One of the big themes of this year’s results season has been cost cutting. Big companies that can’t generate much top line revenue growth are trimming costs in order to boost profits.

In capital-intensive industries like mining and oil, cutting costs is often seen to mean slashing capital expenditure on new projects. But there’s also another type of cut cutting that applies in all companies. Everyday operational expenses such as travel, food and consumables can provide fertile ground for axe-wielding beancounters.

Employees with a view that “it’s only £50, the bosses can afford it” tend to forget that in an organisation with 5,000 employees, £50 can easily become £250,000 or more of wasted cash. For FTSE 100 firms with tens of thousands of employees, the realisable savings can easily run into tens of millions.

The challenge to achieving this kind of low-cost operational nirvana is that controls over this kind of expenditure are often quite weak.

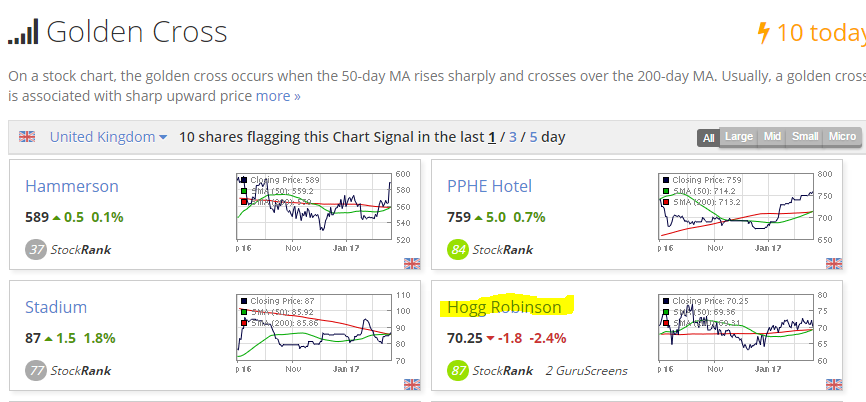

That’s where Hogg Robinson comes into play. This 170-year old small cap has two main lines of business. Corporate travel and scheduling services, plus purchasing and expense management.

Hogg Robinson’s travel business has 14,000 employees in 120 countries. The firm’s purchase and expense handling division tracks and manages more than $30bn of expenses for 155,000 organisations each year, with a growing focus on online services.

Of more interest to us is that Hogg Robinson has a StockRank of 90 and has made a reappearance in my Stock in Focus screen this week. While it’s not the perfect stock, I think this business has a number of attractive characteristics which could make it a profitable addition to the portfolio.

A free cash flow cow?

Anyone who has read Hogg Robinson’s balance sheet or Paul Scott’s past commentary will know that this stock does have one glaring weakness. As is often the case with old companies that have employed a lot of people, Hogg Robinson has a serious pension deficit. I’ll come back to this shortly.

Elsewhere, the situation isn’t too bad. Net debt fell by 39% to £33.6m last year, which equates to just 0.6 times 2016 EBITDA. Revenues have been under pressure as a result of a move towards online travel booking, but the group’s technology business, Fraedom, is growing fast. Hogg Robinson’s…