Good morning!

This article from Paul McManus of Walbrook PR is worth a read. I met Paul recently, and we talked at length about ways to improve communications from listed companies to the private investor community, for the benefit of all - after all, it's PIs who create the liquidity, narrow the spread, and set the share price. So it's perplexing why some city firms just ignore PIs, when they should be building channels of communication & engagement.

Thoughts on Greece

The increasing likelihood of a Greek default, and possible ejection from the Euro, is the topic on everyone's mind at the moment. I've got mixed feelings about this. Clearly Greece is insolvent, so needs to default, and move on. Prolonging the agony in this way, is not doing anyone any good in the long run - it's just deferring the inevitable.

This issue has been rumbling along for years now, so arguably the market has already priced it in. The market might even rally once this issue is resolved, after the initial panic has subsided - since a major uncertainty would have been removed.

Also, the politicians and civil servants now know what to do in a financial crisis, which they didn't in 2008. They have to recapitalise and/or nationalise major failing banks. No ifs or buts, it has to be done, and fast. They know that this time, so I think Govt action will be more decisive this time compared with 2008, if we do go into another financial crisis.

On the other hand, the market has been sanguine up until now, because last minute deals have always been found re Greece. This time it looks as if there's a decidedly increased risk of Greece defaulting, being ejected from the Euro, its banks collapsing, and Greece reverting to the Drachma, which will then instantly depreciate greatly. Although in reality, I think Greece will become a cash-based, black economy, with the population continuing to use Euros for day to day transactions. That makes it even harder for the Govt to collect in tax revenues. So I don't think going back to the Drachma will be a cure-all by any means.

I can't think of any historic example where a country has abandoned a strong currency, and created a new, weaker currency. Normally it's the other way around - after hyper-inflation, countries scrap their old, failed currency (e.g. Weimar Germany, Zimbabwe) and issue a new, stronger one. People are happy to use the new currency, and abandon the old, failed currency. However in the event of a Grexit, nobody will actually want to hold New Drachma, as it will be a weak currency. So I can envisage a situation where the Greek Govt pays everyone in New Drachma that it prints, and people then immediately rush to the bank to convert them into Euros. So quite how that plays out, I'm not sure. The New Drachma could just continuously devalue until it's worth nothing, with everyone continuing to transact in cash, in Euros.

So much money has been spirited away abroad by wealthier Greeks, that once the New Drachma has stabilised, there is likely to be a big influx of money from abroad, plus of course a tourism boom as foreigners seek out cheap holidays in Greece. So if the Greek Govt can successfully force people to use the New Drachma, then it could stabilise after a while, who knows?

How does it affect my shares though? I'm not sure, is the honest answer. In the short term, there's clearly the risk of a panic sell-off here if Greece does default. Yes, the problem is a known problem, and banks have had 7 years to prepare for this eventuality, but who knows what impact the contagion will have? Derivatives can multiply the impact of default events, and start a chain reaction of financial distress at globally interlinked financial institutions. Then margin rates on geared products are increased, and the chain is stretched tight until the weakest link snaps, as happened in 2008 with Bear Sterns, Lehmans, and others.

It's the political contagion that also worries me. The Euro was meant to be irreversible. Clearly the creation of the Euro was a lunatic idea in the first place, and has been a mistake of epic proportions. However, once it becomes clear that countries can default and leave the Euro, leaving the bill with France & Germany, then I don't see how the populations of countries like Spain, Portugal, and even Italy, will be able to resist the temptation to go down a similar path.

If that scenario plays out, then we could eventually move into a financial crisis of possibly worse proportions than 2008, as the Euro breaks up.

However, I'm not going to sell any of my small cap shares at the moment, because it's too expensive - suffering the bid/offer spread every time I get nervous, is not a good strategy. Also if one tinkers with one's portfolio in that way - selling when nervous, then buying back at a higher price once you're less nervous, then it crushes overall returns. Been there, done that!

Given that everyone is nervous, it's particularly interesting to see which shares are rising at the moment. If things can rise in a market that is very nervous, then they will probably fly once the market is more calm again.

I've bought some out of the money Put Options on indices, to hedge my portfolio. It's expensive, but allows me to sleep at night. Also, it's cheaper than selling, and buying back small cap shares, and being hit by commission, and a wide bid/offer spread. The nice thing about buying Put Options is that you can use leverage, but with controlled downside risk. They will almost certainly expire worthless, but will have achieved their purpose, of being an insurance policy against a market meltdown. I did the same thing before the market sell-off in Oct 2014, and it worked very well indeed - my Put Options threw off buckets of profit, which absorbed the losses on my long positions, and gave me some fresh cash to deploy at the market bottom.

