Good morning, it's just Paul here today, as it's Friday.

CEO interview with David Stirling of Zotefoams (LON:ZTF) -

Audio version is now live here.

Here is the written summary .

We've positively covered this specialist foam manufacturer in the SCVRs seven times this year, with increasing enthusiasm for how the company is successfully passing on inflationary price rises, thus demonstrating its product is in demand. This follows years of heavy capex to revamp its factories in the UK, USA, and Poland. I reviewed the last good update from ZTF here on 13 Oct 2022 , and I'm also impressed with the balance sheet, plus the shares remain good value. So I invited the CEO to talk to me.

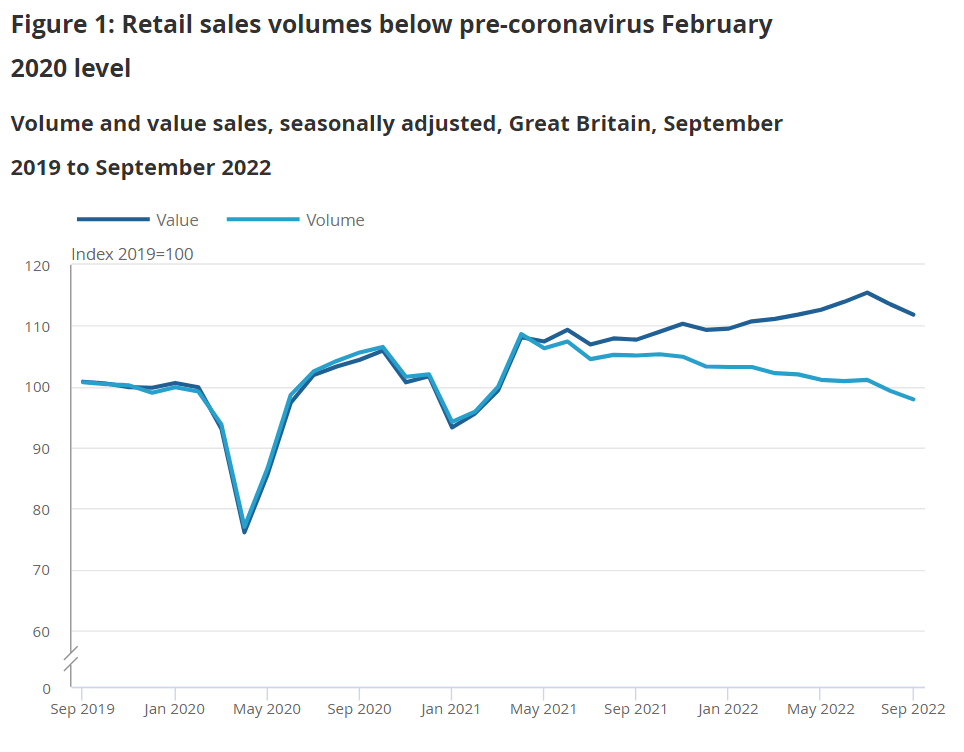

Retail sales data for September 2022 is published today by the ONS. As usual, the press are reporting it wrongly, which they always do, saying that retail sales are down. That is wrong! Volumes of goods sold are down, but the value is actually up. I like this chart below, which explains it better than any words. See how higher inflation has opened up this gap between value, and volume of retail sales. Of course, it's value, not volume, that matters to us as investors, because the value line is what becomes company revenues.

Agenda

XP Factory (LON:XPF) [I hold] - I mystery shopped its 2 new Bournemouth sites yesterday afternoon, and am impressed. As it was a rambling & photo-filled review, it took up too much space for here, so it's in a separate post here, for anyone interested.

Trifast (LON:TRI) [no section below] £89m mkt cap at 65p - this fastenings company dropped 9% yesterday on an H1 (6m to 9/2022) trading update. It’s dropping FY 3/2023 adj PBT guidance from £16.3m to £14.7m, due to increased costs, and delays in negotiating customer price rises. H2 weighting, so interim results may not look great. The balance sheet was already very heavy with inventories & receivables, and inventories are said to have risen even more in H1. I think the strong balance sheet can cope with this though. This share is starting to look cheap. So it could be worth you taking a closer look. [no section below]

Wickes (LON:WIX) - a solid…