Good morning!

Cohort (LON:CHRT)

The market has given a thumbs up to an £8m acquisition announced this morning, by defence contractor Cohort, of a company called Marlborough Communications. I've been saying for a while that Cohort should do something with its surplus cash, so this is an encouraging move. As they are paying cash, then naturally it is earnings enhancing, as cash is currently yielding virtually nothing just sitting in the bank.

The RNS today quotes turnover and EBIT figures for the acquired company, with 2012 figures of £12.4m turnover and £1.9m EBIT said to be typical. I can't determine whether it's a good acquisition or not, without knowing the proper profit figure! EBIT is not a proper profit figure, as the company could be capitalising a whole load of development spending and other capex. So I would have liked the announcement to refer to a proper profit figure.

EDIT: I've spoken to the company's advisers, and am happy to correct this point. They say that the EBIT number is quoted because they want to report profit on a cash/debt neutral basis. I was thinking of EBITA or EBITDA as being inflated figures, but of course thinking about it more clearly after my second cup of Aldi colombian coffee, the EBIT figure is perfectly fine, as that includes depreciation charges. So my mistake on this point, which I'm happy to correct. Apologies for the earlier misunderstanding.

Note that the deal is for 50% plus one share, so Marlborough Comms will become a subsidiary, with its full numbers brought into the consolidated group accounts from the date of acquisition, but there will be a significant "minority interest" line on both the P&L and Balance Sheet, to reflect the part of profit and net assets that is not owned by Cohort. The EPS figure adjusts for this though, so is usually the easiest number to focus on in (relatively unusual these days) situations where subsidiaries are not 100% owned.

As regards the other 50% (minus one share) part of Marlborough Comms, there is an unusual but quite interesting way of dealing with that;

Cohort has agreed to acquire the remaining MCL shares following the end of the year to 30 September 2016 at a price determined by MCL's order book and EBIT performance for the years ended 30 September 2015 and 2016. Cohort's obligation will lapse in the event that the calculated price for the remaining balance of the shareholding in MCL exceeds £12.5m, and if this happens Cohort may elect to proceed with the transaction, continue with MCL under joint ownership, or find an alternative buyer for the business.

So this is an interesting, and innovative deal whereby Cohort has really bought half of Marlborough Comms, on a suck it & see basis, leaving its options open about acquiring the other half or not. I like that, as it means they can walk away if the liability to buy the other half becomes too expensive on the agreed formula.

Adding more businesses to the Cohort group will reduce the risk of profit warnings too, as if any one company under-performs it is less of an issue in a bigger group. I'm warming to this company now they are doing something with their cash pile.

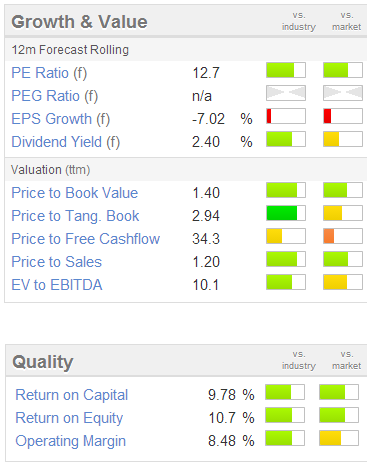

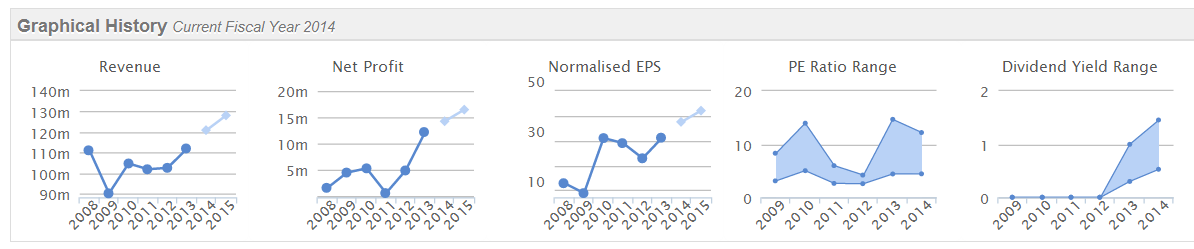

On valuation it is mostly green (good) in the Stockopedia graphics below, and note that it scores a very high 95 in the StockRank system. So it looks interesting, if you can live with the inherent risk of companies that supply mainly Governments, on large, lumpy contracts.

