Good morning! Last call for any donations to my spring charity fundraising - I'm abstaining from alcohol for three months (not had a drop since NYE!), and am also running the Brighton Half Marathon this Sunday. It's going to be a disaster, as the weather has been so awful that I've only managed to get out for 4 training runs. Having a stinking cold for the last fortnight hasn't helped either. So realistically, I'm just aiming to beat last year's time of 2:23, which is quite slow, and probably won't get anywhere near the 2:09 I managed in the autumn London Parks half marathon.

Anyway, all donations to my chosen charities (75% going to MacMillan cancer care, and 25% to the run organisers, local charity Sussex Beacon) are very much appreciated. I'm still a fair distance away from target, so anything you can spare would be brilliant. Here is my fundraising page. Thanks to everyone who has kindly made a donation so far, I'm very grateful for your support.

Caffyns (LON:CFYN)

This is a small chain of car dealershps, with a market cap of around £15m at 527p per share. The company has issued an IMS this morning covering the period from 1 Oct 2013 to 12 Feb 2014. It sounds very good, with new car unit sales up 9.8% against the equivalent period last year. They point out this is on top of 20.6% growth achieved last year, confirming that the new car market is in rude health - as has been reported by other market participants for a while now.

Used car sales growth was even stronger, with 21% growth, although aftersales (servicing, etc), was only up 2.6%. The margins on new cars are wafer thin, so it can be the aftersales that is the most lucrative part of this sector. No indication is given of profitability against forecast, which is a rather glaring omission from a trading statement. This might be because, as they point out, the full year result is heavily dependent on the "crucial month" of March.

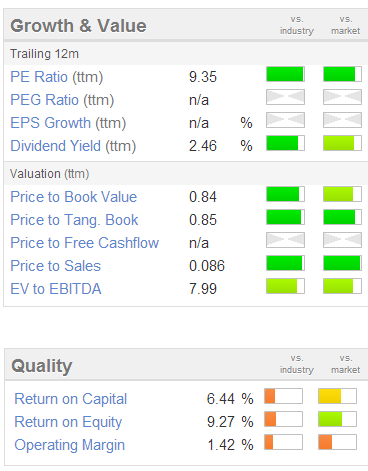

The Stockopedia graphics show a lot of green, although one needs to be careful about net debt, as companies in this sector tend to heavily rely on bank debt, and that can make them appear cheap on a PER basis, but also makes them potentially higher risk.

The Stockopedia graphics show a lot of green, although one needs to be careful about net debt, as companies in this sector tend to heavily rely on bank debt, and that can make them appear cheap on a PER basis, but also makes them potentially higher risk.

The other thing to consider with debt is that the interest bill will rise significantly (to the detriment of earnings) once rates go up. Everyone seems sanguine about when rates will rise, but I wouldn't be so sure about that. All calculations should really now be factoring in normalised interest rates, as it's only a matter of time.

I completely missed the boat on car dealerships, failing to predict how strongly the car market would recover. Certainly in the USA new car sales are seen as a key economic confidence barometer, so maybe is here too? Together with the latest Bank of England forecast pushing up UK economic growth to over 3% this year, this appears to be a decent recovery now underway, which should feed through to higher wages & higher consumer spending in the not too distant future. So you can see why shares are buoyant right now, as the Stock Market has correctly anticipated a strong recovery.

IPO Fever

IPOs (i.e. companies Listing on the Stock Market for the first time) have been extremely buoyant in the last year, with lots of companies joining the market, most of which have risen quickly to a significant premium. Therefore this area is attracting a lot more attention.

I feel that there is an information gap - i.e. most of us only hear about IPOs after they have happened, and the rapid initial gains have already been made. There is definitely an opportunity here for innovative brokers or other companies in the financial sector to create some sort of platform to better inform private investors about forthcoming IPOs. Maybe IC and Shares magazine could create new sections to highlight forthcoming IPOs, and how we can go about buying into them?

