Good morning!

UK Investor Show

I thoroughly enjoyed the UK Investor Show on Saturday. As always, Mark Slater's insights were absolutely superb, he talks unadulterated common sense. Another highlight for me was the recorded video from Nigel Wray, who was unable to attend in person unfortunately. He is another brilliant investor who is full of wisdom & experience.

I enjoyed the perspectives from the "bear pit" too. Bears don't always get it right, but if they turn on a company where I hold a long position, then I sit up and take notice. They're more often right than wrong, and bears are usually the most experienced & thorough (in their research) investors, so fighting them on bulletin boards is a pointless exercise, when we should instead be listening carefully to what they say.

The Stockopedia session with Ed was so popular that four rooms had to be amalgamated into one, and even then there were people standing & sitting on the floor! A few people got up to leave when I took over, but thankfully not too many lol!

Dozens of readers of this blog chatted to me, as I was wandering around the venue. Almost every conversation started with the words, "Hello Paul, I read your blog every day..."! I was thrilled to get such positive feedback, with lots of people saying how useful they find these reports.

One chap made a good point, he said that to save time, he skips to the "My opinion" paragraph in every section, and if I sound positive on a stock, then and only then does he read the rest of that section. What a good time-saving idea, for those of you that are very busy, so thought I would pass that idea on to you here.

It's such a pity the investing world is so male-dominated. I wonder what we can do to encourage more ladies to get involved too? Females apparently make better investors, due to being a bit more cautious than men, and less prone to taking a gung-ho attitude towards risk, that is the undoing of many of us from time to time. A friend was trying to point out someone they knew in the crowd to me, saying "He's the older gentleman over there, with grey hair". I responded, "That doesn't narrow it down much! Everyone in the room fits that description!"

I thought the bearish comments against Tungsten (LON:TUNG) were overdone, but contain an element of truth. Hence why I changed my bullish stance a few months ago, sold most of my shares around 240p, and am now neutral to mildly bearish on the stock, due to concerns over the high valuation, cash position, cash burn, and the over-hyped nature of their business model - which is not unique at all either - other einvoicing companies are doing the same thing by linking with finance providers to offer early payment options.

The next big event is David Stredder's latest initiative, Mello Workshops. Myself and the Stockopedia team will be there too. I'm looking forward to doing two presentations, one about balance sheet analysis (and how it de-risks your investing), and the other will be an explanation of my disastrous mistakes with gearing & illiquidity in 2008, and how my spread betting accounts blew up in the financial crisis. By telling other people about my own disastrous mistakes, hopefully I can forewarn others of the dangers of leverage. I've certainly learned my lessons the hard way! So I'm very careful about managing gearing & liquidity now.

Mar City (LON:MAR)

Shares suspended - it looks as if the NOMAD has resigned, which is a pretty poor show in my view. If a company gets into difficulty, then it needs its advisers to stick by it, not walk away. The problems with related party transactions are not new, everyone involved with the company knew, and had approved of the incestuous relationships between the listed company and other companies controlled by the Directors.

The cynic in me also wonders whether suspending the shares might not have been fortuitous, in that the share price was getting perilously close to the 34p level, which was the trigger point for HSBC to potentially call in the £10m loan to Directors, which had been advanced to them, secured on 43% of the entire company's shares being pledged as collateral.

Personally I ditched my shares in this company within 10 minutes of the profit warning, thus exiting at about 68p, thankfully. My personal rule is that if a profit warning contains serious accounting issues, likely to involve restating the accounts, etc, then it's an automatic sell - as things are always far worse than the company at first admits. So more bad news tends to follow.

That said, I don't think MAR is going bust. It has a sound balance sheet, but the net asset value of 62p (after restatements for the problems reported on 20 Feb 2015) is likely to be reduced again, in my opinion. The big debtor balances due from management are also questionable I imagine.

On the positive side, the company's modular housing does look very interesting, and perhaps with new management, it might make a viable concern. I couldn't invest with the current management still in situ though.

Existing shareholders are probably very worried, but I think the shares will come back from suspension fairly soon, when a new NOMAD is appointed. The Non-Exec Chairman has accelerated his departure too.

