The stock screen I use to select shares for my rules-based SIF Folio hasn’t provided any new stocks to buy for a month. That’s not unusual in itself. What is unusual is that for much of that period, only one stock has qualified for my screen - construction group Morgan Sindall, my favourite firm in a sector I generally avoid.

I’ve been running the SIF virtual folio for nearly five years and cannot remember such a dry spell. I’m not sure what this tells me about the outlook for the stock market, but I admit to being a bit nervous. However, my general policy is to avoid macro judgements and focus on stock picks.

Morgan Sindall is already in the portfolio, so I can’t buy it again. But after four weeks without new opportunities, my rules allow me to relax my valuation criteria slightly. The purpose of this provision is to try and make sure that I don’t miss out too much in major growth markets, when stock valuations tend to become elevated across the board.

Although there’s some risk to this approach, I’m a strong believer in the adage that it’s time in the market that counts, not timing the market. So I’m willing to keep buying if suitable candidates are available.

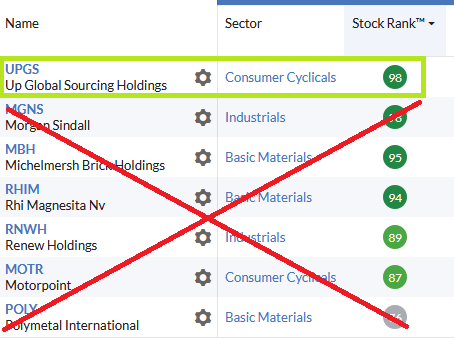

As it turns out, there is one stock that qualifies for the relaxed version of my screen and isn’t ruled out by existing holdings or diversification requirements:

Small cap Up Global Sourcing Holdings (LON: UPGS) owns a range of popular consumer goods brands. Examples include Kleeneze, Salter, Beldray and Russell Hobbs - you can see a full list here.

These products are generally affordable everyday items. I’d hope that demand would be durable in all but the worst of recessions.

UPGS also benefits from owner management (CEO Simon Showman owns 22%). Although the stock got off to a shaky start after its 2017 flotation, it’s performed well since then:

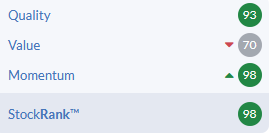

UPGS (the UP stands for Ultimate Products) has become a popular stock with private investors and is also one of Ed Croft’s 2021 NAPS picks. The Stocko algorithms like UPGS, too. It currently boasts a StockRank of 98 and Super Stock status:

There is conceivably some overlap with