Good morning from Paul & Graham!

Small Caps Podcast with Paul Scott- I've resuscitated the idea of a weekly recap podcast, and am quite pleased with the first edition, which I recorded on Saturday morning. It recaps on the week's SCVRs, and talks about market conditions. If people like them, I'll keep doing them, so please do give me your feedback.

Agenda -

Paul's Section:

AO World (LON:AO.)- An article in yesterday's Sunday Times flags up the risk of trade credit insurance being reduced/withdrawn. This is a very useful reminder that many businesses are not only funded by banks, but also by their suppliers. I'm steering clear of AO.

Porvair (LON:PRV) - interim results show profit growth. Outlook comments sound positive, and I think with broker targets set low, there's little risk of a profit warning here. It's still on quite a punchy rating though, so I don't see value here. A poor track record of divis also reduces its appeal in a higher inflationary world.

Graham's Section:

H & T (LON:HAT) (£128m) - A good trading update from this pawnbroking group, and an acquisition announcement. Broker forecasts haven't changed formally yet but are likely to be too low. The company is enjoying strong demand for pawnbroking loans, retail is performing well, the gold price is helping profits from its gold purchasing activities, and international travel is boosting FX services. It will soon own a watch repair business, bringing lots of relevant expertise in-house. I continue to rate this one very highly.

Augmentum Fintech (LON:AUGM) (£201m) - Results from this fintech investor show NAV per share up 19%, and there’s an interesting discount in its share price versus the reported NAV. The company believes that it is undervalued and is buying back its own shares, to potentially be reissued at a later date. The investee companies may be familiar to you, and Augmentum argues that it is navigating the overpriced fintech landscape in a disciplined way.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

AO World (LON:AO.)

68p (before market opens)

Market cap £326m

Sunday Times article

Yesterday’s Sunday Times contained a worrying article in the business section, revealing that a leading trade credit insurance company, Atradius, has cut cover on AO World. It says this could lead to cashflow problems, and possibly a cash call on shareholders.

This is a timely reminder that trade credit insurance is incredibly important, and its withdrawal can push companies into insolvency.

I recall a crisis in 2016, at one incarnation of the GAME computer games shops. Its balance sheet actually looked OK, but the biggest trade credit insurer took fright about the company’s future prospects, withdrew/reduced cover, and the shares plummeted, never to recover previous highs.

Although insolvency was averted in that case, with a new credit line being put in place from a major shareholder in 2016, which propped up the company.

This article from the Guardian in 2016 is a useful read. It reminds us that removal of trade credit insurance played a part in causing the insolvency of retailers Woolworth, Focus DIY, and Zavvi.

For anyone not familiar with trade credit insurance, it is an insurance product which suppliers use, to guarantee they will get paid, even in the event of the customer going bust.

You only have to look at the balance sheets of any company, to see that many often owe their suppliers (within trade payables) more money than they owe the bank. Therefore, suppliers’ confidence in any company’s solvency is a critically important factor in whether the supplier is prepared to sell products or services on the usual 30-60 days credit payment terms. If suppliers are worried they may not get paid, then they often start demanding some or all of the money up-front, before dispatching goods. That causes a cash squeeze at the customer, who might then be forced into administration, if their cashflow dries up. And of course if suppliers refuse to supply products, because they're worried about the customer going bust, then that's it for the customer - game over, since it rapidly runs out of products to sell.

I remember battling with this very issue, over a long period of time, in my days as a CFO in the 1990s. Every time the trade credit insurer pulled the rug out from under us, it plunged the company into a financial crisis. I managed to solve the problems every time, but it was a serious threat to the business, multiple times.

Given current macro conditions, with an economic slowdown looking increasingly likely, and profits likely to be squeezed badly in some sectors, then investors really need to think carefully about the risk from possible withdrawal of trade credit insurance. Consumer-facing sectors look the most vulnerable.

Hence on webinars, we need to be asking about how much companies rely on trade credit insurance, and how they would cope if it were reduced or withdrawn.

Also, investors need to examine how reliant companies are on their suppliers for financing? A good way to do this, is to calculate creditor days - an example is given here. If it’s over 60 days, then that could indicate creditors are being stretched to finance the business.

Also, if a company looks likely to become loss-making in future, from an economic downturn, then trade credit insurers might preemptively cut cover. They often do this for entire sectors - especially retailers, or other sectors they believe are likely to come under pressure from a downturn or other macro events.

Hence more than ever, checking those balance sheets is vital at the moment. You get very little balance sheet analysis elsewhere, but it's a key focus here in the SCVRs, which I'll concentrate on even more than usual, so we can hopefully avoid shares that are about to collapse.

It’s not just excessive bank debt that is a problem, the trade creditors are also a vital form of financing, so the less reliance there is on them, the better.

Ideally, I like to see no bank debt, and a big cash pile relative to trade creditors.

