Good morning! Quiet for news today, but several companies have caught my eye;

Robinson (LON:RBN)

Share price: 198p

No. shares: 17.7m

Market Cap: £35.0m

Robinsons is a plastic & paperboard packaging company, serving the consumer sectors (food, drink, toiletries, etc). It is based in Chesterfield, but recently made an acquisition of a Polish packaging company ("Madrox"), which was a material size acquisition, completed 5 days before the interim period end. The company also has surplus property assets I believe, although I can't remember how significant those are. Checking back, the company referred to, "

Interim results - for the six months ended 30 Jun 2014 are issued this morning, and don't look good to me. The market seems to agree, with the shares down 10% at the time of writing this (09:28). Turnover is almost identical to the prior period H1, at £10.9m. Although note that gross profit is lower by £139k, indicating pricing pressure. This is confirmed in the narrative, which says;

In a period when we have seen both grocery and major brand sales come under pressure from discounters, I am pleased to report that, despite a weak second quarter, our turnover in the first six months of 2014 has remained at last year's level. Gross margins have slipped slightly mainly as a result of cost increases that could not be passed on to our customers.

This rather glosses over the fact that Q1 turnover was up 8%, and therefore Q2 turnover was down 8%, which is a serious reversal. It seems that Robinsons (along with the whole supply chain) are being squeezed, which is why personally I never like investing in any company directly or indirectly supplying supermarkets - they will be permanently under intense margin pressure.

Operating profit - has crashed from £2.1m to £0.1m, although exceptional items account for a good chunk of that. Reversing out exceptional items to get to underlying performance, H1 operating profit this year was £495k vs £1,030k last H1. So that's still a more than halving of profit.

So I'm not quite clear why the company says;

The underlying operating profit pre-exceptional, non-repeating items and the Portland factory rental income is broadly comparable with the previous year.

Ah OK, I've just found the reconciling items, as follows;

Operating costs have risen by £0.2m primarily as a consequence of non-repeating credits that benefited the prior year. Property rental income is £0.2m lower than the same period last year, following the sale of the Portland property to Sonoco.

This £0.4m does indeed bring the underlying trading performance in H1 this year to within about £100k lower than last year. So it's not as bad as the headline figures suggest at first, which could explain why the share price has not fallen more than 10%.

Madrox acquisition - I've reported on this before, and it looks a good deal, with some helpful figures given in today's interim report, so clearly Madrox will significantly boost the profitability from H2 onwards;

The audited Madrox accounts for the year ended 31 December 2013 reported sales of £9.8m and a profit before tax of £2.2m. The unaudited accounts for the 6 months ended 30 June 2014 show sales of £5.0m and a profit before tax of £1.1m.

It looks a higher quality business than Robinsons, with a much higher operating profit margin - providing those margins are sustainable of course - they may not be, due to the competitive pressures mentioned earlier.

Balance Sheet - The Madrox acquisition was funded partly by using its existing cash pile, and taking on some debt. So the company now has net debt of £4.9m. That level of debt looks fine to me, it's not excessive in my opinion, especially considering that the company has property assets.

Overall the balance sheet looks alright - note the large £16m in fixed assets, property plant & equipment, reflecting both the property assets, and the capital intensive nature of this sector - you need factories & machinery to manufacture packaging materials.

Pension fund - note the £4.1m pension asset - I seem to recall doing a detailed review of the pension fund here a while back - here is my report from 21 Aug 2013. The pension situation here is fine - the fund is genuinely in surplus, and the company may even get some funds back at some point, and has a payment holiday. So no problem there.

Director remuneration - this was another issue from previous reports here, and would need checking, as it looked very high last time I reviewed the company's figures.

Dividend - The interim divi has been increased 12% to 2.25p, so that seems in line with broker forecasts of 5p full year divis, which gives an uninspiring yield of 2.5% (based on 198p share price). Although since Madrox could potentially double profits, then I think there could be scope for a much bigger dividend going forwards. It depends whether management decide to play it safe and reduce debt as their first priority, or be bold and pay out bigger divis.

I'm more interested in a company's capacity to pay good divis, rather than what the current dividend yield happens to be, and in this regard Robinsons could be good for people prepared to take a long term view. I wonder what management have said about divis in the past? If anyone has an insight into this, please comment below.

Outlook - the company has said the following this morning;

We reported sales in the first quarter were 8% higher, so sales in the second quarter have reversed that to leave us level with the previous year at the half year stage. Trends as we begin the second half indicate some improvement and, if sustained, we expect to show growth in sales in the underlying business by the end of this year. The Madrox addition will make a significant step change in the scale of the Group.

So it depends how much reliance you are prepared to put on the part I have bolded above. Personally I don't like relying on H2-weighted expectations, as it makes another profit warning more likely. So when pricing a share, I always err on the side of caution whenever a poor H1 has occurred, as an H2 warning could easily knock another 10-20% off the share price, depending on severity. Hence it would be unwise to pay a full valuation now.

