After a long dry spell, the Stock in Focus screen is back in action this week. There are two new qualifying stocks to consider adding to the portfolio. As this will be the last SIF column published in February, I’ll also be reviewing two stocks that have reached the end of their six-month minimum holding period.

February’s monthly review

My screen didn’t serve up many new stocks last August, thanks to the Brexit slump. So we only have two stocks to review today (each company name is linked to my original article on the stock):

- Infrastructure investment group John Laing

- Corporate travel services group Hogg Robinson

John Laing

This is the kind of stock I quite like to own in my income portfolio. Dull, long-term and capable of producing a reliable stream of dividends.

John Laing’s post-close update in December confirmed that the firm’s 2016 results are expected to be in line with forecasts. It also highlighted the pleasing diversity to this business, which owns stakes in assets such as European motorways, an Australian hospital and wind farms.

The stock has risen by 7% since joining the portfolio, but still boasts a StockRank of 92. However, 2017 forecasts suggest that earnings per share are likely to fall by 17% this year. It’s this uncertain outlook for growth that has caused John Laing to drop out of my screen. It still qualifies on all other counts. But as growth is a key part of the profile I’m looking for, John Laing will leave the portfolio this month.

Verdict: Sell

Total return: +7.9%

Hogg Robinson

Hogg Robinson’s share price performed well during its time in the portfolio. Ironically, this is the main reason for its departure. The corporate travel group’s 1-year relative strength is negative. This indicates that it’s underperformed the FTSE Small Cap index to which it belongs over the last year.

This may be because of Hogg’s monster pension deficit, which rose from £258m to £413m during the six months to 30 September. Overpayments seem limited at the moment, but clearly there’s the potential for these to become onerous if the deficit doesn’t start to fall.

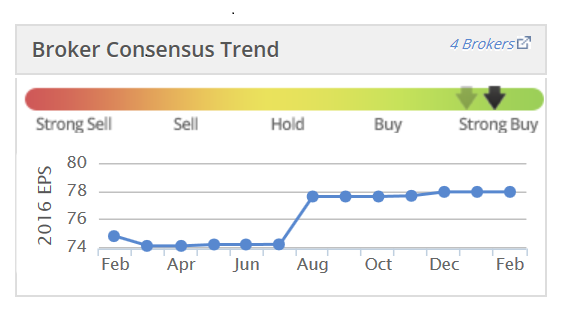

That aside, the firm’s interim results in November showed decent progress. Full-year results should meet expectations and brokers covering the firm have lifted their consensus forecasts since November:…