Ok, so what's the gig with #siliconvalleybank?

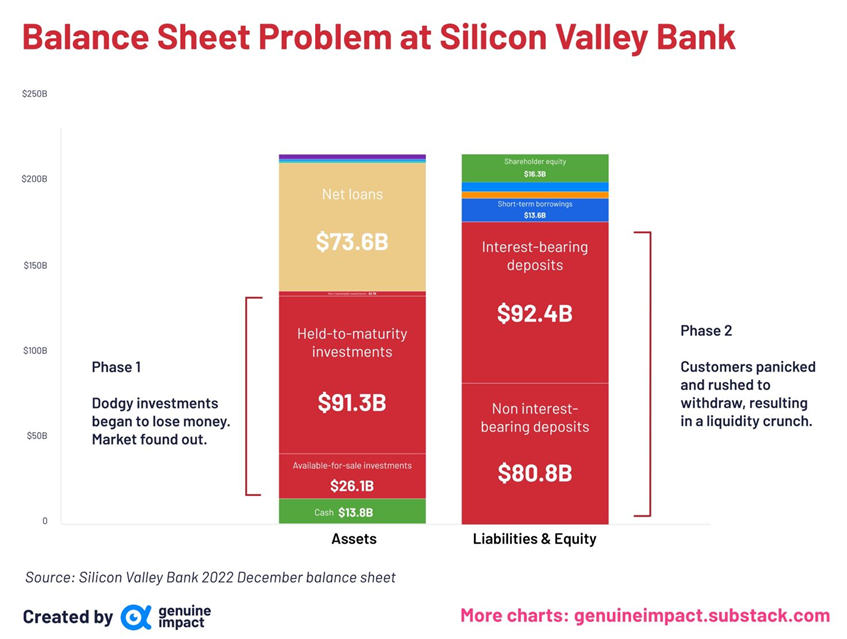

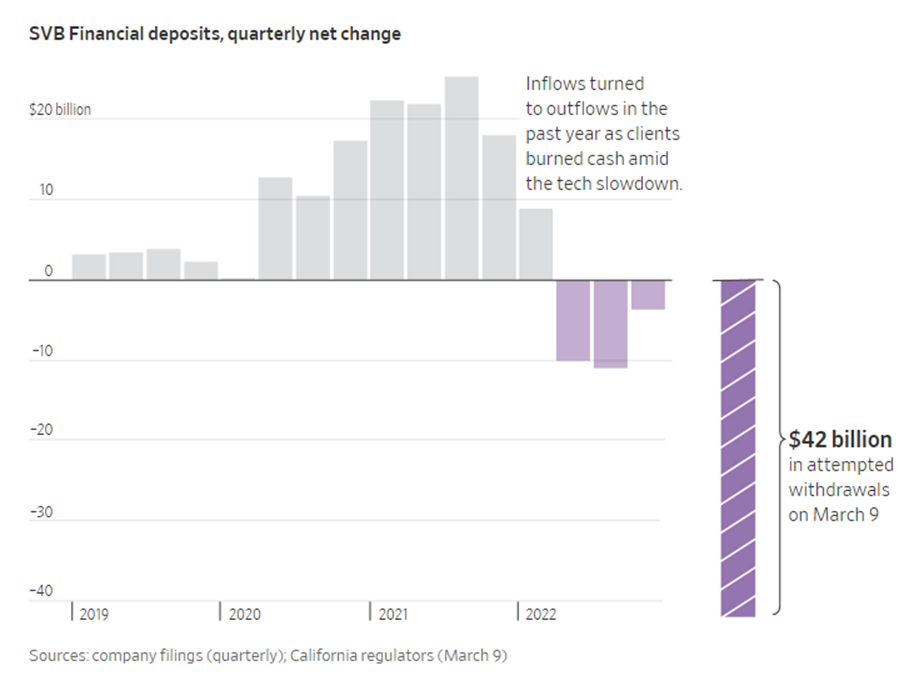

Well basically it grew too fast using borrowed short term money from largely corporate/VC depositors, who were burning cash & could ask to be repaid at any time.

