It’s been a good year so far for my rules-based SIF folio, but it’s been a good year for the wider UK market too. This means that so far in 2025, SIF has been pretty much level-pegging the FTSE All Share index.

Even so, with a total return of around 17% for the first nine months of this year, I’m quite happy with the outcome to date. Maintaining this result through to the year end would make 2025 the portfolio’s third-best year since its inception in 2016.

In this review I’ll provide a run-down of performance in Q3 and review the unusually small number of trades I made during the quarter.

I’ll also provide a snapshot of the portfolio as it was on 30 September – and an update on my position sizing.

How the SIF folio works: as a quick reminder, here is a summary of the rules I use to run this portfolio:

I select shares to buy from my buying stock screen in a weekly review, adding new shares when possible, while taking into account diversification by sector and the number of existing holdings;

Shares are held for a minimum of nine months. However, if they issue a profit warning or fall by more than 25% below the portfolio’s cost price, they’re sold at the next weekly review;

After nine months, I test shares against my selling stock screen. If they pass they remain in the portfolio subject to a rolling monthly review. If they fail, they’re sold.

SIF Q3 2025 Performance Review

(For some background on Q3 performance, you can find my 2025 half-year review here.)

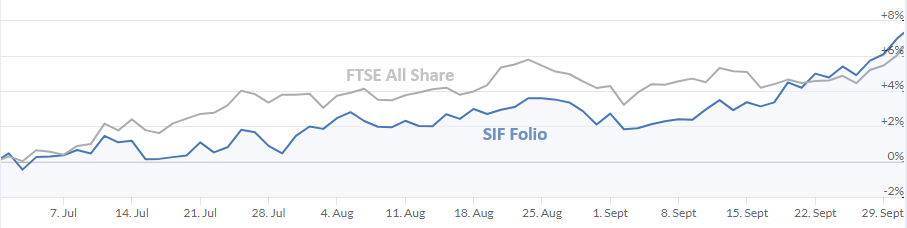

The SIF portfolio delivered a total return of 7% during the third quarter, including dividend income. This was broadly in line with the total return from the FTSE All Share (note that the chart below only shows the index’s price return, not including dividends):

Here’s how this breaks down into a split between dividends and share price gains for both SIF and its FTSE All-Share benchmark:

Q3 2025 | Price Return | Income | Total Return |

SIF Folio | 6.3% | 0.7% | 7.0% |

FTSE All-Share | 6.1% | 0.8% | 6.9% |

9M 2025 | |||

SIF Folio | 13.7% | 3.3% | 17.0% |

FTSE All-Share | 13.3% | 3.3% | 16.6% |

Taking a longer view, here’s how SIF has performed since inception in…