Good morning!

I had a look at results from Telit Communications (LON:TCM) last night, and updated yesterday's report quite late, so here is the link for that.

Audioboom (LON:BOOM)

Share price: 3.25p

No. shares: 535.6m

Market cap: £17.4m

Results y/e 30 Nov 2015 - these figures are shockingly bad. Turnover for the year was only £192k. The company managed to rack up a £7.5m operating loss. This is complete madness.

The cash pile reduced from £8.9m a year earlier, to £3.1m at 30 Nov 2015. Given ongoing heavy cash burn, the company must be close to running out of cash by now.

It's always jam tomorrow with Audioboom, and no doubt conversations are already ongoing with existing shareholders, to see what appetite they have to pour fresh cash in, to support its continuing cash burn.

This type of business model - heavy cash burn, with repeated rounds of fundraisings, is probably the worst type of investment you can imagine. This type of company very rarely succeeds commercially (although the ones that do succeed, can occasionally do so in a spectacular way). I think it's dawning on investors that Apps seemed a trendy idea a couple of years ago, but in reality are just black holes for cash, usually run by delusional characters who believe their own hype.

I've probably mentioned it before, but if you want a riveting (and relatively short) read, on a dot.com boom & bust story, then "Boo Hoo - A Dot.Com Story from Concept to Catastrophe" (nothing whatsoever to do with Boohoo.Com (LON:BOO) by the way) is an absolutely brilliant book. It's about one of the first dot.com disasters, called Boo.com which had a shoot for the moon type of business model, and it collapsed when the funding dried up. Eventually shareholders tire of putting fresh waves of money into cash-burning businesses.

So the historic numbers for BOOM look a complete joke. However, there is a second announcement from the company today which gives a glimmer of hope;

Q1 Quarterly Update - as the begging bowl is out, the pressure is on to issue some positive news. Therefore in such situations I'm always particularly sceptical about the claims being made.

Nevertheless, this bit sounds quite interesting;

Revenue in Q1 exceeded the total revenue for the full year ending 30 November 2015 of £192,000.

So turnover of more than £192k in Q1. So that's probably about £200k turnover in Q1, or £800k annualised. That's a big improvement, but still nowhere near enough to cover overheads of approx. £6m p.a. (before share-based payments).

Therefore the company would need to increase turnover again, by about 8-fold, to get to breakeven. Sounds a tall order to me.

The key question is whether increased turnover is sustainable? The company makes positive noises on the outlook, but doesn't quantify it;

Audioboom is now able to reconcile its forward media campaign bookings, due to technical advancements on its advertising booking platform and increased focus from the Cumulus media sales team. Accordingly, the Company is pleased to report strong advanced bookings of advertising revenue for Q2.

Have they run out of cash yet?

Net cash at 29 February 2016 was £2.2m. In addition to increasing revenues, tight control on expenditure combined with greatly reduced consumer marketing spend, in line with the Group's strategy to focus on the B2B platform, has reduced the rate of monthly cash burn in Q1 by 34% from the monthly rate for the 12 months to 30 November 2015.

Since cash was £3.1m at end Nov 2015, it has burned through £0.9m in 3 months. So assuming the same rate of cash burn, then I estimate it has just over 6 months' cash left in the bank - so getting tight, and a fresh fundraising is an absolute certainty. The only questions are when, how much will be raised, and at what price?

The price of the next fundraising is entirely up to the people who put up the next tranche of money. If they're existing shareholders, then they usually want to preserve the value of their existing shares, and save face, which is helpful for existing small shareholders.

If however existing shareholders are not interested in putting in fresh cash, then new shareholders will be needed, who may extract punishing terms, putting in new money at say 1p per share.

My opinion - if I had to guess, then I reckon existing shareholders might well stump up say a fresh £2-3m, as the Q1 update does contain some signs of progress (just in the nick of time though).

On the basis of the 30 Nov 2015 y/e results, it looks a total basket case. However, on the face of it, the Q1 update shows signs of progress. I always keep an open mind, and if the facts change then I change my mind. I think it's too early to become optimistic about this company, but if it makes further progress on growing revenues, and gets a tighter grip on its overheads, and manages to raise more money from shareholders, then it could have a future.

Is it going to be worth billions in future?? That's very unlikely in my view. This is not another Facebook or Twitter. Users are not really very engaged, they just follow links to Audioboom for content that happens to have been uploaded there. So I don't think you can value Audioboom on a per user basis, which was the original story when it floated.

If however it can reach profitability, on the basis of ad revenues, then it could have some value at some point in the future. Personally I'm trying to avoid jam tomorrow shares as much as possible, as they only rarely work out (hardly ever, actually). So why take the risk, when you can buy proper businesses on reasonable valuations, and get paid divis?

Jam tomorrow shares are undoubtedly the biggest "leakage" from my investing performance. When I keep away from them, and stick to profitable, dividend-paying companies, the results are dramatically better, and compound over time. Whereas frittering money away on jam tomorrow stuff can leave your portfolio stuck in first gear.