Worse still, #svb then double downed & invested it in long-dated assets that it was unable, or unwilling to sell. End result = LIQUIDITY & INSOLVENCY CRUNCH.

Meaning from an investors' perspective, there are (at least) 5 key takeaways from the collapse.

1) Idiosyncratic risk. Basically #SVB was a disaster waiting to happen.

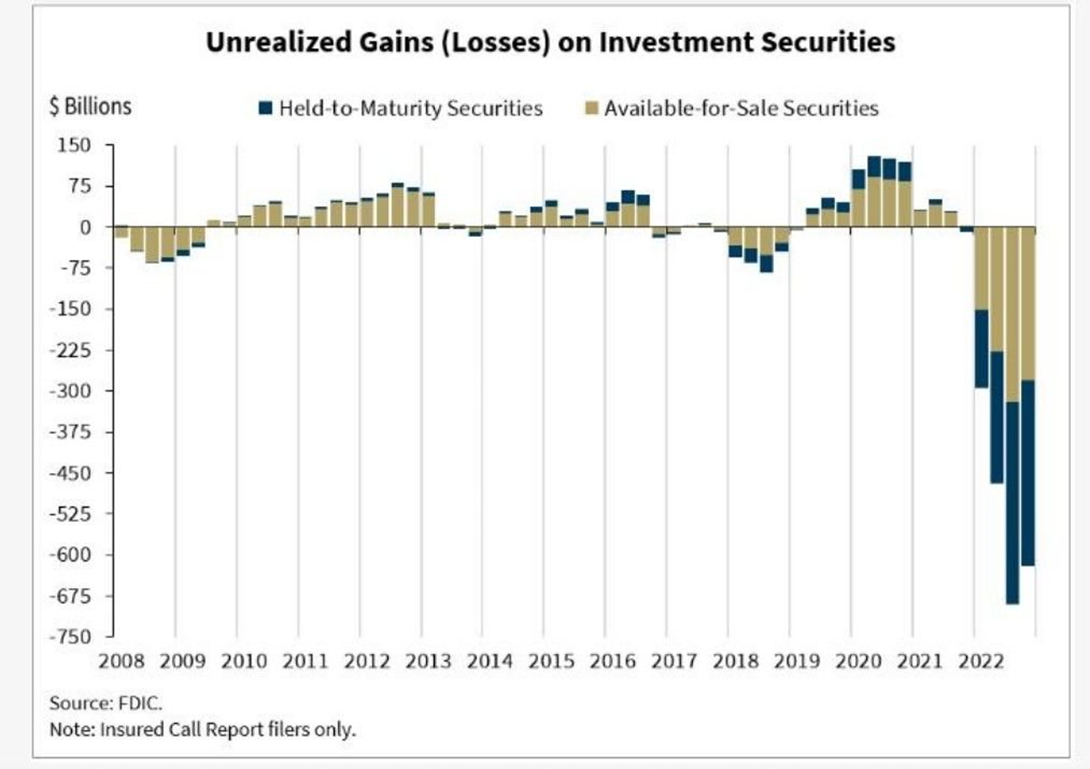

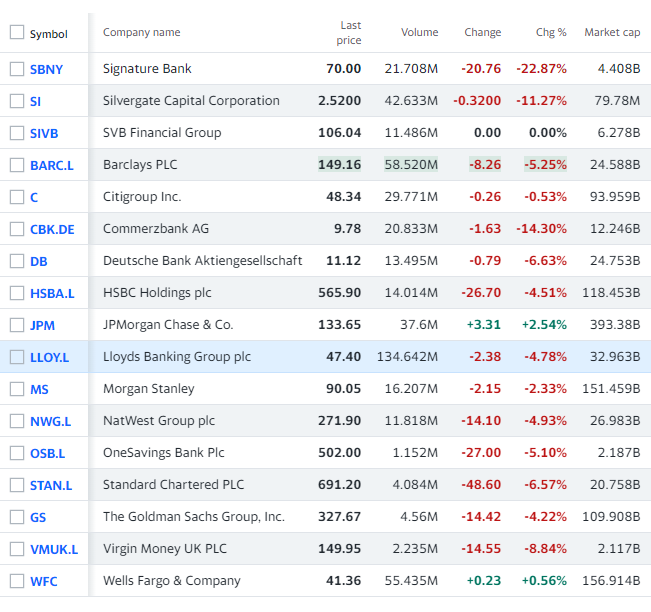

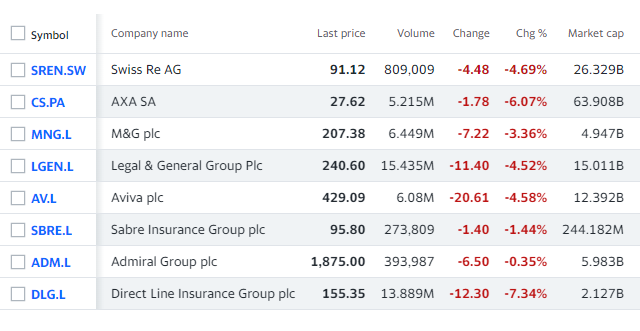

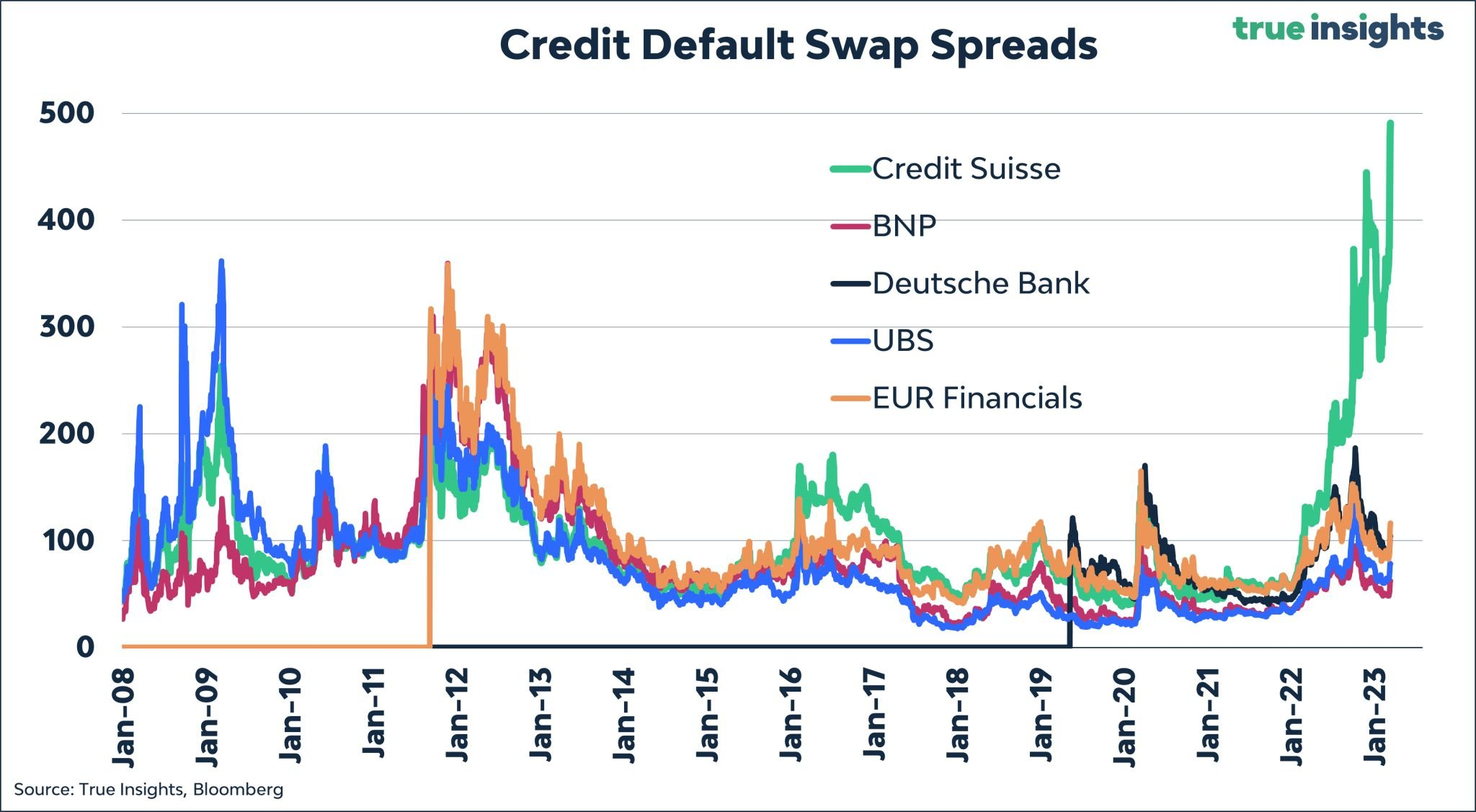

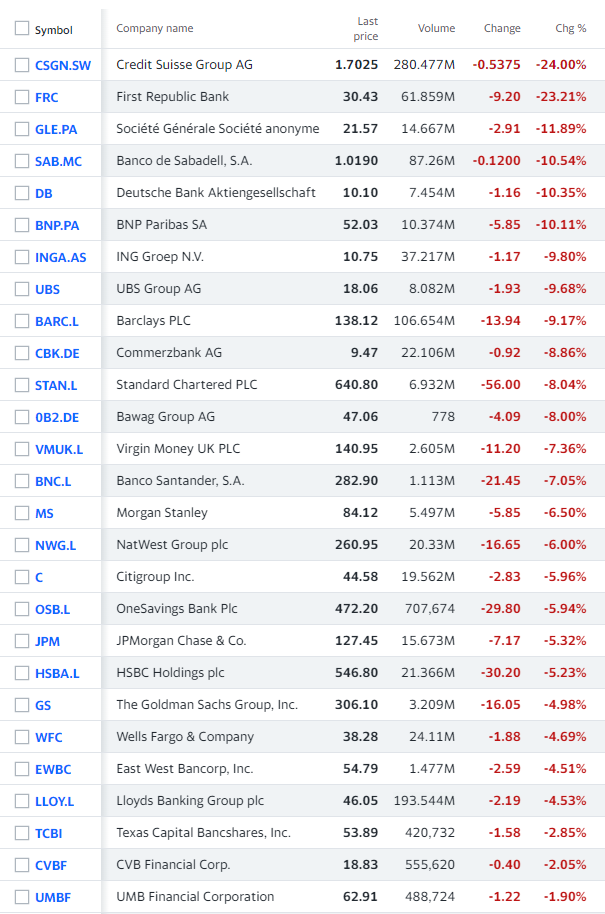

2) There's now a broader systemic issue wrt $600bn+ of unrealised losses (ie not marked to market) still sitting on US bank balance sheets (>20% NAV).