EDIT: There is a BRR Media short video with Cohort's CEO today, giving an overview of the acquisition.

Software Radio Technology (LON:SRT)

Special mention has to go to this maritime electronics company, appropriately based in Bath (!), which has taken what I think is a great initiative to turn their AGM into an Open Day, where anyone (shareholder or not) is welcome to visit the company and have a tour of their facilities, meet the team ,etc. What a great idea - details are here.

I hope more companies build their AGM into something more than just a legal requirement, then attendance might improve. I won't be able to make it, as the travel would be too onerous from Hove, but thought I would give this very worthwhile initiative a mention. I think this shows an attitude of openness, and shareholder friendliness, which is sorely lacking at many companies, with shareholders all too often treated as a nuisance.

Begbies Traynor (LON:BEG)

As with all my comments here, the following is based on a quick skim of the figures and the outlook statement. I don't have time to read all the narrative & report on that too in these reports, so it's always necessary to do your own research to fill in the potential gaps.

After a long period of disappointment, shares in Begbies (the only Listed insolvency practitioner) have been doing alright recently. Here is the 10-year chart, with my comments added;

Today's figures look reasonable to me. The business has been shrinking in the last few years. Normally you would expect an insolvency practitioner (who manage company Administrations and Liquidations) to do a roaring trade in the weak economy that we had from 2008 to 2013. However, Government policy of ultra-low interest rates, and political pressure on banks to allow insolvent zombie companies to continue trading, has massively distorted the usual creative destruction of a recession.

So Begbies has been relentlessly downsizing its business over the last few years, resulting in a lot of restructuring charges. It looks as if the last big chunk of restructuring happened last year, as exceptional items have reduced from £3.9m last year to £0.8m this year (ending 30 April 2014), which relates to the planned relocation of their London office.

Let's try a bullet point format, which might be less wordy;

Context: market cap is £41.6m at 45.5p per share (with 91.445m shares in issue)

Positives

- Adjusted EPS came in pretty much in line with expectations at 4.3p (expected: 4.4p)

- PER is modest at 10.6

- Dividend has been maintained at 2.2p for full year (yield of 4.8%)

- Should benefit from (operationally geared) upswing in insolvencies as interest rates rise.

- Net debt reduced to £14.5m (down £2.7m), covered by large debtor book (£36.3m)

- £5m overdraft cancelled by the Board, as not needed.

- All bank covenants "comfortably met" during the year.

- Solid operating margin of 13.3% (down from 15.0%) despite reduced turnover.

- Owner-managed business (Ric Traynor holds 29% of the equity).

Negatives

- Revenue still declining - down 10.4% to £45.8m

- Adjusted profit fell from £6.7m to £5.0m (although that is in line with expectations)

- Some investors may not be comfortable with level of debt.

- Competitive pressures - larger cases tend to go to the Big 4 accountancy firms.

.

So overall, I think this is a good business, at a reasonable rating. There is a reasonable chance of growth beginning at some point, from organic growth as higher interest rates push more struggling firms over the edge into insolvency. Plus Begbies is making some small bolt-on acquisitions at modest prices. Not the most exciting share in my portfolio, but I'm certainly happy to continue holding my small position for another year. Might top up on any decent dips.

STV (LON:STVG)

A reader has asked me to look at the announcement from this Scottish TV group today about its pension fund deficit. I'm largely stumped by this. The key parts of today's announcement say this;

The deficit at the valuation date was £135 million on an actuarial basis and £83 million as at 31 March 2014. This reduction is primarily due to increases in the asset values of both schemes during the period together with deficit funding payments made by the Group.

