Manx Telecom (LON:MANX)

Share price: 196.5p (+0.5%)

No. shares: 113m

Market cap: £222m

Fairly stable results at Manx, the main broadband/communications company on the Isle of Man.

- Revenue up 1.5%, £80.8 million.

- Underlying EBITDA flat at £27.7 million.

- Underlying PBT flat at £16.3 million (reported PBT £8.8 million).

The profit result is flat on an underlying basis, but on a reported basis, quite a few elements have hit the result:

- revaluation of interest rate swaps (£1.2 million loss)

- Transformation programme (£4.3 million)

- Property revaluation (£1.3 million)

- Acquisition costs (£0.2 million)

- Impairment of equipment (£0.5 million).

Last year, the company's reported PBT was higher than underlying PBT, lending credibility to the argument that the deductions above are indeed one-off events.

The Transformation Programme is "aimed at improving competitiveness and the customer experience" - I can understand why companies internally will set budgets for these sorts of programmes and will want to look at them separately to the underlying profit result for the year. But from an investor point of view, programmes like this do tend to crop up at many companies from time to time, and it's hard to think of them as truly exceptional.

Final Dividend: 7.2p, up from 6.9p. Combined with the prior interim divi, the yield is 5.5%.

My opinion

Seems a very reasonable proposition to me, as far as utilities go.

It has 95% market share in the fixed line network, despite having opened its fixed line product on a wholesale basis to competitors.

Turnover is gently increasing with a variety of non-core and potentially UK-wide services offering some opportunities for growth and innovation (data centre revenue is declining, but special SIM card revenue is growing and offsetting this).

The exceptional costs are worth studying, in particular the Transformation Programme which is set to cost £10 million in total over two years (of which £4.3 million already charged to profits).

Utility shares are never going to be 100-baggers, but are just a relatively safe source of income for investors - they have more in common with high-yield bonds and REITs than conventional equities.

Heavy investment requirements and predictable revenues make them the perfect borrowers, and indeed Manx has net debt of £52 million, which looks manageable.

Possibly worth looking at for long-term income, in my book.

Marshall Motor Holdings (LON:MMH)

Share price: 170.5p (+2.4%)

No. shares: 77.4m

Market cap: £132m

A huge amount of change here following the £107 million acquisition of Ridgeway (it cost £94.5 million after netting off the cash acquired in the deal).

So the like-for-like numbers are worth more to me than the headline numbers: LFL revenue growth is 10.7%, with new cars outperforming both used cars and aftersales.

As is normal in this industry, the profit margins are thin: MMH records an underlying profit margin of 1.7%, up 18 basis points.

Checking the financial review, I see that the gross margin (simply the difference between revenue and cost of goods sold) fell slightly, to 11.6%.

Valuations in the car dealership industry are very low right now, apparently because investors think that A) activity in the car industry may be at a cyclical peak; and B) the devaluation of the Pound Sterling may bite into margins and/or sales of imported vehicles.

But the outlook statement does not herald any imminent change in fortunes:

"Following the UK referendum on EU membership and the resultant continued economic uncertainty, the Board remains cautious on the UK vehicle market in 2017. Our order book for the important March plate-change period is, however, encouraging and current trading is in line with our expectations. Our outlook for the full year is unchanged."

Final Dividend increased to 3.7p (from 2.4p).

My opinion

The valuation of MMH can't ignore that it now has £54.5 million in net debt, following the major acquisition mentioned above.

On a pro forma basis (i.e. including 12 months of EBITDA from Ridgeway), the net debt/EBITDA ratio is 1.2x, which is fairly reasonable.

Adding in the net debt to the market cap gives us an enterprise value of about £190 million for a company which just earned net income of £17.8 million (after spending £2.2 million on acquisition costs).

But this year's result includes only a partial contribution from Ridgeway, since May. Brokers are forecasting that EPS will rise in 2017 to 25p-26p.

With such low multiples, I really think value investors should be taking a look at this (and indeed at the motor industry in general).

Somero Enterprises Inc (LON:SOM)

Share price: 279.5p (+6%)

No. shares: 56.2m

Market cap: £157m

I'm reluctant to comment on this, as others are much more knowledgeable on the company than I. But since it's a popular stock, I'll say a little bit on it.

Also see the detailed write-up by VegPatch at this link.

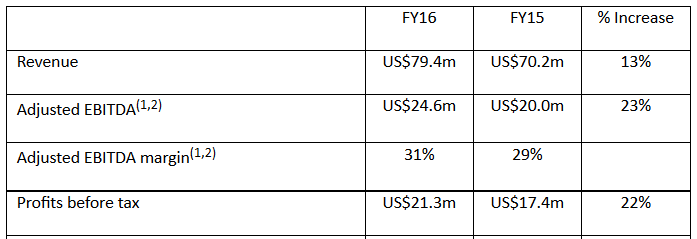

"An exceptional year of profitable growth"

The performance can't be faulted, e.g. cash flow from operations also improved strongly, coming in 17% higher at $17 million.

Growth was led by Somero's primary North American market (remember that this is one of the rare US companies listed on AIM). North American revenues increased by $7.4 million, dwarfing the net revenue contribution from all other markets combined.

New products were an important

factor, new laser screed machines being responsible for $4.6 million of growth

(such as the S-10A, pictured below).

Dividend: the full year payment is up 61% as the payout ratio is increased to 40% with a final dividend of 8.6 cents.

Outlook

Construction activity is booming in the US, the most important end-market:

The solid momentum in North America at the end of 2016 has carried over into 2017 driven by demand for replacement equipment, technology upgrades, and interest in new products. We remain encouraged by the solid level of non-residential construction activity in the US, a view that is supported by reports from our customers of lengthy project backlogs that extend well into 2017. Proposals for US corporate tax reform and fiscal policy programs to invest in US infrastructure are additional factors reinforcing our confidence in North American growth prospects.

Europe and China are also doing well.

The summary outlook is positive:

The Board believes the Company is well-positioned to capitalize on the many opportunities we see across our portfolio of markets and products and we remain confident Somero is poised to deliver another year of profitable growth to our shareholders in 2017.

My opinion

The present market cap translates to $190 million, so there is no doubting that this is a potential value investment, especially given the over-strong balance sheet and the company's dividend payment track record.

Can anyone provide insight into Somero's competitors? In terms of laser screeding equipment, I don't see anyone outside of China.

That being the case, perhaps Somero's equipment and approach really are best-in-class, and there are real competitive advantages which help to explain the sparkling performance here (performance which is arguably better than could be expected merely from the cyclical improvement of conditions in the construction industry).

That's all I have time for today, thanks for reading!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.