One of the lessons I learned last year was that when I exercised my discretion and rejected a stock from my screen results, my SIF portfolio fantasy fund usually lost money as a result.

I intend to take a more mechanical approach to buying highly-ranked stocks from my screen this year. But what about low-ranked stocks? Should I be more critical of these, because they lack the statistical support of a high StockRank?

The question of rank

Most of the stocks that qualify for my screen have stocks ranks of 75 or more. This isn’t deliberate, as I don’t use the StockRanks in my screening criteria. What happens is that my screening criteria overlap in some areas with parameters that score highly in the StockRank system.

At the time of writing, 12 of the 14 stocks which qualify for the Stock in Focus Screen have a StockRank of more than 75:

This is a fairly typical set of results, in terms of StockRank distribution. My challenge this week is that only the bottom stock on the list, Polymetal International, qualifies as a potential buy for the portfolio.

All the stocks above Polymetal in the list are either already in the portfolio or are ruled out for diversification reasons. I could stretch a point and include mining royalty group Anglo Pacific, as most of its revenue comes from coal, which doesn’t feature in the SIF portfolio. But overall, I feel I’d gain more in terms of diversity from a gold miner.

The case for gold

I broadly accept the argument that the gold market isn’t strongly correlated with the market for industrial commodities, such as copper, iron ore and coal. There aren’t really any major industrial markets for gold. It’s still bought almost exclusively for investment or for jewellery (or both).

However, with a StockRank of 44 and exposure to the unpredictable Rouble/USD exchange rate, Polymetal might not be the stock I’d choose. The potential for unwelcome surprises seems higher than it might be elsewhere.

Is this a fair conclusion? Let’s take a closer look.

Value: better than it seems?

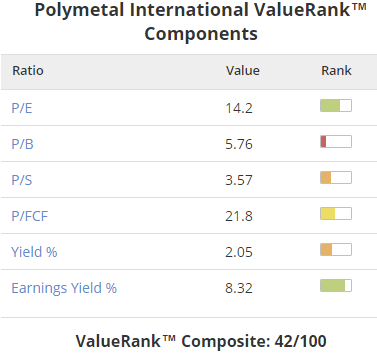

Polymetal’s ValueRank of 42 isn’t especially promising. The breakdown of this score (which you can see by clicking on the rank scores on the sector page) reveals a mixed bag of ratios:

A trailing P/E ratio of…