portfolio has reached that stage now:

The portfolio has shrunk to 15 stocks in recent weeks, reducing sectoral exposure. I’m not entirely comfortable with this, especially as we enter what could be an uncertain and volatile winter.

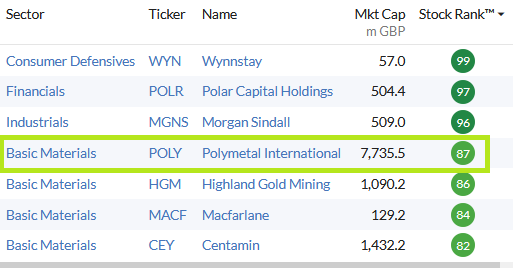

Fortunately, my SIF screen has what could be the ideal suggestion: FTSE 100 gold miner Polymetal International, which sits in the Basic Materials sector.

This was a role that should already be filled by Egypt-based Centamin. However, this FTSE 250 firm recently made a rapid exit from SIF when it breached my profit warning and stop-loss rules.

Polymetal International (LON: POLY)

FTSE 100 group Polymetal International operates a number of gold mines in Russia and Kazakhstan.

Source: Polymetal International investor presentation 15/09/20

It was founded in 1998, to “capitalise on the opportunity to revive a series of inactive assets left over from Soviet era exploration”. It’s the type of company I mentally refer to as an oligarch stock - founder Alexander Nesis’s ICT Group controls 24% of the firm, giving him a stake that’s worth £1.8bn at current levels. Since 2003, the company has been run by Mr Nesis’s brother, Vitaly Nesis.

However, Vitaly Nesis has proved an able CEO, in my view. Polymetal has been listed on the London market since 2007, during which time it’s paid a decent string of dividends, delivered significant production growth and joined the FTSE 100 on more than one occasion.

Given that ICT’s holding makes it a minority shareholder,…