Here’s an example below of a strong balance sheet, from James Latham (LON:LTHM) which recently reported superb results. As you can see below from the middle section of its balance sheet (working capital), the cash pile of £37m is enough to pay off most of the money owed to suppliers (trade & other payables of £50.9m).

LTHM is also highly profitable.

Therefore a trade credit insurance company would assess the risk as negligible, and happily provide trade credit insurance to LTHM’s suppliers, since it’s free money for the insurance company - charging fees for insuring debt which is almost certainly going to be paid in full, hence practically zero risk.

.

Also look how current assets above total £179.6m, versus current liabilities of £52.6m - that's a current ratio of 3.42 - which is excellent. I normally regard anything above 1.5 as strong. So this is super strong - hence little to no solvency risk.

However, in more wobbly situations, the trade credit insurer may well take fright, and refuse insurance cover, causing a crisis that could be terminal.

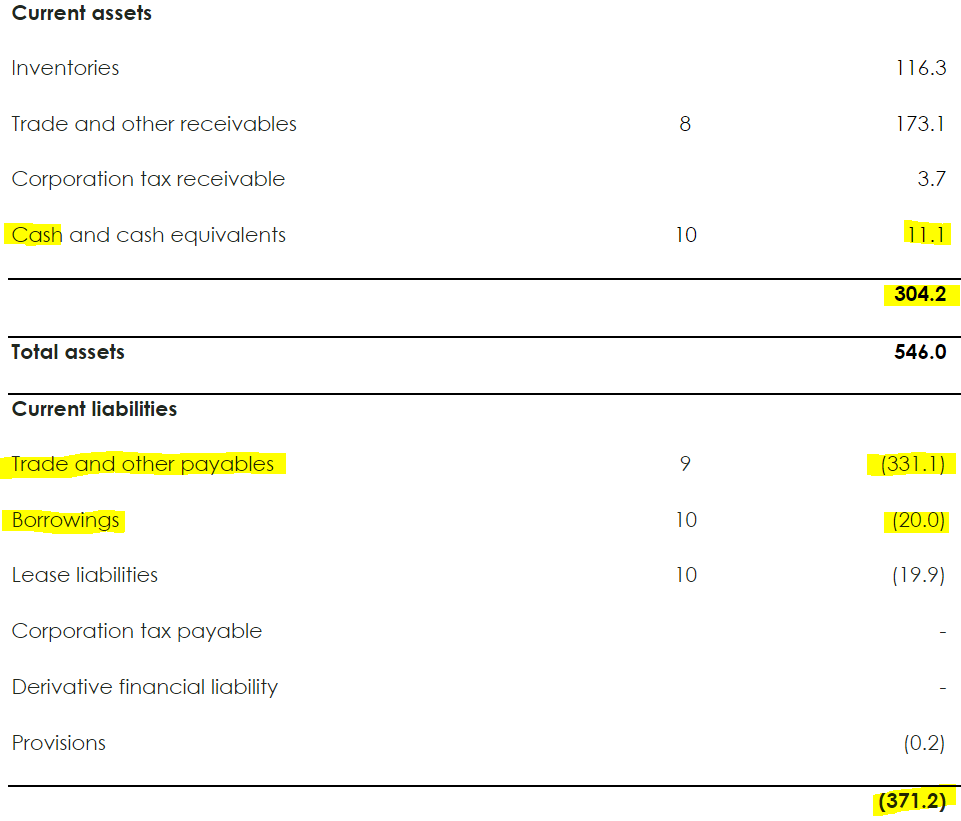

Looking at the balance sheet below from 9/2021 at AO World (LON:AO.) It shows a very much weaker situation. See how enormous the trade & other payables line is, at £331m - that’s mostly money owed, which will have to be paid out in the next year. Note 9 shows that £208.3m of this relates to trade payables, plus another £36.4m accruals - which is usually money owed, but not yet invoiced by suppliers.

Overall, AO’s balance sheet looks a bit rickety to me, with large and unusual entries in debtors and creditors, relating to warranties sold, and mobile phone contracts, which is a considerable area of risk, I reckon.

Note that the current ratio is low, at 0.82 (easy to calculate - it's just total current assets, divided by total current liabilities). If it's over 1.5, then everything is probably fine.

.

.

My opinion - I’ve flagged up risk at AO before, and it doesn’t surprise me at all to hear that a trade credit insurer is apparently getting worried about risk. That could cause serious problems for AO.

Definitely one to avoid for now, given consumers cutting back on discretionary spending. Although some argue that many electrical products are sold because something has broken and needs replacing. Margins are wafer thin, because customers shop around online, for the lowest price - a race to the bottom.

If you absolutely have to invest in this sector, I think Marks Electrical (LON:MRK) looks a much better (smaller) business than AO, as MRK is efficiently run on a shoestring, as opposed to AO's grandiose, arguably delusional strategy for global domination, which it's now having to retreat from (with closure of its failed German business).

AO shares are down 13% in early trades.