Also, note that the company reassures (for what it's worth, which is very little!) on current trading today, saying;

World Careers Network (LON:WOR)

Share price: 293p (down 19% today)

No. shares: 7.6m

Market Cap: £22.3m

(at the time of writing, I hold shares in this company)

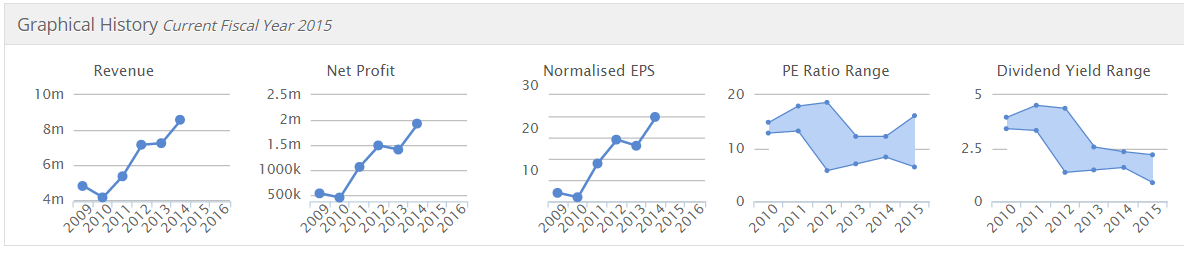

Interim results - no wonder the shares are down 19% today, these are very disappointing figures. As you can see from the Stockopedia graphs below, this company has an excellent track record of growing sale & profits;

That good track record has collapsed this morning, with interim figures showing turnover down from £4.2m to £3.5m, and operating profits all but collapsing from £1,003k last time for H1, to just £287k this year's H1 (6 months to 31 Jan 2015).

I was about to launch into a rant about how terrible it is that the company has not updated shareholders since the last full year results were published on 3 Nov 2014. However, on re-reading those results, the outlook section made it clear that things were going to be more difficult in the short term.

Outlook - some glimmer of hope in here, but it's hardly exciting;

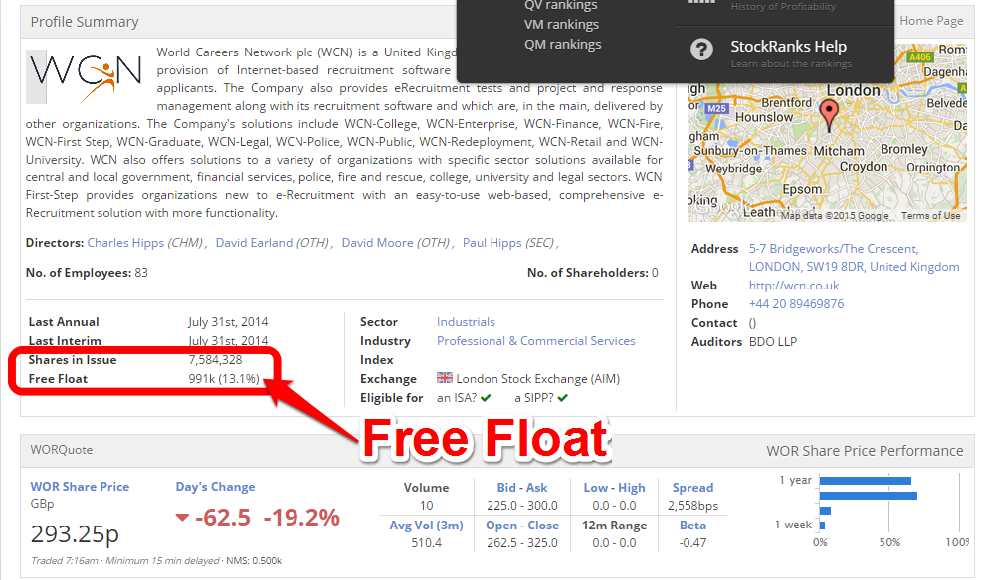

Lack of liquidity - Lucian Mears made the very good point at the UK Investor Show, that one of AIM's main failings is that companies are allowed to list their shares with virtually no free float. This means that share prices in such companies can become completely detached from reality, and are extremely easy for people with bad intentions to manipulate - which is why there are so many "pump and dump" operations which happen on AIM stocks. It's the hapless private punter who ends up losing money on such scams, which are depressingly regular events on AIM, I'm afraid.

