Good morning! Stadium (LON:SDM) reports its interim results to 30 Jun 2013. It's a small electronics group, with a market cap of £12.6m at the current share price of 42p. Checking our archive here, I see they issued an H1 profits warning on 3 Jul 2013, at which time I commented that on balance the shares looked cheap at 30.5p, but didn't buy any because the market Bid/Offer spread was too wide.

Looking at the H1 figures announced today, they are not good. Turnover is up 2% to £21.4m, but adjusted profit before tax is down 50% to £0.37m, for a wafer thin profit margin of only 1.7%. Adjusted EPS is 1.0p (vs. 1.9p in H1 2012). So not good at all. However, what is interesting is the outlook statement, which suggests an improved performance in H2 (my bolding):

The closure of the Rugby site was completed in August 2013, the other re-organisation activities in Head Office and Asia are substantially complete, and the expected benefits will be realised in the second half of this year.

We expect a strong second half performance built on a solid order book within the interface and displays business and the book-to-bill ratio within the power products business supports a much improved second half performance, which will be further enhanced by our e-commerce platform and a broader commercial offering of power products. Within the iEMS business, we have secured a number of contracts with new customers, albeit at lower margins, reflecting the on-going pricing pressures prevalent in this market.

The Board remains committed to the growth strategy of investing in our businesses both organically and through acquisition, and will continue to explore opportunities to drive this strategy forward. Whilst trading conditions during 2013 have remained challenging, the Group is now firmly on a path to deliver improved operating performance. The Board is confident of delivering second half profits in line with current expectations, and has an increasing optimism towards 2014 performance and beyond.

So I read that as a positive outlook overall, with a few caveats about pricing pressures. Although personally I'm careful about buying into situations where H1 has been weak, but all sorts of reasons are given why H2 is going to be better, as it doesn't always pan out like that! So the price has to be right - i.e. to give a considerable margin of safety in case H2 doesn't pan out as well as hoped.

The Balance Sheet overall looks fine, apart from the pension deficit, with my key working capital measures being;

1) Net cash of £0.3m, which looks fine - although perhaps window-dressed for the period end, as they have £4.9m in cash offset by £4.6m loans & overdraft - why not pay them off if the cash is there all the time?

2) Working capital - current assets of £21.3m are 157% of current liabilities - anything over 150% is generally strong in my view, although going down to 120% is usually OK, and even 100% in other sectors such as services, where there tends not to be any stock holding.

3) Pension deficit - a black mark here, with a £6.8m liability in long-term creditors, and including some bank debt and other bits & pieces, total long term creditors is rather high at £9.7m (which is material in the context of the £12.6m market cap.

So that pension deficit would need some investigation before I could invest here.

I'll watch & wait here I think - if the price plummets today, then I could be tempted to pick up a few if they are cheap enough, but am also a bit perterbed by the interim dividend being cut from 1.05p to 0.45p, which doesn't seem to fit with the confident outlook for H2. Divis are a key indication of management confidence, so a cut, when combined with lots of positive narrative, doesn't really work for me.

(Edit: To my surprise, the market has reacted positively to the poor interims from Stadium, with the share price currently up 2p to 42.5p mid-price. So clearly the positive outlook commentary has convinced investors to overlook the poor H1 performance)

Internet & interactive TV gambling company, NetPlay TV (LON:NPT) has announced interim results to 30 Jun 2013 which look pretty good. The shares are up 2% to 19.1p at the time of writing, which by my calculations puts the market cap at £56m. The company was historically loss-making, but seemed to crack its market in 2011 when it moved into a modest profit, and then 2012 with a leap in profit to £3.6m.

