Good morning!

Zytronic (ZYT)

This is a British maker of bespoke touch screens for large electronic devices (think vending machines, gaming machines, ATMs, etc). The company has this morning issued an AGM trading update, which reads very well, saying;

The board is pleased to announce that current trading is considerably ahead of the comparable period and revenues and margins, led by an improving trend in touch sensor orders and sales, are at levels similar to the performance of the second half of last year, which is in line with management expectations.

So to interpret this, I take the following steps;

1. Confirm the period dates that they are talking about - it's a 30 September year end, therefore this statement refers to the bulk of their H1 period, which is the six months to 31 Mar 2014. So as of today's date we are five months into that period.

2. Check what the company's performance was like in the comparable (i.e. H1) period last year - so checking the interim results from last year, the company performed poorly, with revenue down 20% to £8.5m, and profit down 64% to £0.8m. EPS was only 4.1p (prior year 11.1p). Therefore an improvement against those weak figures is to be expected!

3. As revenues & margins are at similar levels to H2 last year, then we need to work out what that was, by looking at last year's final results, then deducting the H1 results, to arrive at just the H2 results.

4. Consider any complicating factors - in this case they refer only to revenue & margins, so it's ambiguous as to whether that means gross margin, or operating margin, or both (note "margins")?. It would have been better if they had also mentioned profitability directly, since an increase or reduction in overheads would also have an impact.

Overall then, I've had a to make a few assumptions, but by my reckoning H2 last year was £1.1m profit, and 7.0p basic EPS (because H1 LY was 4.1p basic EPS, and FY LY was 11.1p EPS). So annualise the current run rate of 7.0p EPS, and we're at 14.0p EPS for this year probably (assuming no change in trading in H2).

However, also note that at the full year the company discloses adjusted EPS, which was 1.8p higher, so that lifts this year's estimate to 15.8p EPS, assuming no change in trading from H1 to H2. Looking at Stockopedia and another website, broker consensus for this year is between 13.3p and 13.9p EPS. That is usually calculated on adjusted EPS, so my calculatio of 15.8p for this year (based on today's statement) looks to be about 2p ahead of broker consensus.

That makes sense, because the broker forecasts were by their own admission, very conservative for this year, and I've mentioned here before that Zytronic really should thrash this year's forecasts if their recovery is on track. Last year was an unusually bad year, because some large contracts with a vending machine company did not repeat as expected, leaving a gap in their order book.

Also, the share price here has been rising nicely, suggesting that the market had confidence forecasts would be exceeded, and it now looks as if that confidence was well placed.

So to continue my step by step approach above,

5. Consider the valuation - this is most easily done on a per share basis, so at 244p per share currently, and using my estimate of 15.8p adjusted EPS for this year, then the PER drops out at 15.4. That's a reasonable price for a company that is recovering from a bad year in my view (i.e. where there is scope for earnings to rise further).

Also bear in mind that Zytronic has a very strong Balance Sheet, with £5.5m in net cash at the last year end, which is about 37p per share. So the ex-cash share price is 207p currently, which reduces the current year PER to 13.1, which is starting to look attractive.

There is a generous dividend, of 9.1p last year, giving a current yield of 3.7%.

With patience, and assuming no further slip-ups on trading, I can imagine Zytronic continuing its steady share price recovery to 300p+. There is some future potential excitement with new products, including curved multi-player touch screens, for gaming and vending applications. The company has historically made strong operating profit margins, indicating pricing power. Anyway, let's see how the market reacts, but I suspect the shares will probably rise from here. It's likely to get favourable coverage in MoneyWeek and Shares magazine next week too, as both are already fans of the company.

I'll keep my eyes peeled for revised broker forecasts, to see if my 15.8p estimate is in the same ballpark as brokers once they have re-run their models to include today's news.

Digital Barriers (LON:DGB)

I've always been very bearish on the valuation of this company, reporting on it five times last year with a bearish conclusion each time. Their most recent results were commented on here by me on 28 Nov 2013, and as I concluded, the figures were terrible, and the valuation at 169p per share was bonkers.

I tried to short these shares at the time, as it seemed such an obvious over-valuation, but they were not shortable through the particular SB company I use for my trading account (as opposed to my long term investing account).

