The stock buying screen I use to add shares to my rules-based SIF portfolio has been going through an extended dry spell. I have not been able to add a new stock to my rules-based SIF portfolio since 23 November, when Burberry joined the fold.

This lack of supply has coincided with a run of profit taking on positions across the portfolio. As a result, SIF had a 45% cash weighting at the end of 2021. This situation has come about as a result of me following the rules, so I’m not unhappy. But I’m aware that unless the market falls sharply, my cash weighting could dampen down returns from the portfolio in 2022.

A New Year double dip

SIF’s long dry spell means that I’m able to activate my fallback plan. This allows me to relax two of the valuation criteria in my screen to widen my pool of potential buys. It’s an idea I borrowed from the legendary Jim Slater that has worked quite well for me over the last few years.

To relax my standard buying screen, I make the following changes:

Minimum earnings yield: reduce from 8% to 6%

Rolling PEG ratio: increase limit from 1.2 to 1.3

You can see the full amended screen, with current results, here.

When market conditions are buoyant, I’ve found that switching to the relaxed screen can make a big difference to my screening results. That’s true now. Only nine stocks currently qualify for my standard screen, but 19 qualify for the relaxed screen.

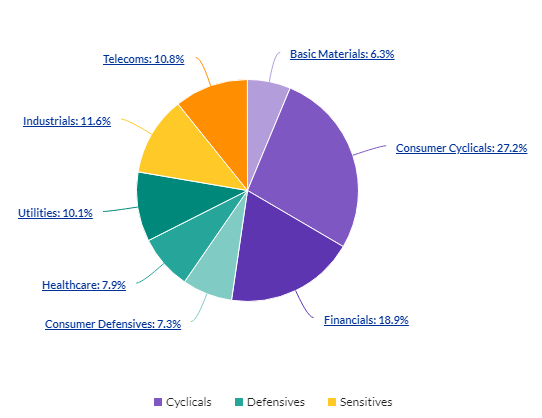

I sort my screening results by StockRank. At the top of the list are housebuilders Redrow (LON:RDW) and Vistry (LON:VTY) . But with 27% of the portfolio already invested in consumer cyclicals – including Headlam (LON:HEAD) and Vertu Motors (LON:VTU) – I am not comfortable adding further exposure to this sector.

Instead, I’m going to look at adding not one but two new industrial stocks to the portfolio, Redde Northgate (LON:REDD) and £MGAM

I don’t normally add more than one stock at a time to SIF, but there’s no rule against it. In this case, I looked at…