There's not much company news today, hence why I decided to have a bit of a ramble.

Anite (LON:AIE)

Recommended cash acquisition - Anite shareholders will no doubt be celebrating this morning, as an agreed, cash takeover bid at 126p per share has been announced. This is a 22.3% premium to last night's closing price, and a 40.1% premium to the average price over the last three months.

This looks a good deal for Anite shareholders in my opinion, as the company's performance hasn't been great in recent years, and the valuation being paid by the acquirer, a Dutch subsidiary of an American outfit called Keysight Technologies Inc., looks fairly generous.

Keysight has only secured irrevocable undertakings to support the offer from 15.2% of Anite shareholders, which is much lower than usual in this type of situation. So it doesn't look a done deal yet - maybe shareholders might hold out for an improved price, or seek alternative bids from other companies?

In this type of situation, I normally sell half to lock in the profit (if the market bid price is close to the takeover price), in case the bid fails, and run the balance to the conclusion. Although it depends on the situation, and how likely it seems to proceed. It's always worth checking out the accounts of the acquirer - do they have the firepower to increase the offer, or are they stretching themselves to do the deal at all (which would make it more likely to fail)?

Recommended deals usually go through.

KBC Advanced Technologies (LON:KBC)

Share price: 109p (down 0.5% today)

No. shares: 82.1m

Market Cap: £89.5m

AGM statement - the key paragraph says;

Additional detail is given, which I summarise as follows;

- Costs cut - headcount down by 10% (mainly N.America)

- Annualised savings of £3.4m, with one-off cost of £0.8m this year

- Focus on key regions, e.g. M.East & N.Africa (£9m contract wins this year)

- Acquisitions (Infochem & FEESA) performing well, and opens a new sales channel for KBC

- New CFO in May 2015 completes new management team

Valuation - the group is forecast to make 8.7p EPS this year, and 9.65p next year. Therefore it looks modestly priced at 109p, that's a PER of 12.5 and 11.3 respectively. Although given the uncertainties, and gloom in the oil & gas sector, then this rating is probably appropriate for the time being.

Dividends - KBC used to pay out huge divis, but no more - the yield is a paltry 1.2%.

Director buying - it's worth noting the large & repeated Director buying over several years now, which gives confidence. Although it also makes me wonder what the share price would have sunk to if all that loose stock had not been absorbed by a fund connected to one of the Directors.

My opinion - overall KBC seems to be relatively unscathed by the problems of the oil & gas sector, which is encouraging - it provides consultancy & software to improve efficiency for oil companies, so a lower oil price & lower profits for oil cos makes KBC's services more relevant.

The company only mentions £9m of contract wins this year, which is not a lot considering its turnover in 2014 was £76m.

If the divi yield was more generous, then I'd be tempted to have a nibble here, but as it's not, I'm not. To my mind there are probably better bargains elsewhere in really bombed out oil services shares - this one has held up very well considering what's happened elsewhere in the sector, as you can see from the two year chart below.

Inland Homes (LON:INL)

Share price: 70.2p (up 2.9% today)

No. shares: 202.2m

Market Cap: £141.9m

Land sale - this developer has exchanged contracts on the sale of 205 residential plots, for £19m, with a major housebuilder. This is the last of the transactions relating to Drayton Garden Village Ltd, a SPV which held these assets.

This sale appears to replace an earlier mooted deal to sell these plots to an institutional investor for the building of private rented housing.

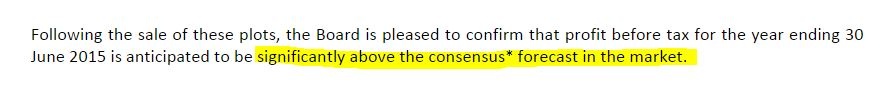

This latest deal means the company's profits are ahead of forecast;

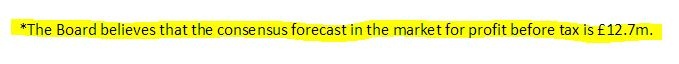

So that's clearly good news. Note the asterisk next to the word consensus above. The company very helpfully states further down specifically what figure for market consensus it is referring to. This is a very good idea, and I think all companies should follow this example, as it aids clarity in understanding, especially for PIs who may not have access to the latest forecasts, or who are worried that consensus figures on various financial websites may be wrong or out-of-date (which they sometimes are).

So, for clarity, Inland adds;

My opinion - as with other house-builders, Inland is making hay whilst the sun shines. My view is that we're in a multi-year house-building boom, as the outstanding profits that can be made are bound to stimulate more desperately needed supply, especially in the South East.