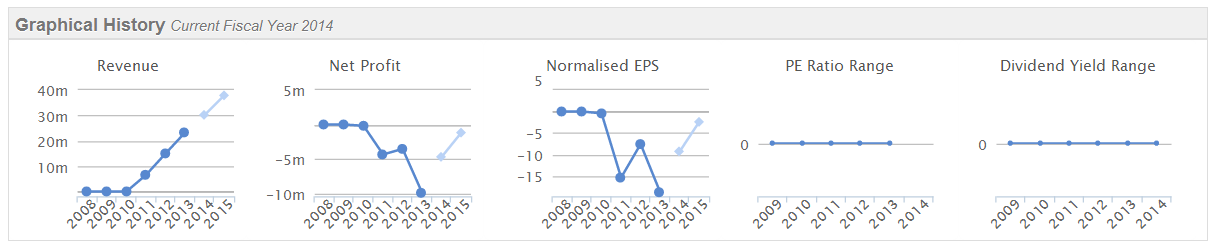

That opinion has been vindicated today by a profit warning that has knocked 17% off the price, brining it down to 117p per share. That's still a valuation of £76m, for a company with a lamentable financial track record of making worsening losses;

Bear in mind also that the forecasts for 2014 & 2015 shown above in light blue will now be revised down a lot, and the picture is even worse.

Looking at the detail of today's profit warning, sales for 2013/14 (it's a March year end) are expected to be slightly lower than last year's £23.3m. The adjusted loss of £7.6m last year is expected to be 40% worse this year, so that's about £10.6m loss. With £14m cash remaining, there's only enough in the tank for just over a year of continued operations at that level of losses.

The company has reiterated its target of reaching breakeven in the year ending 31 Mar 2015, but talk is cheap, it's the numbers that matter. So I remain highly sceptical about this company.

They are reducing their cost base by £3m p.a.. The only positive I can see is that the sales pipeline is said to be strong;

The Group's sales pipeline remains strong and numerous significant sales are expected to close in the next few months which will contribute to revenues in the next financial year. The first of these, awarded in February 2014 is worth in excess of £2.0m and will be recognised in the first half of FY15.

So perhaps there is light at the end of the tunnel? This is the type of stock where one couldn't possibly invest without meeting management, and really questioning them hard about the prospects for future sales. I would say the likelihood of another fundraising being required later in 2014 or early 2015 is very high. The risk is that without material progress on orders, the story is going to sound very stale. It might succeed, but to my mind investing in this company at this stage would just be a complete punt, so at such a high valuation it doesn't interest me.

Comments on Shorting

Which reminds me, for people who claim to have some sort of moral aversion to shorting, let me explain how it works. I place a bet with a SB company on a share price going down. Someone else places a bet on that same share price going up. The SB company pays out the profit to the winner, paid for by the loser, and takes a small cut for their trouble. So what exactly is the problem with any of that?

Bulls constantly talk up their own stocks - go onto any advfn bulletin board for a popular stock, and see a tsunami of one-sided postings all the time, from people who aggressively shout down anyone with a less than 100% bullish opinion, and agonise over every tick up & down in price.

Bears talk down stocks that they are bearish on, and some have been (justifiably perhaps) criticised for using scare tactics to frighten other people into selling. That said, you usually find that attacks by bears have a lot of substance in them, on a factual basis. Also to be blunt, if you haven't researched a company properly, and can be scared out of it by someone putting something on a bulletin board, then should you really be investing at all? To people who have done their homework properly, attacks by bears provide a buying opportunity. Sometimes the bears win, sometimes the bulls win, that's what makes a market.

Short sellers are needed in order to at least limit over-valuations, although as we're seeing at the moment, bears are being overwhelmed in numerous speculative stocks, which is laying the ground for the next crash in fashionable stocks, a repeat of March 2000 is looking increasingly likely in my view. Nobody knows when, and in all likelihood it probably won't be for some time, since the excesses of today are nowhere near the scale of late 1999, early 2000. However we are clearly on the same road, which is why I am starting to call this market "The second technology shares boom & bust"! We just haven't had the bust yet!!

I've generally lost money on my short positions in the last few months (ASOS and Ocado in particular, although Quindell is now in profit, and Globo around breakeven). The lesson I've learned from this, which a number of people have pointed out to me on Twitter and here, is not to short things whilst sentiment is still so bullish. It would have been better to make a list of things to short, held back, and then once the market overall has turned bearish on fashionable, wildly over-priced growth stocks, short a basket of them, with no individual position being so large that it can do any damage.

It's a dangerous game though, shorting, as the losses are potentially unlimited. As we saw with Facebook recently, a company that has hugely overvalued paper can use that paper as its own currency to buy other companies at vastly inflated valuations. So anyone who is short in the face of that would be toast.

In the past I've nearly always lost money shorting in the short term, given up, but in the long run have been proved correct. It can take years though for a bubble stock to finally burst. So this time around I'm only doing it on a smallish scale, and with a long term view. It also acts as a nice buffer in a market downturn, to have some short positions that absorb the losses from other things dropping in price.

So as stated many times before, I totally distance myself from the tactics of other people who short stocks, but reserve the right to short individual companies whenever I like. Generally speaking also I've found it a complete waste of time trying to engage in discussion with bulls, as all they really want to do is silence any critics. So apart from the odd Tweet, I'll let the final outcome be the commentary on my individual short positions, and won't discuss them here. They're not small caps anyway, so are outside the scope of these reports.