3) Possible contagion across the wider economy, as firms cannot pay staff/suppliers & are forced to lay off employees.

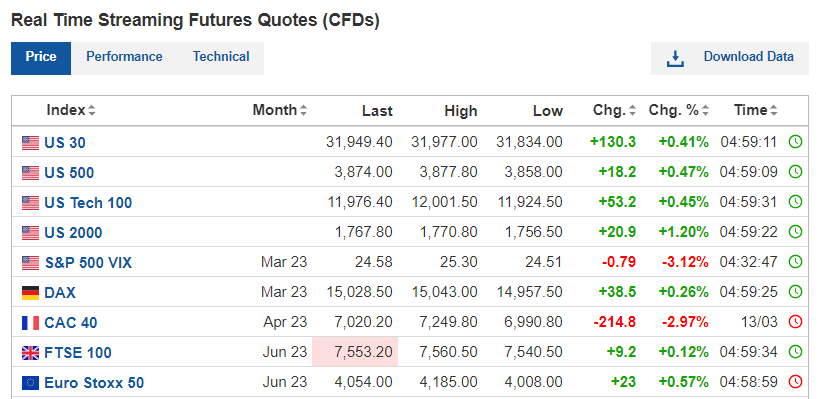

4) Higher cost of capital – especially for early stage life science & tech stocks – as credit spreads & ERPs widen more than Treasury yields fall.