There's money to be made during the hype phase of stocks like this, early on. But once they've peaked, then the story is usually depressingly familiar - a long, slow grind downwards back to where the price started. Who would want to be the mug holding the shares all the way down this glide slope?

Walker Greenbank (LON:WGB)

Share price: 205p

No. shares: 60.2m

Market cap: £ 123.4m

Background - this upmarket fabric & wallpaper group was affected by flooding in Dec 2015. I reported on it here, pointing out that the company had full insurance, including business interruption cover, hence a knee-jerk reaction to sell the shares was wrong, which has proven to be correct - the shares recouped the initial drops after the flooding, and are now back to where they were pre-flooding.

Interim insurance payment - the company says today that it has received an £8m interim payment from its insurer, a commendably quick payment. Also note that old machines are being replaced with new, so the company should end up in a better position than before, with more modern machinery;

Digital fabric printing began towards the end of last month on a like for like replacement machine and customer shipments are starting this week. The three other machines are being replaced with next generation digital printers with higher throughput and capabilities. The first of these has been commissionedand is expected to be in full production shortly.

With capacity mostly back to normal by end Apr 2016, the interruption to business probably hasn't done lasting damage to customer relationships, and in any case is fully insured.

My opinion - insurance policies these days are usually very comprehensive, covering all aspects of loss, including business interruption. I'm impressed with how quickly WGB's insurer has paid out - all credit to them - WGB should name check the insurance company & broker, as a good job deserves recognition.

It seems likely that WGB will end up in a better position overall after the flood, than before, with higher capacity, more modern machinery. Therefore there should be no adverse impact on the share price.

Natural disasters are really only damaging to shareholder value if the company is under, or uninsured, which is not the case here. This situation is worth bearing in mind when other similar cases arise at other companies. The key thing to look for is obviously an emphatic statement that the company is fully insured, including business interruption. If that is clearly stated, then really there's nothing to worry about from a shareholder perspective. Indeed, any dip could well be a buying opportunity.

EDIT: There are some interesting reader comments below concerning insurance - especially possible hikes in the insurance premiums, and difficulty if another flood happens - the site could become uninsurable. So thanks to the readers concerned who added those interesting additional comments, well worth reading.

Regenersis (LON:RGS)

Share price: 195p (down 1% today)

No. shares: 79.0m

Market cap: £ 154.1m

Interim results, 6m to 31 Dec 2015 - the nature of this group has completely changed, as a deal has been done (completing in Q2 of 2016) to dispose of the main electronics repair businesses, for cash consideration of E103.5m. This seems a good price, for what wasn't really a very good business (in my view) - low margin, and with limited organic growth potential.

It does however seem odd, when after doing the rounds for several years, talking up their business, management suddenly announce they're selling it, to concentrate on something more exciting - the data erasure business acquired, called Blancco.

A c.£50m return of cash to shareholders is planned from the sale proceeds, so that's about a third of the market cap.

What to make of the remaining business? I'm not really sure.

Webinar - I'm very keen to encourage/promote any initiatives to improve shareholder communications, and results webinars are a fantastic way for private investors to virtually meet management, and receive a results briefing, with Q&A, over the internet.

Here is the link to register for RGS's webinar, this Thurs 10 Mar at 4:45pm.

Blancco seems to be a high margin business. It reports £9.9m turnover in H1 (up an impressive 46% Y-on-Y), and using their own definition of profit, "HOP" (headline operating profit), it made £3.5m, but that's before £0.8m in corporate costs, so £2.7m after for the 6 months.

My opinion - management here are clever financial engineers, so I always treat the figures with a higher than usual degree of scepticism.

The disposal is so material, that I'd rather wait until the dust has settled and the funds are in the bank. Also it would be good to see clean figures, with the old business gone.

The new business, data erasure, seems to be high margin, and growing strongly, so I suppose the hope is that the shares get re-rated onto a growth company valuation. It's difficult to assess at the moment, but on balance I'm probably leaning towards being mildly positive about this share, providing the E103.5m disposal proceeds are received as planned in the next few weeks/months.

Management are good at getting excitement going about growth, etc, and generally promoting the shares. So that could drive upside possibly? Although watch out for Director selling - that has been well-timed in the past.

Lakehouse (LON:LAKE)

Share price: 39.5p (down 1.2% today)

No. shares: 157.5m

Market cap: £62.2m

(at the time of writing, I hold a long position in this share)

Board restructuring - the CEO is stepping down with immediate effect;

Sean Birrane has announced he wishes to step down from the role of Chief Executive Officer and will be resigning from the Board. Sean will be remaining with the business for an interim period.

