As I write, the sun is shining and the temperature is unseasonably high. Lockdown is starting to unwind. Is this finally the start of a return to normal, or are there more setbacks to come?

It’s too soon to be sure, but markets seem optimistic. I can think of a number of stocks in the travel, leisure and hospitality sectors that are priced at pre-pandemic levels when recent debt and equity issuance is factored in.

Checking through my portfolio records I find there are four stocks that have been in SIF for nine months or longer. This means they’re due for a monthly review against my selling criteria. The companies concerned are:

Used car supermarket Motorpoint Group (LON:MOTR)

Corporate finance firm K3 Capital Group (LON:K3C)

German commercial property firm Sirius Real Estate (LON:SRE)

Discount retailer B&M European Value Retail (LON:BME)

I’ll look at each of these in more detail in a moment. But let’s start with a look at the performance of the portfolio over the last month.

SIF Folio: March performance

The portfolio has continued to bounce around its all-time high over the last month:

However, there has been little real change since my last monthly report. SIF’s performance has been broadly in line with the wider market in March:

I’m not going to attempt to read the tea leaves on future market movements. But for what it’s worth, my feeling is that many valuations remain quite full. However, I think that some pandemic winners -- such as B&M -- are now starting to come back down to earth.

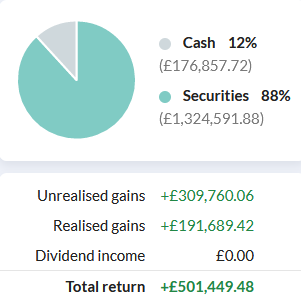

The portfolio’s cash position increased after last month’s sales of Morgan Sindall and Countryside Properties:

Finally, here’s a full list of the portfolio’s holdings on 29 March, before any transactions that might result from this review:

B&M European Value Retail (LON:BME)

This value retailer has been an excellent performer for SIF, but the stock is well down from its 600p highs. B&M has stayed open during lockdown, thanks to its essential retailer status. The company’s wide product ranges and retail park locations mean that it’s attracted shoppers who might normally have gone elsewhere.

In fairness, recent commentary from CEO and significant shareholder Simon Arora has been quite open…