Good morning, it's Paul here with Friday's SCVR.

No preamble today, as I was too tired last night to put anything together. Let's see what the 7am RNS brings.

Police forces are apparently on a New Year's Eve footing for "Super Saturday" tomorrow's pubs opening day. It's obviously going to be carnage, and no doubt we'll have Priti Patel & other Govt ministers chastising us on Monday for the bad behaviour of a hooligan anti-social minority (about 20% of the UK population I would guess! And growing every year, it seems).

Estimated timings - should be mostly done by 1pm, but I want to cover a few stragglers left over from earlier this week, after lunch. So final finish time c.4pm.

Update at 17:56 - today's report is now finished.

Running through the list, there's hardly anything of interest today. Looking at the reader requests today;

.

Manolete Partners (LON:MANO)

546p (up 7% ) - mkt cap £237.8m

Final Results - I've not come across this company before. It floated in Dec 2018, and seems to be involved in litigation financing. Graham outsourced coverage of it to subscriber abtan who wrote an interesting piece on it here on 21 Nov 2019. Reading that piece, it's clear that this share is not of interest to me, and I'm not interested in ploughing through loads of details on individual cases in order to work out what the shares might be worth.

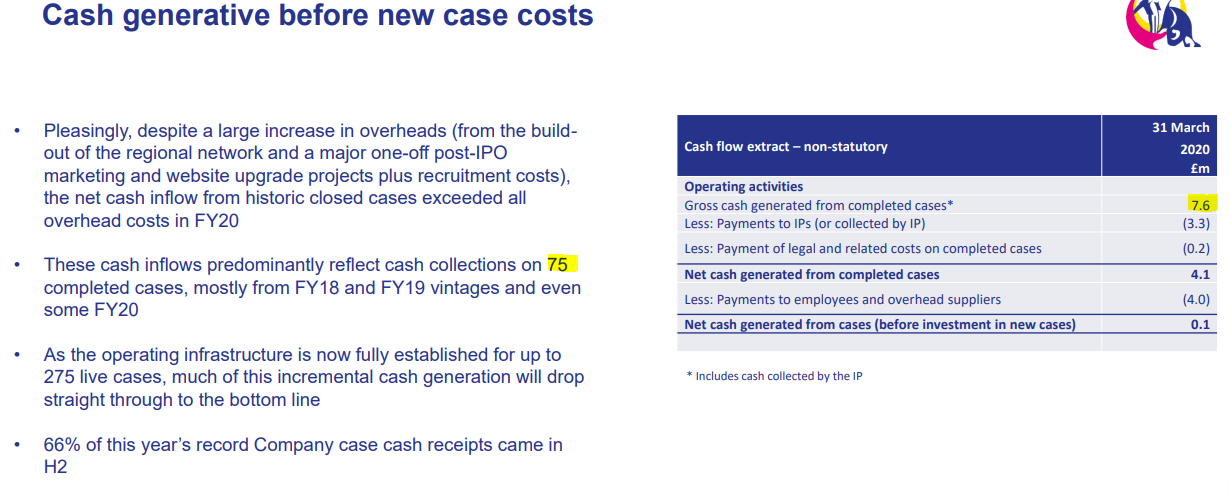

Having a quick skim of the results today FY 03/2020, the headline numbers look good - adjusted (for IPO costs) PBT up 40% to £9.5m.

Final divi doubled to 3p (a very low yield though). Outlook statements reads positively.

My main worry with this sector (as some readers have commented on below) is that short sellers attacked another, larger, litigation funding company, Burford Capital (LON:BUR) and the share price has never recovered - currently sitting at about 500p, still about 75% down from its peak. I remember listening to the conference call from Burford when it was fighting the shorting attack, and it struck me how many potential problems there are with estimating the outcomes of cases, realised/unrealised profits, selling fractions of cases just before the year end to establish a higher book value, etc. It sounded an absolute minefield. The more information Burford provided, the more questions it seemed to stimulate.

According…