The clocks may have gone back but my SIF Folio has made satisfactory progress over the last month, given the wider uncertainty we continue to face.

As it’s the end of the month, I must review stocks which have been in the portfolio for at least nine months. This month, there are three companies on the list:

Cake and bread maker Finsbury Food (LON: FIF)

Used car supermarket Motorpoint Group (LON: MOTR)

Media and events group Daily Mail and General Trust (LON: DMGT)

I’ll come to these shortly, but let’s start with a quick look at the performance of the whole portfolio.

SIF performance: October 2020

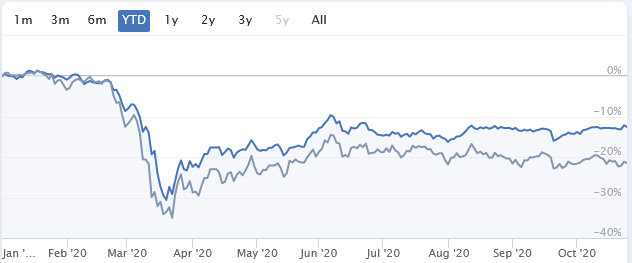

My rules-based SIF portfolio delivered a less volatile performance in October than the wider market, while continuing to edge ahead (SIF = blue, FTSE All Share = grey):

This continues the trend of modest outperformance seen so far this year:

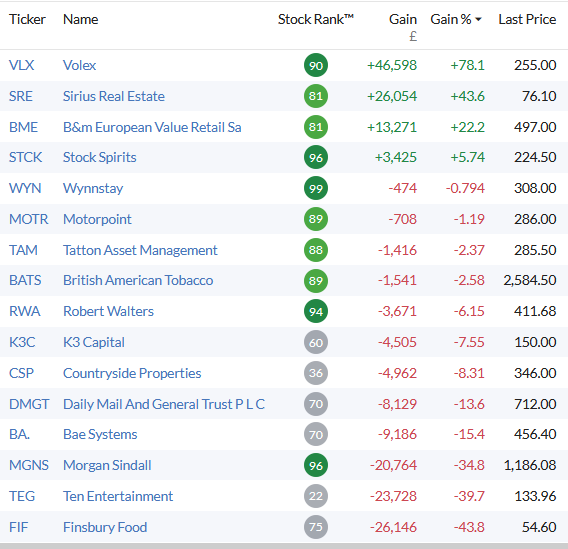

In terms of individual stock performance, it’s been a mixed bag. Nat Rothschild’s firm Volex and German commercial property group Sirius Real Estate have been the standout winners so far this year, but the jury remains out on a number of my other pandemic picks:

The biggest losing position left in the portfolio after last month’s sales is Finsbury Food. This is one of the positions up for review this week, so let’s start with this food producer.

Finsbury Food (LON: FIF)

(Original coverage: 21-Jan-2020 / FY20 results review 22-Sept-2020)

I did think that this bread-and-cake producer’s recent annual results deserved a slightly stronger show of support from the market. I covered the figures here, which I thought were reasonably in the circumstances.

As a reminder, Finsbury Food historically generated around 20% of its revenue from the foodservice (hospitality) sector. Obviously much of that has been lost this year, with a consequent impact on profits. But sales to retailers have been resilient, on the whole.

However, Finsbury’s share price has remained resolutely unloved since these results. So I’ve been wondering what I might have missed. I can see three possibilities:

The hit to profits from lower foodservice sales could last well into 2021. Perhaps I didn’t weigh this enough.

I was disappointed by the £7.5m impairment charge against the £25m acquisition of gluten-free specialist Ultrapharm in 2018. To me, this looks like…