Valuation - Note that the broker forecasts seem to be wrong - in that they don't factor in any increase in EPS from the Madrox acquisition. That doesn't make any sense at all, so I am expecting the 2015 broker forecasts to be revised up significantly. My previous back of the envelope sums indicated that 2015 could be about 15-20p EPS with Madrox included, versus current broker consensus (which I think is only one broker anyway) of 11p for 2015.

So the forecast PER of 20.9 shown on Stockopedia is likely to drop significantly when revised 2015 forecasts are issued by WHI, probably quite soon.

EDIT: I've got the updated forecasts from WH Ireland now, and they are saying 20.1p adjusted EPS for 2015 now, so the PER drops nicely to just over 10, which looks good value if that figure can be achieved. I'm a little wary, given the soft Q2, however a PER of 10 is probably sufficiently modest to factor in a margin of safety already.

My opinion - I'm concerned most about the Q2 slowdown in sales. If that continues, then there could be another profit warning in the pipeline. For that reason I'm going to watch from the sidelines. Although in other respects the company looks interesting & could turn out to be good value in 2015 once the big acquisition has been bedded in & built into forecasts. Surplus property assets with development potential is an interesting potential long-term kicker.

eg Solutions (LON:EGS)

Share price: 70p

No. shares: 16.5m

Market Cap: £11.6m

This is a small software company. As with almost all software companies, this one is incapable of explaining in simple terms what it's software actually does. I've read their website & Annual Report, and am none the wiser. It somehow optimises back offices anyway, whatever that means. I've been critical of this company in the past because of several issues;

- It wasn't clear that it had a viable business model at all.

- The CEO seems overly dominant, in both size of shareholding & excessive remuneration.

- Attending a private investor event to talk up the share price whilst a discounted Placing was underway in the background.

So it's very much a company that I don't want to own shares in! However, I bought a few this morning (which was a real battle, it's a ridiculously illiquid share, with wide bid/offer spread) due to a positive announcement today.

Trading update - this sounds potentially game-changing to me. It says;

eg solutions plc (AIM: EGS), the back office optimisation software company is pleased to announce that trading during the six months ended 31 July 2014 has continued strongly and, following a significant new contract win and strong momentum in trading, eg now expects to report financial performance for the full year to 31 January 2015 ahead of current market expectations.

A big contract win seems to have been key in this regard;

eg has won a material new contract with an existing client, a major third party outsourcing company. Revenues under the initial contract are expected to be in excess of £1.2m, of which £0.63m will be recognised in the current financial year, and separately, eg will receive a further amount per year in additional annually renewable licence revenues.

Sounds good! However, the bit that really got my adrenalin flowing this morning was this bit;

As reported in the Company's trading statement of 3 June 2014, there has remained a strong market for eg's product suite during the first half of the year and the Company expects the market opportunity to grow during the second half and beyond.

eg secured nine new contract wins from new and existing clients during the first half, contributing to its recurring and repeat revenue base and a forward order book of £13m. The Company expects to report revenues for the first half of approximately £4m and profit before tax above £0.6m. On 31 July 2014, the Company had a gross cash balance of £0.8m.

eg intend to continue to reinvest during the course of the current financial year into growing its operational structure, expanding its revenue pipeline and capitalising upon the market opportunity.

So you immediately think, OK double that £0.6m profit to annualise it, and this thing is making £1.2m p.a.. However, it's not that simple, as I understand that the H1 figure of £0.6m profit contains an element of one-offs, probably licence revenues. So the full year profit might be around, or under the £1.0m level, who knows?

It just sounds as if the company is on a roll. I like big contract wins, strong order books, and large clients - as all are evidence of the product having a competitive edge, and the company having the skills to sell it. There are some strong testimonials from big name companies on eg's website - it seems to be operating in the financial services area. So if banks, insurance companies, etc, are buying software from this tiny company, then that sounds intriguing.

There was Placing at 73p a while back, and the CEO offloaded some of her shares to Herald, so that has brought her shareholding down somewhat to a still rather too high 32%. Although note that Hargreave Hale & Unicorn are also on the >3% list, along with Herald, which suggests that there is something of interest here - we can be fairly sure that these Instis have met management, and checked out the business fairly carefully. The free float is tiny, so good luck if any readers do try to buy any shares - I found it very difficult, and only managed to pick up 6,000 shares in the end, and had to pay the full offer price for them, opening up an instant 10% loss through the horrible spread. Hence why I won't be buying any more - as if something goes wrong, you can't get out, if you have more than a few £grand's worth.

So high risk, very speculative & illiquid, but looks potentially interesting, if the company can continue executing well.