A reduced recovery plan period of 11 years has been agreed compared with 18 years at the previous valuation date. The payment profile will be £5.5m in respect of 2014, of which £4.7m was paid in January 2014, and between £7.0m and £7.75m from 2015 to 2025 inclusive. The next triennial valuation is due on 1 January 2015.

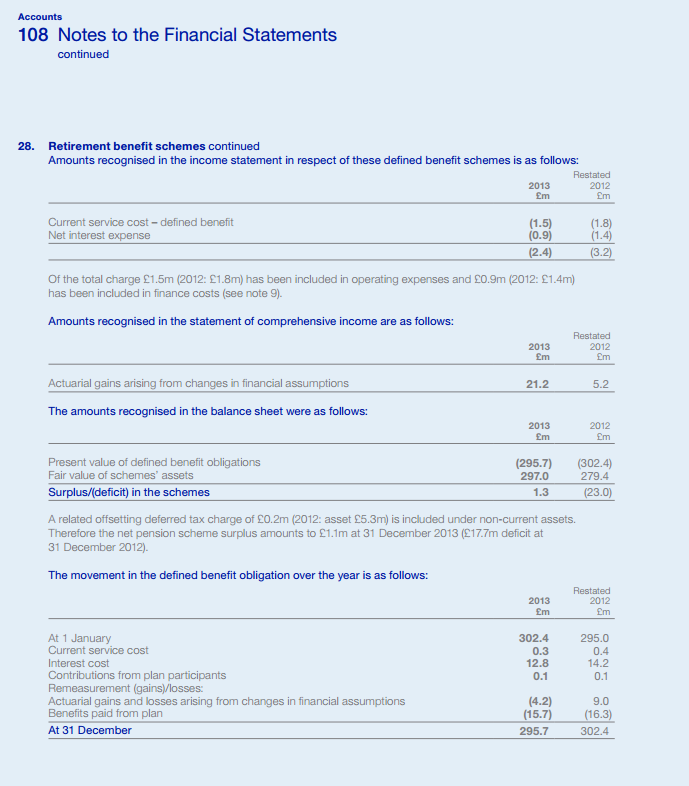

Please see below an excerpt form the notes to the the 2013 Annual Report, where the company reported a pension fund SURPLUS of £1.3m. I know there can be timing differences, and that the accounting treatment and actuarial valuations (on which the recovery payments are based) can be poles apart, but this is ridiculous!

.

.

The trouble is, the figures in today's announcement re recovery payments are highly material. A cash outflow of £7m p.a. looks to be about half of annual profit, which will surely restrict what the company can pay in dividends. I'm surprised the shares haven't fallen a lot more today. This certainly needs clarifying - how on earth can such a massive deficit open up, but not be shown in the accounts?

This just reinforces my view that pension funds are a can of worms. People say, oh everything's fine, the deficit has gone, and then something like this crops up!

Can any readers enlighten me as to what's going on with STVG's pension fund to trigger such a large deficit where there didn't appear to be a problem previously?

It seems to me that the Balance Sheet figures on pension deficits are totally unreliable, and best ignored. Instead one needs to find out the actuarial deficit, and what the recovery payments are, as that's real cashflow. The trouble is, this looming problem wasn't shown in note 28 to the 2013 Annual Report. Maybe it was elsewhere in the document, I've not checked through it in full.

Thorntons (LON:THT)

Detailed sales figures have been issued today for the chocolate company. These look OK, although there's no surprise because the company updated the market just last week (3 July) with the overview of the year ended 30 Jun 2014. So today just adds more detail.

Turnover is now split almost exactly 50:50 between the declining retail estate (36 stores closed in the year). They must have containers full of old shopfittings in their car park, if my retail experience is anything to go by. Nobody ever knows what to do with all the assorted detritus that you pull out of closed shops!

I don't really have anything to add to my comments from last week.

That's it for today. See you in the morning.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in BEG, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.