Events this year have shone a harsh light on the balance sheets of listed businesses. Many companies that were previously thought to be sound have been forced to raise cash.

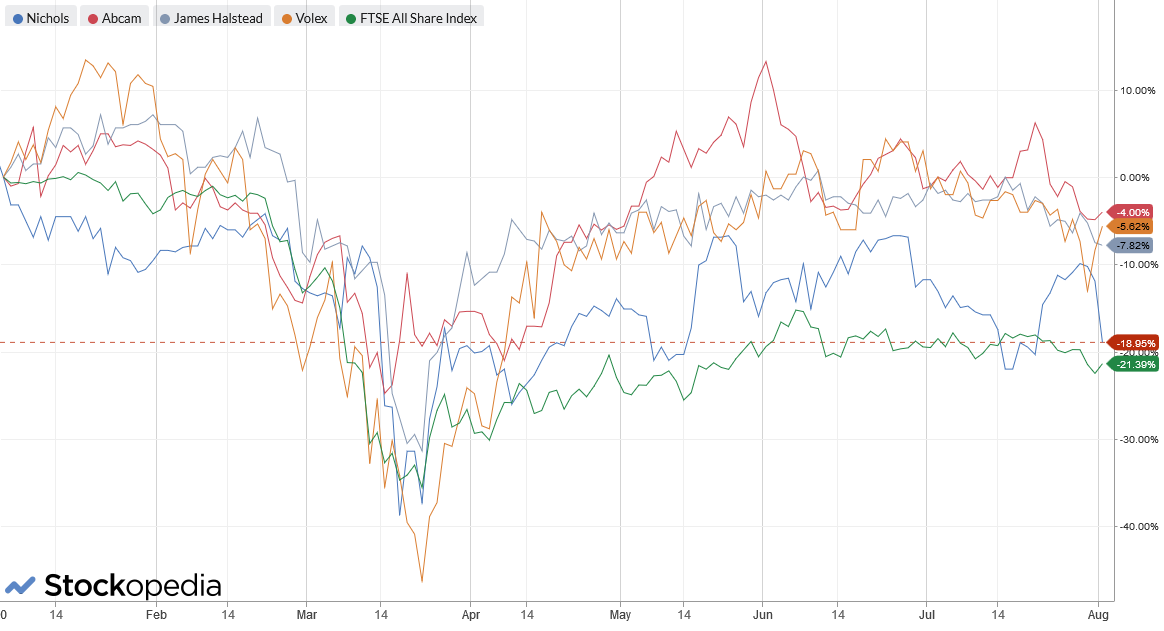

For shareholders, some of the heroes of the day have been mid-cap AIM businesses with owner management, genuinely strong balance sheets and long histories. Diverse firms such as James Halstead, Abcam, and Nichols have outperformed the market and showed no sign of distress.

These three firms operate in very different sectors (flooring, life sciences and soft drinks). But one thing they do have in common is that they rarely look cheap.

This week I want to take a look at another AIM firm that’s showing similar promise but does look potentially cheap.

Volex: wired for success?

Cable supplier Volex (LON: VLX) has been in business for more than a century. Today it makes the electrical wiring assemblies used in smartphones, computers and industrial products such as medical scanners and electric cars. According to the website, it’s one of the top two suppliers globally in this market, with a 7% market share -- so I guess it’s a fairly fragmented market.

This £200m firm recently reported “flat” revenue for the second quarter and “similar” profitability to the same period last year. It has net cash and recently confirmed the payment of its 2019 final dividend.

As Paul commented at the time, that’s a pretty credible performance for a manufacturer facing a difficult operating and commercial environment.

The owner-manager at Volex is City financier Nat Rothschild, who has owned a quarter of Volex since 2008. He decided to take a more hands-on role in 2015 and joined the board as executive chairman, rapidly ousting the previous incumbents.

Cynics might suggest that Volex is Mr Rothschild’s quest for stock market redemption, after the disastrous flotations of Indonesian coal stock Bumi and Kurdish oiler Genel Energy. Critics have also pointed to his lack of experience in the industrial cabling market. However, this story has been a fairly happy one so far.

Volex shares have tripled from their 2016 lows and are worth about 60% more than when Mr Rothschild took charge. Trading results have also improved. Although sales are down, a focus on product differentiation and margins means that profitability has improved significantly over the last…

.JPG)