Good morning, all. Hoping for some positive RNS announcements from some quality companies today!

Today we have:

- Sutton Harbour Holding (LON:SUH) - final results

- Management Consulting (LON:MMC) - proposed placing and open offer

- Reach (LON:RCH) - trading update

- Countrywide (LON:CWD) - share price sliding

Graham

Sutton Harbour Holding (LON:SUH)

- Share price: 33p (unch.)

- No. of shares: 105.6 million

- Market cap: £35 million

Sutton Harbour Holdings plc ("Sutton Harbour", "the Company"), the AIM listed waterfront regeneration and destination specialist, announces preliminary results for the year ended 31 March 2018.

This stock has always been a bit unusual. It's primarily a property play, with the potential for some additional income on top.

It now has a majority owner with 73% of shares, which it purchased at 29.5p.

The free float excluding that investor is only worth about £10 million. There are a couple of other large holders, too. So it's not too liquid.

Official net assets are £39.3 million or 37.2p per share, so the market cap offers you a small discount to that figure.

The property values are up-to-date but are falling, according to the latest valuations. Maybe a discount in the market cap makes sense, under the assumption that property values still have further to fall?

Worth noting that it is leveraged, using £24 million of bank loans on today's balance sheet.

Plymouth Airport

Some "hidden value" could be released from the company's lease on Plymouth Airport (now closed).

The Airport has been closed since 2011, and nothing has been done with the site yet. Various government bodies have been deciding what is to be done with it:

The Company currently awaits the outcome of the hearing and specifically whether the Government Inspectors will uphold Local Planning Authority's proposal to safeguard the Former Airport Site for 5 years for potential general aviation use (which includes private aircraft and other non-commercial passenger services), following which, the local planning authority proposes a review of the policy. The Company maintains that far greater social and economic benefit for the city will result from the development of the site for an appropriate mixture of residential and other uses which can deliver housing (including a substantial contribution to the need of social housing), community and educational facilities and employment space, effectively integrated with the existing surrounding developments.

Planning issues can be very controversial. In this case, the planning process means that SUH is left holding a derelict piece of land with nothing happening on it, as far as I know.

Operations - revenues from the company's fisheries and marinas have fallen, while car park revenues are stable. Gross profit from these sources is down 17.5% to £2.1 million.

My opinion - I can't remember how or why this stock originally ended up on my radar. Probably as a potential asset play, a couple of years ago.

As far as the situation now is concerned, it strikes me as fairly priced at a modest discount to NAV.

It likely is going to need positive news on the Airport site to trigger a re-rating.

Stocko algorithms are a bit more harsh, calling it a Sucker Stock (no quality, value or momentum!)

Management Consulting (LON:MMC)

- Share price: 2.75p (-12%)

- No. of shares: 511 million

- Market cap: £14 million

This is an operations consultant with offices around the world.

The Board announces that the Company is today launching a Placing and Open Offer to raise proceeds of approximately £8.5 million net of expenses under the Placing and Open Offer.

The discount to the current share price is extreme: shares are being issued at 1p.

To raise £10 million (gross), that will mean 1 billion new shares, so existing shares will represent ownership of just one third of the company:

Shareholders should be aware that the Board is of the view that it was necessary to set the issue price at this level to ensure the success of the Placing and Open Offer.

In other words, sufficient demand to invest would not have existed above 1p.

And without this injection of funds, the company will face a cash shortfall and insolvency next year.

When I covered this stock in August 2017, the Going Concern note warned that "all options" would have to be considered, if the company under-performed. The share price was 7p at the time. The 2016 annual report included a similar warning.

So this has been on the cards. The dilution is going to be worse than it might have been, but that's always the risk when a company needs to be refinanced.

I got some feedback in the comments section about professional services businesses which have done well for investors. Such companies do exist: Accenture ($ACN) and AON ($AON), for example. I guess I would need to do more research, to understand what set them apart from the others.

Management Consulting (LON:MMC), on the other hand, has been listed for 20 years. While it may be a successful company for its clients and employees, creating lots of value for those stakeholders, it has achieved very little for shareholders over that time. I don't see any reason for that to change going forward.

Reach (LON:RCH)

- Share price: 78.7p (+4%)

- No. of shares: 299 million

- Market cap: £236 million

This is the stock formerly known as Trinity Mirror (TNI). It owns the Daily Mirror, Daily Express, Sunday People, Daily Record, Daily Star, OK! and some big regional newspapers. It bought the Daily Express, Daily Star and Ok! earlier this year.

Reach plc is issuing a trading update for the 26 week period to 1 July 2018 ahead of its 2018 interim results announcement on 30 July 2018.

Let's see how the like-for-likes are performing:

Had Express & Star been owned from the beginning of 2017, Group revenue on a like for like** basis would have been expected to fall by 7% over the period with print declining by 9% and digital growing by 5%.

To break it down a little further, the Express & Star publications have been doing much better than the rest of the group. Their total like-for-like revenue is down by only 3%.

Net debt is £85 million. Impressively, the company had almost entirely eliminated its net debt by December 2017. It then bought the Express & Star publications!

Recall that the group's pension deficit is one of the most important numbers to watch. It is not mentioned today, but was last reported at £378 million (on an accounting basis).

Outlook is in line with expectations.

The company very helpfully includes these expectations at the bottom of the trading statement: adjusted PBT of between £131.7 million - £133.9 million.

My view

I don't know if I'm brave enough to buy shares in this myself. I am beginning to see a strong argument for it being undervalued.

We could put the enterprise value as:

- Market cap £236 million

- Net debt £85 million

- Pension deficit £378 million

- Total = £700 million

I suppose it's important to note that actuaries would probably put the pension deficit at a much higher level.

But still, the enterprise value shown above is only about 5x the adjusted PBT figure. Many of the adjustments will be non-cash and one-off charges related to the acquisition of Express & Star.

So I reckon this is definitely worth investigating to see if you can visualise the company emerging safely, with a normal balance sheet, in a few years' time.

Rising interest rates should reduce the pension deficit, too.

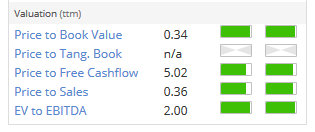

Value metrics are fantastic.

Would Express & Star have been happy to join forces with Reach, if Reach was headed for the knacker's yard? (I suppose a pessimist would argue that they are both headed to the same place.)

Another similar share, Johnston Press (LON:JPR), looks headed for worthlessness. It has a £220 million bond coming due next June, and the bondholders have formed a committee to discuss the situation.

Reach (LON:RCH) appears to be in a much healthier situation. The dividend yield is 8%. I will probably end up waiting until the outcome is a bit more certain, but this one is going on my watchlist.

Countrywide (LON:CWD)

- Share price: 36.7p (-8%)

- No. of shares: 238 million

- Market cap: £87 million

It has been pointed out in the comments that the Countrywide (LON:CWD) share price has continued to slide all week.

On Monday, it announced that it wanted to raise equity finance to cut its debt load in half, i.e. about £100 million. The share price was c. 60p when I wrote Monday's report.

There has been no news since then, but the share price has continued to slide. The market cap is now less than the amount it wants to raise, and less than half of the debt load.

A bit like the situation with Management Consulting (LON:MMC), the scale of the dilution being faced by shareholders is escalating.

That's the big problem with equity refinancing. As a shareholder, you might look at the share price and think "I will still be left with x% of the company after the placing, it's not so bad". But if the placing ends up being at a much lower level (and it's impossible to predict where a placing will take place, without inside information), then the percentage you are left with could be just a fraction of that.

All done for today and for the week. Thanks for dropping by!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.