The last words reassure to a certain extent, that nothing untoward has happened which we don't already know about. Although there is a conspicuous absence of any statement thanking him for his service. Maybe that's not surprising, given that the company warned on profit so soon after listing? I don't suppose shareholders would react too kindly to a glowing tribute, given that they have lost more than half their money in just under a year.

The Chairman, Stuart Black, is taking over as CEO, so let's hope he can sort things out. He was formerly CEO of Mears Group, up to 2008.

The most interesting bit, is that a trading update is included in today's announcement. It's always worth reading all RNSs for companies that you're interested in, as you occasionally find an unexpected update on trading, or some other pertinent info, buried in an announcement about something else;

Further to the trading statement issued on 1 February 2016, the Board confirms that the Company remains on track to deliver its revised expectations for the current financial year.

That's clearly good news, and reassures that the CEO isn't leaving because things have got any worse.

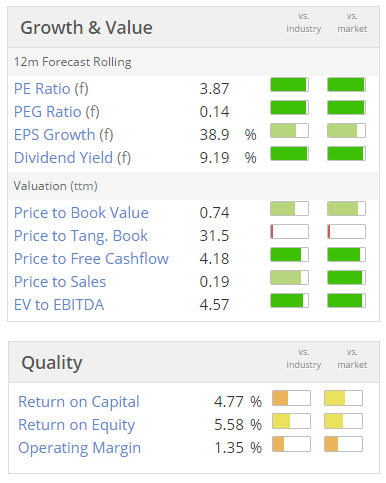

IF the company gets close to revised forecasts, then this share will look very cheap indeed - the forward PER is less than 4! That's usually a sign that earnings forecasts won't be achieved. However the company has just confirmed that it is indeed on track to meet forecast.

Look at the forecast dividend yield too! Even if earnings & divis are half what is forecast, the share would still be good value. So there seems to be a large margin of safety in the current price, which I find encouraging.

That said, the company has blotted its copy book, so investors will understandably be treating it with suspicion at the moment. Also there is a worry that, with social rents required to fall by 1% p.a., that more customer work could be deferred. I don't really see the logic in trying to save money by deferring work that needs to be done. It's often false economy, and just leads to infrastructure becoming dilapidated, instead of being properly maintained.

Incidentally, as a general point, I've noticed that since Councils have been squeezed financially, signs of inadequate maintenance are cropping up all around us. I've definitely noticed a big deterioration in the white lines on roads, which are often becoming almost completely worn off, and road signs covered in algae because they're not being cleaned.

Anyway, I shall watch with interest what happens with LAKE. It's potentially cheap, but that depends if there's more bad news to come out or not.

The chart is starting to look a bit more encouraging - sellers don't seem to want to push it much below 40p, and there are enough buyers at that level to mop up the sells. Therefore once the disappointed IPO buyers are cleared out (those that want to sell anyway), then the ground is cleared for a recovery. That then sucks in momentum traders, and you can get a nice move upwards.

Note that there have not been any TR1 forms, or Holding in Company RNSs since the profit warning, so it looks as if existing major shareholders are either giving the company the benefit of the doubt, or can't find buyers for their shares if they do want to sell.

Johnston Press (LON:JPR)

Share price: 41.5p

No. shares: 105.9m

Market cap: £43.9m

I have long (over several years) been telling readers here that the equity of this newspaper group is probably worth nothing, due to the extent of its debt, and pension deficit, combined of course with a dying core business.

Bonds downgraded - my attention is drawn to the £225m senior notes having been downgraded by Moodys to Caa1, the 3rd lowest ranking on their scale apparently. The yield to maturity on the bonds, at 20%, is already signalling that this is a distressed situation, where the bondholders may not get their money back, in full.

Readers should remember a core principle of company law - that holders of equity rank behind all creditors. So if there's not enough to repay creditors, then equity is worth nothing.

Also, why on earth would anyone buy the equity, since it has no income stream, and a 100% loss is the probable long-term outcome, if you can instead buy the bonds, and at least receive a nice healthy yield in the time between now, and the company going bust? Small investors may not be able to buy the bonds, as size restrictions on trades sometimes apply.

The nice thing about shares where there are also traded bonds, is that the bonds act as a second opinion on valuation. Bond investors tend to act smarter than equity investors, as they are less moved by emotion, but instead look at things purely in terms of yield, and the likelihood of getting repaid the principal. Whereas equity investors can often get sucked into stories about what the future might hold.

The bond yield at JPR is clearly signalling that equity is probably worth nothing. Therefore this has prompted me to reiterate my warning here, since I added JPR to my Bargepole List at 210p in Aug 2014. It's since lost 80% of its value. The balance sheet is terribly stretched, and remaining cashflows are likely to be utilised servicing debt & the pension fund.

The recent £24m acquisition of the i newspaper seems a very strange thing to have done. Bondholders will no doubt be concerned that the company will not have accumulated anywhere near £225m in order to repay those bonds in 2019. In which case, the bondholders could well end up taking control of the company, and of course that would leave the equity worthless.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.