A friend flagged up Actual Experience (ACT) to me as an interesting IPO, so I tried to buy yesterday morning as soon as the shares Listed at 54p, but the price raced away so fast that it proved impossible to buy any. Guess where it ended its first day's trading? At 245p per share! So it was a four and a half bagger on the first day! This is a technology company which is a spin-out from a University, with some revolutionary new way of diagnosing bottlenecks in IT systems. There are clearly high hopes for the company's technology, as it has gone from £17m market cap to about £75m just in its first day! This is real bull market stuff, and the market now hasn't felt this bullish to me since about 1998 to 1999. That all ended in tears of course, so I think caution is needed right now - it's a difficult balancing act between making money from speculative opportunities, without taking ridiculous risks that could end badly.

I've been talking to a number of brokers recently about getting involved more in IPOs, so if I spot anything sensible and reasonably priced, then I'll flag it up here in these morning reports. Although caveat emptor always applies with new issues - I'm generally very sceptical about the people who know the business best selling or accepting dilution - as it usually means the price is favourable to them, not the person buying! Having said that, as with the Actual Experience (ACT) IPO yesterday, the free float can be very small, so the IPO is really about getting the market to set the price.

My approach is to be flexible according to market circumstances, and in a bull market I'm very happy to make money from IPOs, if there is money to be made. It's a window of opportunity during a period of market buoyancy in my view. Whilst keeping a close eye on the exit of course, as nobody wants to be left holding over-priced junk at the end of a bull run. That said, the brokers I've talked to are saying that junk is being turned away at present, so we're certainly not into the indiscriminate late stage of this IPO boom - yet!

The party will be over when IPOs start flopping, which can happen quite suddenly, and the appetite for IPOs could dry up quickly if sentiment changes - because I think a lot of people are buying them because they generally rise. Take that away, and demand could disappear overnight. In the meantime it's a potentially lucrative area.

VP (LON:VP.)

This niche equipment hire group has issued an IMS today covering the period from 26 Nov 2013 to date. It has continued to trade in line with expectations (not bad considering the bad weather), and as regards the year ending 31 Mar 2014;

The Board expects to report full year profits in line with market expectations.

The valuation looks pretty full now, on a forward PER of 17.1 times, and a forecast dividend yield of a whisker over 2%. As with so many shares at the moment, I think the smart money has been made for the time being. I can see a case for earnings continue to rise (maybe accelerate) in an economic recovery, but competition will also increase, and staff will want higher wages.

Is there really much immediate upside on the chart below, at a PER of 17? I suspect not. It might be worth a look if there is a sharp correction, but personally I wouldn't be interested above about 500p.

Kada Technology Holdings (LON:KADA)

I don't like overseas companies Listed on AIM, and very rarely touch any of them, especially Chinese and Indian companies - they are fraught with risk, and you cannot rely on the figures being what they seem, in my opinion. There are so many differences in custom & business practices, that it's a huge mistake to apply Western analysis onto the figures from overseas companies, on the mistaken assumption that everything is comparable, again just in my opinion.

I am looking forward to a fascinating Mello investor evening on Monday coming, in Beckenham, when no less than three Chinese AIM companies are presenting. Or I assume their UK representatives will be presenting anyway. Should be fascinating.

However, one of many disastrous AIM Listed Chinese companies has reported a troubling-sounding trading update today. Kada today has reported;

...working capital has continued to be an issue for the business and the Group has felt the force of an increasingly difficult debt market in China during the final months of 2013 and the beginning of 2014. Each of KADA's major lenders has sought to re-negotiate its lending terms with the Company. This is a similar situation to those being experienced by a number of our competitors. This uncertainty over the Company's future availability of debt has materially affected the Company's results in 2013

That sounds pretty nasty to me, and certainly makes these shares uninvestable for me, at any price. Although they were already in that bracket for me before today's statement! The share price is down 53% today to 17.5p - just look at the chart, to see the destruction of shareholder value here;

So the general points they make about Chinese banks pulling in lending should ring alarm bells for all Chinese stocks which have bank debt. Cash-rich ones might still be OK though perhaps, who knows?

I think it won't be long until these things virtually all de-List from AIM, and then you'll be looking at a virtual wipe-out of shareholder value. Who would want to hold shares in an unListed Chinese company? So enormous risk lurking here, although also potentially big returns if you can find one that is genuine, but has been tarred with the same brush as the bad ones? That's not a game I want to play, but good luck to those of you who do.

That's it for now, have a smashing weekend, and thanks again for all the kind donations for my charity run this Sunday, much appreciated!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.