Opinions vary about this week’s addition to the SIF portfolio, but one thing that’s certain is that convenience store operator McColl’s Retail is officially a defensive stock. As I explained last week, the portfolio is desperately short of defensive businesses. Adding McColl’s will help improve this balance, so I was pretty chuffed to spot this new addition to my screen results this week.

McColl’s started life as a vending machine operator in 1973. The shift to convenience started in 1994, when McColl’s started converting some of its Forbuoys newsagents into food stores.

The group’s current operating brands include McColl’s, Martin’s and R S McColl. The acquisition of 298 convenience stores from the Co-op in July 2016 for £117m has put McColl’s on track to have 1,000 convenience stores by the end of this year, along with more than 400 newsagents.

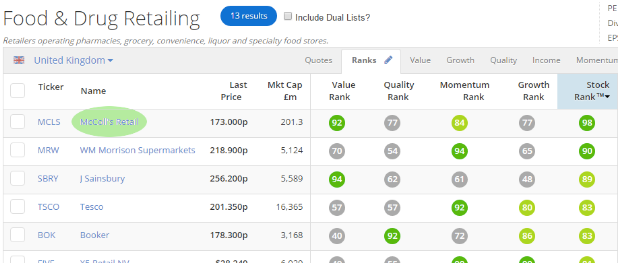

To put that in context, Tesco, the largest supermarket convenience store operator, has more than 2,000 convenience stores, while Sainsbury’s has 783. However, McColl’s lack of large format stores means that it remains a relatively small business. Annual sales are less than £1bn, and the FTSE Small Cap-listed group’s market cap is just £201.3m.

Stockopedia’s algorithms rate this low-margin business very highly, with a StockRank of 98. In fact, it’s the top-ranked stock in the Food & Drug retailing sector:

Let’s take a closer look.

Let’s take a closer look.

A value retailer

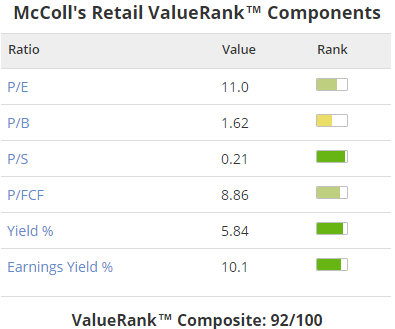

A low-margin business like this shouldn’t have a high valuation. McColl’s doesn’t. The group’s shares trade on a trailing P/E of 11, and a trailing price/free cash flow ratio of 9. There’s also a very healthy earnings yield of 10.1% and a dividend yield of 5.8%:

In my view, earnings yield (EBIT or operating profit / enterprise value) is a very useful ratio for judging how attractively valued a business is. By including net debt and excluding interest and tax, you get a direct view of how much profit a company’s operations are generating, relative to its total valuation.

The SIF screen requires an earnings yield of at least 8%, but McColl’s double-digit earnings yield suggests to me that it could be very attractively valued at current levels.

It’s also worth noting that McColl’s free cash flow yield of 11.3% (1 / 8.86) highlights the firm’s strong cash generation. Not only is the…