Pre 8 a.m. comments

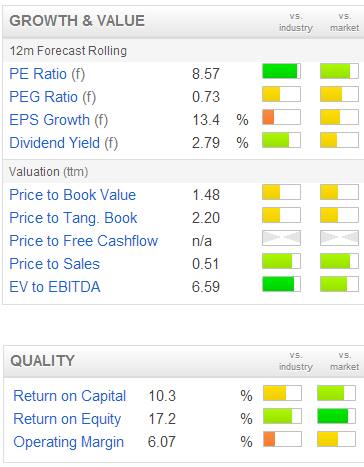

Good morning! The year end (31 Mar) trading statement from Norcros (LON:NXR) has been issued, and doesn't seem to contain any surprises. This is an interesting company which looks significantly under-valued to me, since its peers are typically on a PER of about 17 (pricing in some economic recovery/growth), whereas Norcros has languished on a single digit PER for a long time, although the shares have risen nicely they still look good value to me.

Norcros manufacture and distribute Norcros showers, Johnson Tiles, Norcros Adhesives, and following a very recent acquisition, Vado taps & fittings. They operate mainly in the UK and S.Africa - interestingly Southern Africa being a good growth area at the moment apparently.

Group turnover rose to £210m (up 5% vs prior year, and up 10% on a constant currency basis), and this is all organic growth because Vado was only acquired on the last day of the financial year.

Underlying operating profit is a creditable £13.0m (versus £12.1m for 2011/12). I am impressed with how Norcros makes a fairly steady 5-6% operating margin, having done its restructuring a few years ago after the credit crunch saw it get into hot water (geddit?!!) loaded up with too much debt after a disastrously ill-timed IPO in July 2007.

Bear in mind that NXR has quite a large depreciation charge, so the underlying EBITDA is c.£20m. This should enable it to repay debt fairly rapidly, although in the short term net debt has risen to £31m (well within newly enlarged £70m bank facilities (some of which will be for Letters of Credit, Forex hedging purposes, but I don't know the breakdown).

However, they also own freehold property with a net book value of £28.2m at 31 Mar 2012, so I tend to offset that against debt in my calculations. One should also consider the large pension fund, but this was 94% funded as at 30 Sep 2012, so a relatively small £22.3m deficit. That will be a volatile figure, but QE has exaggerated all final salary pension scheme deficits, so the likelihood is that it will reduce or disappear altogether once bond yields normalise (as that affects the present value of how liabilities are calculated). It's also a mature scheme, so will dwindle in size over time.

The pension scheme doesn't worry me, and only requires overpayments of just over £1m p.a. at the moment, which is likely to rise to just over £2m at the next valuation, by my estimates. So an irritant, but not something that affects the long term valuation of the business.

The awaited planning consent for land at Tunstall has been announced in today's statement. The outlook statement looks fine, so all in all as a shareholder in NXR I'm pleased with this trading statement, all looks fine. I cannot understand why these shares are under 25p, which looks the right sort of price to me (and would only be a PER of 12), and coincides with the price target mentioned in an outstandingly good Charles Stanley note written by Peter Ashworth dated 15 Mar 2013.

Given that we have been in subdued economic times now for five year, there must be a backlog of demand for new bathrooms building up, as electric showers for example have an average life of 7 years. Therefore I could see Norcros delivering much better EPS once the economy is recovering more strongly, don't forget the operational gearing that cyclical companies have. In time therefore I'm wondering if EPS might not rise to say 3p, put it on a PER of say 12-15, and you're looking at a much higher share price. I'm thinking 1-2 years ahead here.

Oh, the dividend isn't bad either - about a 2.8% yield.

Post 8 a.m. comments

A muted market reaction to the Norcros statement so far, but on negligible volume. I'm tempted to buy some more if they come down to 17p Offer (currently 17.25p with a 0.5p spread - I only like to buy when the spread has narrowed to 0.25p). Broker consensus does not appear to have been updated for the Vado acquisition, so I reckon we should be looking at 2.2p EPS for the current (new) financial year, so that means the PER sits at just 7.7 based on the current 17p share price.

As the Charles Stanley note sets out, comparable companies are on an average PER of 17. Anyway, there we are.

Shareholders in inkjet head manufacturer Xaar (LON:XAR) will be delighted with a terrific Q1 trading update today.

I've always liked this company, but got enthusiastic about it about 8 years too early, so sadly don't hold any. The statement today says that Q1 has been strong, and that management have increased their expectations for the year.

Cash generation has been pretty astonishingly good in Q1, with net cash rising from £28.9m at 31 Dec 2012 to £41.7m at 31 Mar 2013, although some of that is due to favourable working capital movements.

Unsurprisingly, the shares have risen 14% to 480p today. Forecast EPS is currently around 23p for 2013, so we might now be looking at 25-30p EPS possibly for this year, therefore at 480p and with that kind of strong growth happening, the PER of 16-19 doesn't look outrageous at all. If I owned them, I'd probably sit tight, although it's far too late for me to join the party now.

As always, it depends what factors are driving the growth, and whether that growth is sustainable?

Software Radio Technology (LON:SRT) announce a contract win from the Middle East for 500 of its vessel tracking transceivers. I'm not sure how material that is? (they say that it is small, but signifies the start of the region's roll out). Please could someone who is more familliar with the company add some colour to this in the comments section below (incidentally, you do not have to pay a premium subscription to comment here, you just need to be a registered with a free Stockopedia account - there's an option to "join the discussion" in the sign-up page). Would be good to get a bit more discussion going, as these are intended as interactive reports, not just monologues from me!

Plastics Capital (LON:PLA) has issued a trading update for the year ended 31 Mar 2013, saying that revenue, profit margins and cashflow are expected to be broadly in line with market expectations. So slightly below then.

Some more detail is then given about new products & accounts have offset demand weakness in Europe. Their Chinese production line will open in Q2 of this year (Jul-Sep). Recent sterling depreciation has been helpful to them.

I've always thought that patient holders would do well on PLA with a long term view, as it gradually repays debt, and seems to have solid, niche operating businesses.

Electrical cables maker Volex (LON:VLX) has issued a trading statement, which appears to have displeased the market, as their shares are down 6% to 97p, for a market cap of about £60m.

They say that revenues & operating profits for year ended 31 Mar 2013 are anticipated to meet market expectations, and helpfully they mention the average forecast is $473m revenue, and $11m operating profit.

On the downside, net cash has turned into net debt of $20m, and there is another restructuring with exceptionals of $7m planned. It's too low margin, and accident prone for me, so I'll pass on this one.

OK, I have to dash for the train to an investment lunch later. Have a good day & see you same time tomorrow.

Regards, Paul.

(of the shares mentioned today, Paul has a long position in NXR, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.