I don't think anyone is manipulating this share price, but the bid/offer spread is ludicrously wide, and the free float is so small that you can only buy or sell tiny scraps of shares, making it almost impossible to deal in. This is because nearly all the shares are owned by management & connected parties. Which makes you wonder why they want to have all the costs & hassle of a stock market listing?

My opinion - I am weighing up whether to sell my holding in this company or not. Probably the main reason that I haven't already hit the sell button is that the company reports net cash of £8.3m, which is more than a third of the current market cap.

Certainly I can't see any compelling reason to buy the shares now, which probably means I should sell up and move on. Trouble is, the price is currently 225p Bid, 300p Offer! A grand total of 10 shares have changed hands today. How ridiculous!

UPDATE: I've been pondering this some more, and have decided to chuck out these shares. Luckily, as I experienced severe illiquidity when trying to buy, it turns out that I only have 500 shares in my portfolio anyway, which was all I could get at the time! So I've sold them for 235p, and booked a small profit overall, so not a disaster. Memo to self: don't bother with highly illiquid shares in future, they're a waste of time.

For anyone not aware of where to find the free float figures on StockReports, I have highlighted where to find them on the screen shot below, near the bottom left of the StockReport. The figures are calculated by data provider Thomson Reuters:

Trifast (LON:TRI)

Share price: 108p (up 4% today)

No. shares: 116.2m

Market Cap: £125.5m

Trading update - there's a positive announcement today from this fastenings company;

That all sounds really good to me.

Valuation - it's starting to look tempting. With forecasts of 8.06p for 2014/15 now in the bag, possibly a little higher too, and a strong outlook statement, then I am guessing that 9-10p EPS is possible for 2015/16. Therefore at 108p, the PER is probably about 11-12, which looks about right to me, although there is scope for the market to take it higher perhaps?

My opinion - this company has been doing well for several years now, and is a good turnaround. The valuation seems reasonable, although the divi yield isn't great, at only 1.7%.

My main reservations are that I'm not sure how much growth potential there is? After all, industrial fastenings must be a highly competitive sector. What is driving the current strong performance? It might be the buoyant European car manufacturing sector perhaps? How might the group be affected by exchange rate volatility?

Overall, it's probably more likely to go up than down, from this point, but the upside isn't quite clear enough to persuade me to buy any. But I'm leaning towards picking up some, just need to do a bit more research into the questions above.

The chart is perhaps showing that sentiment might be turning more positive too? Note the three higher lows in recent months, which is usually a good sign;

Torotrak (LON:TRK)

Share price: 8.9p (down 2.8% today)

No. shares: 276.3m

Market Cap: £24.6m

Trading update - regular readers here will know that this is one of my least favourite jam tomorrow stocks. It's been trying to commercialise various automotive technologies for what seems like forever, and every couple of years it comes back to the market for more money.

Also, as the existing technologies get nowhere of any commercial significance, they branch out into other areas, which also seemingly get nowhere. Yet there are always deals with tier 1 manufacturers in the pipeline, partnerships, etc, but never any profits. Sorry, there was a £390k profit in 2010, amongst a sea of losses every other year.

The StockRank is only 4, and after hearing Ed's talk on Saturday, I am increasingly coming round to the view that I should only allow myself say 10% of my portfolio maximum, in all shares which have a StockRank under about 75. I think that would be a good discipline.

I was chatting to the Stockopedia guys after Saturday's show, and we agreed that Stockopedia should do our own investing show. We could extend an open invite to all companies with a StockRank of over 75 to attend, and bar everyone else! OK, we would probably lose money on it, as the poor quality companies are usually the ones who want to get in front of investors to talk up their share price, but you never know.

So going back to Torotrak, basically everything is going great, except that they're going to run out of cash again this year!

My opinion - it's just more of the same from this company, I'm afraid. Maybe one day shareholders will get lucky, who knows? It remains uninvestable as far as I'm concerned. I would never buy into such a serial disappointer.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.