Furthermore, most medium to larger house-builders now have excellent, often ungeared balance sheets, so they have capacity to step up production.

Whilst INL may beat forecasts for this year, you can't value house-builders on a PER basis. Or rather you can, but if you do, it would be wrong! The best valuation method is a build-out value - i.e. take net tangible assets, and then add on a discounted amount for the profits that will be made on the existing land holdings once they are all built out.

Inland seems to be valued at about twice net tangible assets, which is probably just about alright, as I recall that when I last looked at it in detail, there was a lot of value not yet recognised on the balance sheet (since land is recorded at cost, and profit on sites is only recognised once they are sold).

There could be more upside to come on Inland. I would say 80-100p per share is possible, providing no macro factors derail the house-building sector generally. Of course, eventually house prices will have to correct downwards, once interest rates normalise, although I've been saying that for about 7 years now, and it still hasn't happened!

AGA Rangemaster (LON:AGA)

Share price: 133p (up 28% today)

No. shares: 69.3m

Market Cap: £92.2m

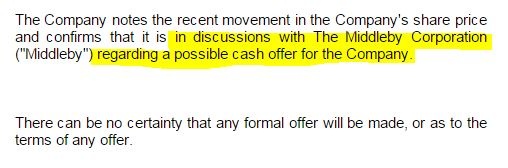

Statement re possible offer - exciting news for AGA shareholders:

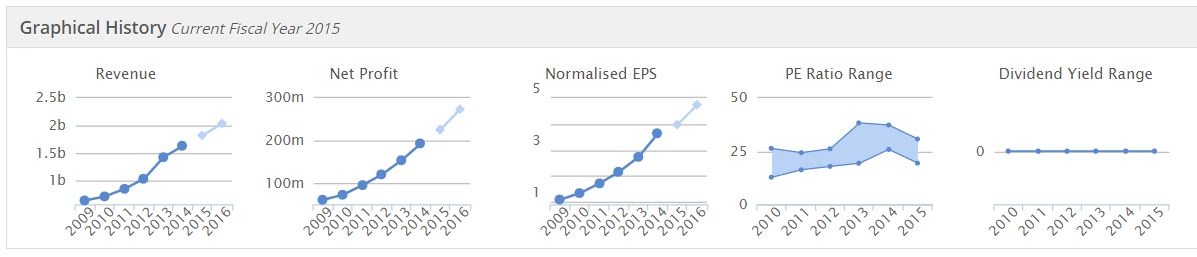

Middleby Corp - are listed on NASDAQ (ticker: MIDD), so as Stockopedia now covers European and American stocks, I can quickly check it out in the format I'm used to.

It has a market cap of £3.9bn, and broker estimates are for $1.8bn turnover this year, and net profit of $225.9m. Note the impressive progression of sales and profits at Middleby:

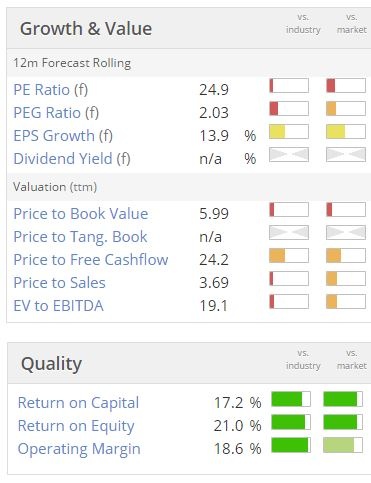

It seems to be expanding quite aggressively, and doesn't pay divis. The balance sheet is mainly intangibles, but the yanks seem to like it, as the valuation metrics for Middleby are pretty racy:

Note however that the quality scores are very high.

Doing a bit of googling, there is an article here which says Middleby has stated that "These discussions are at a very early stage...", a statement which is not mentioned in AGA's announcement.

My opinion - I am absolutely flabbergasted that anyone is considering bidding for Aga, given the size of it's pension scheme, and the onerous deficit recovery payments. Moreover, there surely has to be a risk that the pension trustees could block a bid, or insist on a large cash injection into the pension scheme as part of a deal?

That said, presumably Middleby have already looked into this issue, otherwise they wouldn't be holding talks with Aga. It will be interesting to see how this plays out. The pension scheme is so big at Aga, that I think there must be an above average risk of this deal not happening, but let's wait and see.

I have recorded a 15-min video today to recap on a few other interesting company news items - namely: Flowgroup (LON:FLOW) , Eclectic Bar (LON:BAR) , Walker Greenbank (LON:WGB) , Flybe (LON:FLYB) , Laura Ashley Holdings (LON:ALY) , DP Poland (LON:DPP) , Severfield (LON:SFR)

See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in BAR, FLYB, and ALY, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.