Comments on portfolio risk

I think there's something to be said for having a portfolio of micro caps within a main portfolio, which I do, as every now and then the odd one becomes a multi-bagger. Many go nowhere for sometimes frustratingly long periods, and if you pick badly (story stocks especially), then many can turn out to be disasters and even 100% losses. Hence why it's best not to put very much into each one, in my view - unless you find something really exceptional, then the temptation can be to bet everything on it, which is extremely dangerous of course.

These days I tend to put a limit of about 15-20% of my portfolio in any one stock, and only if that company has net cash, is profitable, and is at least liquid enough for me to be able to get out if something went wrong. Any stock that is very illiquid and/or loss-making and/or has net debt, or any material uncertainty about the company, then I would drastically scale back my maximum position size, usually below 5% of my portfolio. Keeping the risky stuff small is very important in my view.

Each to their own though. Many people like to diversify far more than I do. For me personally though, as I'm a stock picker, it makes sense for me to concentrate my portfolio more than average. Otherwise, if I'm just going to build a diversified portfolio what's the point of stock-picking?! Might as well just buy a tracker! Anyway, my stuff works over the long term, although there can be some nasty drawdowns along the way, but such is life - if you concentrate your portfolio, and buy smaller & often more volatile shares, then higher portfolio volatility is the price you pay in the short term for longer term out-performance.

Harvey Nash (LON:HVN)

Share price: 104.5p

No. shares: 73.45m

Market Cap: £76.8m

Right, back to work after lunch & a snooze on the sofa!

I last recapped on recruitment group Harvey Nash in my report of 5 Jun 2014, saying that it looked quite good value, and seemed to be trading reasonably well (this was the day of an in line with expectations trading update). It was 117.5p at the time, so is now 11% lower, which seems to have been due to the general decline in small caps in recent months, rather than anything company-specific, so I'm already beginning to wonder if this might be a buying opportunity, if today's trading update is any good? Let's find out.

Trading update - this is a clear & well constructed announcement - i.e. the key summary being placed at the start of the announcement, which is always the best way of doing it - i.e. give the conclusion first, then the detail below, for those who have the time & inclination to read more. So it reads;

Harvey Nash, the global executive recruitment and professional services group, is pleased to announce that its interim results for the six months ended 31 July 2014 are expected to be in line with the management's expectations, despite currency headwinds.

On profitability, the company says;

Operating profit for the period is expected to be ahead of the comparable period in 2013 by circa 5% (circa 11% on a constant currency basis*) and adjusted profit before taxation by circa 5% (circa 12% on a constant currency basis).

So quite a noticeable impact from currency movement, but they are still usefully up. Currencies move around, so that's just swings & roundabouts in my view, in the long run.