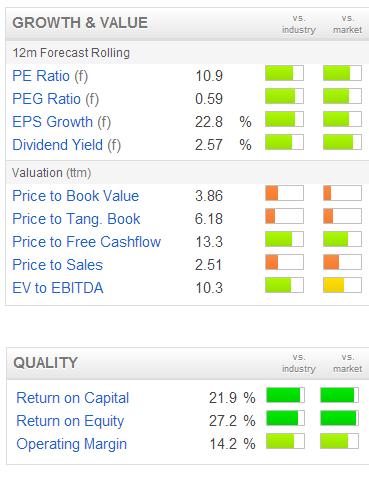

H1 of 2013 saw a 36% increase in net revenue to £14.2m, and an excellent 47% increase in profit before tax to £2.3m. Full year results are expected to be in line with current market expectations. So checking Stockopedia for broker consensus, shows 1.53p for 2013 and 1.81p for 2014, for a PER of 12.5 and 10.6 respectively, which looks very good value to me, for a company delivering strong growth.

They pay dividends too, with the interim divi up 20% to 0.18p, and the full year forecast divi being 0.45p, for a 2013 yield of 2.4% - not bad at all, given the rate of growth.

So what's the Balance Sheet like, I hear you ask? Actually, it looks excellent. On my usual measure of working capital, current assets (including cash of £14.9m) total £16.3m, and current liabilities total £6.1m, so that gives a ratio of 267%, which is very strong indeed. Long term creditors are zero, so this is a pretty bullet-proof Balance Sheet.

I've convinced myself to buy some, so just have added an opening size position (i.e. smallish) to my portfolio at 19.25p.

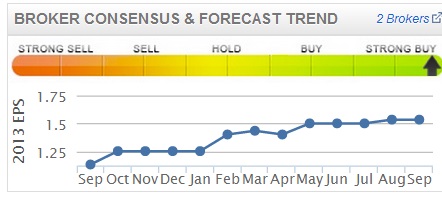

Another good sign with Netplay is that the broker consensus forecast for 2013 earnings has been steadily rising throughout the year. I'm increasingly finding that, when combined with a reasonable valuation, this is a great forward indicator of out-performance - as a company that is trading well will tend to have broker forecasts that lag behind improvements, which can give a buying opportunity.

Another good sign with Netplay is that the broker consensus forecast for 2013 earnings has been steadily rising throughout the year. I'm increasingly finding that, when combined with a reasonable valuation, this is a great forward indicator of out-performance - as a company that is trading well will tend to have broker forecasts that lag behind improvements, which can give a buying opportunity.

On the negative side, I'm not generally keen on investing in gambling companies, because they are not exactly socially useful. On the other hand, we all like to gamble, or we wouldn't be involved with the Stock Market - no matter how people like to dress it up as serious analysis, the truth is that there is still guesswork involved, and an element of luck. So whilst that doesn't make investment outright gambling, it contains elements of it. Most good investors are also good poker players, because they can weigh up the odds, and only take chances where the odds are in their favour - that is pretty much identical to investing.

Also, you tend to find that gambling companies have a constant churn of customers, so need to spend a lot on marketing. I note that Netplay are sponsoring Celebrity Big Brother, which is a good fit - daft people watch the show, so are more likely to be easily parted with their cash (I can only say that because I'm not watching it this year, but in previous years have been glued to CBB!).

EDIT: Forgot to mention, Netplay will be giving a presentation to investors on Mon 16 Sep at Mello, in Beckenham. See contact details on www.freesharedata/mello to book in, although I believe it's already heavily booked!

Looks like I'm not going to have time to look at all the results I wanted to, as have to get ready for a trip to London for a results presentation from Spaceandpeople (LON:SAL). I shall report back either tonight or more probably tomorrow.

Results from Snoozebox Holdings (LON:ZZZ) look appalling. I'm dropping coverage of that one, as it looks to me as if they don't have a viable business model. The cynic in me wonders whether perhaps the refinancing was more about preserving the careers of the Fund Managers who originally backed it, by keeping it going, rather than any real belief in the viability of the company? It's difficult to see why anyone would back it using their own money anyway.

Clever idea, but it just hasn't worked. Although there is still cash in the bank, how long will that last with losses running at such a high level? Sad to see that the founder recently died.

Right, I have to dash or will miss this train. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in SAL and NPT.

A Small Caps Fund to which Paul provides research services also has a long position in SAL)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.