However, people who take a supposedly moral stance against shorting are arguably showing some naivety. It's part & parcel of a properly functioning market that people can take long or short positions. It adds liquidity, helps correct over-valuations thus restricting the scale of bubbles, and of course it's the closure of bear positions that actually provides the buying to pull shares up from low points!

Feel free to discuss in the comments section below, we like lively but courteous discussions here on Stockopedia! - one of the few places where a sensible discussion can be had between people with opposing opinions. Ed has rightly said that he won't tolerate rudeness in the comments here, so please keep it clean, and no personal attacks, ever. Thank you!

The golden rule with all discussion of shares (whether long or short) should surely be to back up your opinions with factual evidence, and to consider the opposing view. Generally I find opposing views more useful to me, as it makes me question my own basis for being long or short. That is much more useful than comments that reinforce my view and potentially make me overly bullish, and hence reluctant to sell even if one really should be selling. There are no prizes for being the house bull (or bear) on any stock, if you back yourself into a corner & end up holding on to a losing position. Far better to just admit you got it wrong, close out, and move on. Although that depends on your timescales. It's perfectly possible to be wrong short term, but right long term, and vice versa!

Costain (LON:COST)

I'm not terribly familiar with this company, having only mentioned it once here before, on 7 Jan 2014. So re-reading my report of that day, I liked the apparent value at 292p (on a PER just under 10 at the time), and good outlook, but I held back from buying any shares as the Balance Sheet wasn't great.

Something must have gone wrong, as this share has dropped 18% today to 260p. The headlines for results for the year ended 31 Dec 2013, issued today, look alright. However, the fly in the ointment is a £75.1m fundraising, at a deep discount to the market price, priced at a very surprisingly low 225p. That's one helluva discount to last night's closing price of about 320p, in a market that is awash with cash, and generally doing Placings at a small discount (roughly 5-15% discount is typical at the moment).

The pricing and structure of the deal are such that it looks to me as if there was little investor appetite for this fundraising, so it had to be priced at a bargain level where existing investors are effectively forced to take up their entitlement.

So a third of the deal (£25.0m) is a Firm Placing, and the balance of £50.1m is a Placing and Open Offer. The Open Offer is 1 new share for every 3 existing shares. The most recent RNS to state the number of shares in issue says there are 66,812,868 at the moment. Hence a 1 for 3 new issue means that just under 22.3m new shares would be issued if everyone takes up their entitlement. So the (non-Firm) Placing will just be for any residual shares that are not taken up by people exercising their entitlement under the Open Offer. It's being underwritten by Liberum & Investec, so there is no danger of the fundraising failing.

Therefore the current share price of 265p is really a blend of last night's 3 shares held at 319p, less 1 new share at 225p. Averaging that out comes to a price of 295p, so the market pricing it at 264p shows that it's fairly unimpressed with this deal, I would suggest.

It could well also be people in the Firm Placing flipping their cheap 225p stock for an instant profit (which can be done by opening up a short CFD today, and then settling it with the new 225p shares when issued). So really the Firm Placing part of this deal is disadvantageous to existing holders, since it's handing free money on a plate to people who took part in the Firm Placing. I wouldn't be very happy about that if I were an existing holder of the stock.

Still, once the dust has settled, at least this will fix their Balance Sheet, and is a good example of why personally I always look for Balance Sheet strength - because it avoids this kind of dilutive fundraising. In this case there is at least an Open Offer for existing holders, but what if it had just been a Placing, as is often the case in smaller companies? It would have been a nasty loss for existing holders.

The total number of shares will go up from 66.8m to 100.2m after this fundraising. This means that the 44.1p adjusted EPS just reported for 2013 would drop to 29.4p if I've done the maths correctly. Given that the Balance Sheet would now be a lot better post fundraising (although still not amazingly strong by any means), then I think you could value that on a PER of 10 perhaps? So a sensible valuation might be just under 300p going forwards.

I can't see any reason to rush into buying the shares, although paradoxically if they weaken further from here, and start to get near the 225p fundraising level, then the risk of the Open Offer failing and the underwriters being forced to take £50m of stock rises. So it's a tricky one.

Personally I don't like this sector generally - a lot of companies in this space have gone bust in the past, and generally companies with very large turnover, and thin margins, working on complicated major projects, are high risk investments. If something goes badly wrong with a big contract, the cost over-runs can be ruinous, so I'll probably avoid this sector altogether from now on.

I've missed quite a few other announcements today, but there are too many to cover everything, and I have run out of time.

See you tomorrow, as usual.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in ZYT, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.