Good morning,

It's Paul's day off today, so I'm planning to cover 3-4 of today's stories in his absence. First up is Record (LON:REC):

Record (LON:REC)

Share price: 42.375p

No. shares: 221.4m

Market cap: £94m

This is an unusual type of asset manager, as it is focused on currencies rather than equity/fixed income.

One might ask: when clients want hedging or currency-derived returns, shouldn't banks be the go-to provider? How can a smaller institution compete with them?

On the hedging side, it doesn't surprise me that there is space for a smaller, independent player. After all, there are plenty of currency brokers dealing with the retail market, providing individuals with advice and better rates on their FX needs when they expatriate/repatriate, buy foreign property, etc. Think of Record as a large, institutional version of this!

And on the currency-derived return side, Record acts similarly to any other independent asset manager or hedge fund.

So, in principle, I'm very comfortable with the idea that there is space for an independent currency specialist, focusing on institutional clients.

The track record of profitability isn't bad either: profits were reset lower during the 2008-2012 period, but have been stable since then.

Which brings us to today's update:

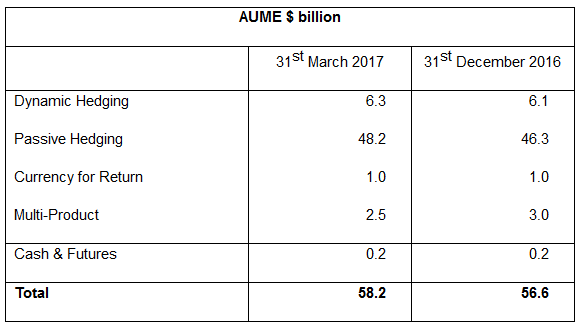

So it's a 2.8% gain in USD terms, and also a 1.7% gain in GBP terms.

My opinion

I'm kicking myself a little bit when I look at the share price chart - even after today's slide, the shares are higher than they've generally been over the last couple of years.

Admittedly, it's not the easiest investment thesis.

On the positive side:

- The company has always been financially strong. At the last interim results (for Sep 2016), it had a tangible and liquid balance sheet which included cash and short-term instruments worth some £36 million.

- In the absence of strong growth, dividends have at least been generous relative to earnings (1.7p divis in 2016 versus 2.5p EPS).

On the negative side:

- The client base is not too well-diversified. According to today's update, the number of clients has reduced from 64 to 59 (this time last year, it had 58 clients).

Note that today's update shows AUME up by $1.6 billion, but $2.1 billion of increase was due to movements in global stock markets and exchange rate movements. So the underlying client flow was marginally negative. And another client will be terminating a $1.2 billion mandate during the current quarter.

Today's outlook statement mentions "good engagement" with clients in the current environment, without suggesting that performance is about to dramatically improve.

So I'll probably continue watching this from the sidelines, despite the excellent StockRank.

Charles Stanley (LON:CAY)

Share price: 315.5pNo. shares: 50.7m

Market cap: £160m

Trading Update and Notice of Results

Includes the magic words: in line.

The Group is maintaining positive momentum across all divisions and trading is in line with management expectations.

Charles Stanley has a March year-end, so (like Record's statement today) this is a Q4 trading update.

The broad movement seems very good:

Total Funds under Management and Administration ("FuMA") at 31 March 2017 were £24.0 billion representing an increase of 5.7% against £22.7 billion at 31 December 2016 and 17.1% compared to £20.5 billion at 31 March 2016.

And the outlook statement tells us that "conditions remain favourable" as the company works on a range of objectives - improving net flows, productivity, operating performance and the balance sheet.

On balance, it looks a reasonable proposition at a PE multiple of 15x and a dividend yield of 3.4%.

Immunodiagnostic Systems Holdings (LON:IDH)

Share price: 297.5p (+1.7%)

No. shares: 29.4m

Market cap: £87m

This swung to a huge loss last year, but the shares have now more than doubled from their low as the market has apparently decided that whatever problems exist here aren't terminal!

Immunodiagnostic Systems ("IDS") produces "manual and automated diagnostic testing kits and instruments for the clinical market".

Today's update tells us that revenues for the year are expected down 8% at constant exchange rates (CER), or up 4% at reported exchange rates.

I can't find many bright spots in the statement, unfortunately. And I wonder about the quality of company's IP portfolio, given the weakness in several income streams.

There is definitely a lot of value in the balance sheet. Cash increased to £31.5 million.

Might be worth keeping an eye on, as it does have the financial flexibility (and therefore the time) to attempt a turnaround.

Pebble Beach Systems (LON:PEB)

Share price: 5.125p (+1.7%)

No. shares: 124.6m

Market cap: £6m

I thought I'd mention this in passing, even though it's below the traditional £10 million cut-off, as it's often been mentioned on these pages.

The group's bank debt was reduced from £17 million to £12 million by the sale of Vislink, and today it's announced that there has been some progress in relation to a $2 million Vislink debtor (where Pebble Beach expects to collect the money with the help of the US company which purchased Vislink).

The bank are said "remain supportive" despite the company's forecast (31 March) that it will be "in breach of its banking covenants for the foreseeable future".

The best case scenario looks to me like a substantial equity raise, to clear the bank debt, if shareholders can be convinced.

That's it for today - have a good weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.