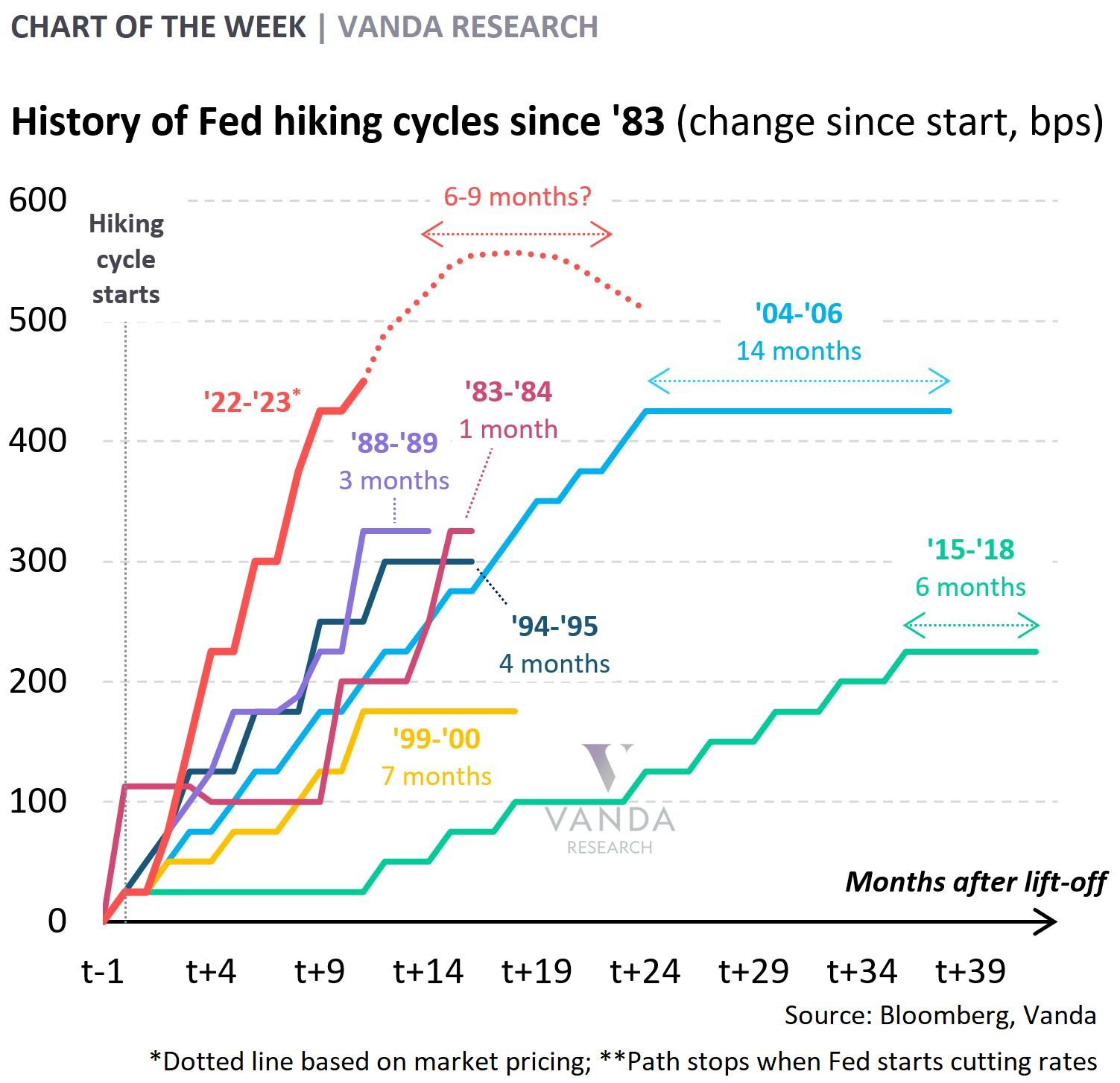

5) Lower peak #Fed funds rate. On Friday morning, I thought the #Fed would hike rates by 0.5% on 22nd March. Now after #svb's #bankruptcy , I suspect we're reaching 'braking' point on the tightening cycle. The moment when higher borrowing costs begin 'breaking' the financial plumbing & liquidity to the real economy.