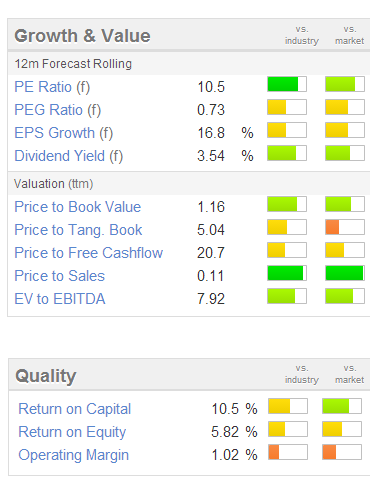

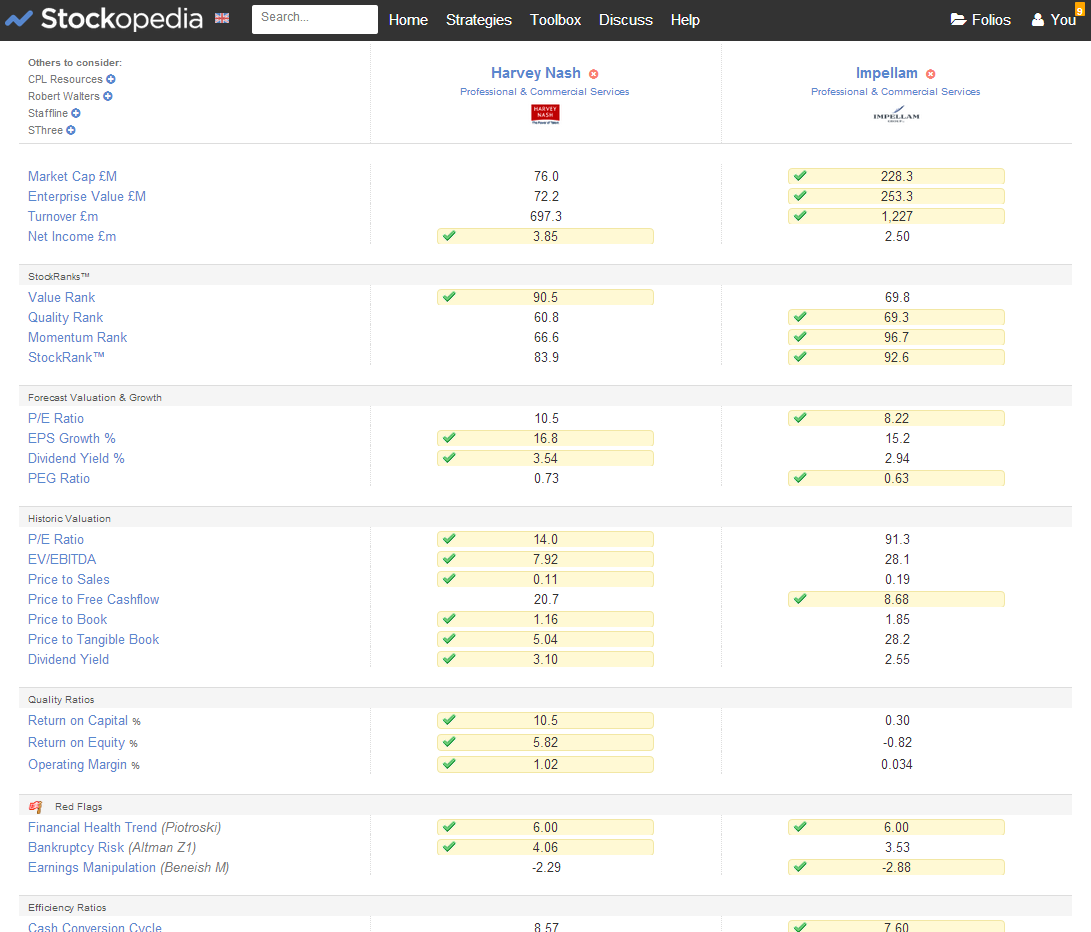

Valuation - as you can see from the Stockopedia graphics below, these shares look good value - a fwd PER of 10.5 looks good to me, with economic recovery (hopefully) building in most of its markets, and a reasonable dividend yield on top.

The only recruitment company I hold at the moment is Impellam (LON:IPEL), which I bought purely as the valuation seemed anomalously cheap. So I've run a comparison of the two companies on Stockopedia, to see which I prefer. This is a really useful tool, you can find it on the main menu in the black bar above, under Toolbox > Compare Stocks.

I've done a screen grab below, hopefully this will be legible:

I couldn't fit it all on one page, so there is more detail below if you run the comparison tool yourself.

The highlighted/ticked items show which company is better for each criterion. Some interpretation is required. For me the historic valuation section is only of passing interest. I'm much more interested in forecast PER, and having up-to-date trading statements from each company, which we have (Impellam last reported on 30 Jul 2014 - I reported on it here).

It seems to me as if Impellam is much bigger (3 times the market cap of HVN), and has a cheaper forward PER, although I think HVN probably has a better balance sheet.

Doesn't look as if there's a huge amount in it either way, and both look pretty good value given where we probably are in the economic cycle - i.e. with more earnings growth to come.

My opinion - I think this stock looks quite good value, and I'm tempted to pick up a small opening stake. I'll put it on my watch list, do some more research, and see if there's a chance to buy a bit cheaper on a general market correction at some point in the coming months.

James Latham (LON:LTHM)

Share price: 510p

No. shares: 19.44m

Market Cap: £99.1m

Lathams is a distributor of timber products. The company seems conservatively run, with a good track record, so it's a company I like - last reporting on it here on 20 Mar 2014.

Trading update - issued today, sounds upbeat, here are the key bits;

Revenue for the first four months of the current financial year, namely April to July 2014, is 10% higher than the same period last year. This is largely the result of higher volumes traded, with more large orders delivered directly from manufacturers or the docks. In addition, sales ex stock have also grown. Margins are higher than for the same period last year, but similar to the March quarter. Overall the Company is trading to market expectations.

Outlook - the company today says;

The outlook is more positive than we have seen for some time and our wide spread of customers and strong balance sheet means that we are well placed to take advantage of opportunities.

Valuation - trouble is, the shares have been going up for some time, thus pricing in the upside. Broker consensus is for 34.9p EPS this year, so that means a PER of 14.6, which is high enough for the time being in my view.

My opinion - as the company says itself, it operates in a competitive market. Looking back over the last 10 years, it has made an operating margin of 5-6% in the good years, and 3% in bad years. So there's probably not scope to increase the operating margin by much, as competitors will undercut them on price if they try to charge more.

That said, with a long overdue surge in housebuilding going on now, perhaps there will be more opportunities to grow the top line, which today's statement suggests is happening. Overall I feel that the current share price looks about right, with probably some more upside possible over time. Note that is scores high Stockopedia quality rankings, and has an excellent overall StockRank of 98.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in EGS, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.