This is an extreme example (with hindsight!) of how badly wrong the market got things back in 2020 - wrongly believing that the surge in business caused by the pandemic would be sustainable.

.

Porvair (LON:PRV)

594p (up slightly today)

Market cap £274m

Porvair plc ("Porvair" or "the Group"), the specialist filtration, laboratory and environmental technology group, announces its interim results for the six months ended 31 May 2022

A few key numbers -

H1 revenue up 18% to £82.3m

Adj Profit Before Tax (PBT) up 14% to £9.8m

Adj basic EPS up 12% to 16.6p

I like this CEO summary, as it sounds balanced -

"This is a record set of Interim results with growth in all three divisions, showing that the Group is performing well and has managed wide-spread supply dislocation and inflationary pressures satisfactorily thus far.

Porvair remains well positioned to address long-term global growth trends: tightening environmental regulations; growth in analytical science; the need for clean water; carbon-efficient transportation; the replacement of plastic and steel with aluminium; and the drive for manufacturing process quality and efficiency.

The strong current order book is flattered in places by extended lead times, but the underlying order position remains healthy, with aerospace and laboratory demand notably stronger than one year ago. The focus for the coming months is on margins. The Group will continue to pass on cost increases where necessary and has accelerated investments in productivity.

2022 has started strongly and provided economic conditions allow the outlook for the balance of the year is promising."

Valuation - it doesn’t say so, but that sounds like an in line outlook statement.

The StockReport is saying 26.7p broker consensus for FY 11/2022, but it’s done well over half of that already in H1 (16.6p for H1).

The sequential half years table here on Stocko, shows that there was an H2 bias to profits in 2017 & 2018, but a small H1 bias to profits in 2019. So there’s not really any clear seasonality there, but H2 seems more likely to be the stronger half.

Therefore if we assume H2 this year might be at least as profitable as H1, then this implies EPS might come out well above broker forecast of 26.7p, at something more like c.33p.

At 594p share price now, the PERs are therefore -

22.2 times based on broker consensus, or

18.0 times based on my estimate of 33p EPS.

Not exactly a bargain, even if we use my higher EPS estimate.

Still, as mentioned in my podcast, I want to avoid profit warnings in a tougher economic environment, so I’m drawn to companies which look likely to beat broker forecasts that have been set cautiously. It seems that Porvair fits the bill in that respect.

Balance sheet - looks fine to me.

NAV is £121m, less £75.6m intangible assets, gives a healthy NTAV of £45.4m.

Working capital looks strong, with a current ratio of 2.0

Net cash of £12.2m is plenty, and note that trade creditors are quite modest, at £28.5m,

There’s a pension deficit, which would need looking into before buying shares here.

Cash generation - not very impressive actually.

This is reinforced by a track record of only paying modest divis in the past.

My opinion - every time I look at this share, I wonder why it’s rated so highly?

It’s a decent business, making fairly good margins, on niche products, with pricing power.

But the shareholder returns have been pedestrian in the last 5 years, although going back 12 years, it’s been a 10-bagger.

It’s difficult to see what would propel PRV higher right now, unless it absolutely thrashes current forecasts. On the upside though, the risk of a profit warning looks low, due to the nature of its products, recovery in aviation, and modestly set broker forecasts.

.

.

Graham's Section:

H & T (LON:HAT)

· Share price: 321.5p (pre-market)

· Market cap £128m

This is the largest pawnbroking group in the UK, and was once the largest position in my portfolio.

I sold my last remaining shares in H&T earlier this year – to fund a car purchase!

I’ve never borrowed to buy a car, and I don’t like the idea of borrowing in order to buy something that will certainly depreciate in value (assuming normal economic conditions!).

So ironically, to avoid taking out a loan, I sold my shares in a lender.

But why sell H&T, instead of selling something else?

H&T had been in my portfolio since 2013, and had survived the evolution of my thinking all the way from then until early 2022.

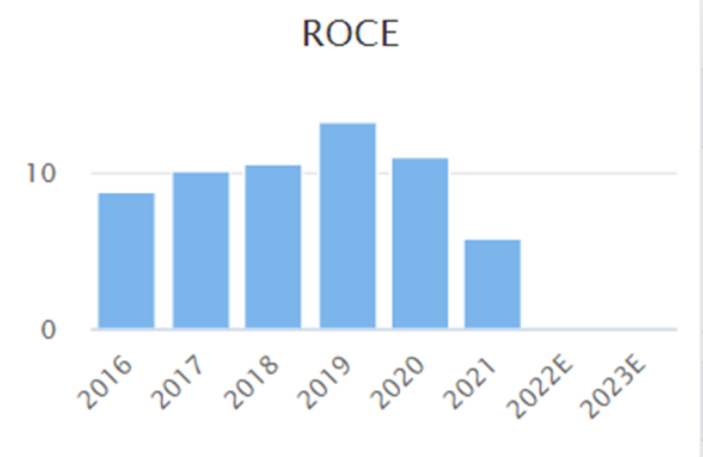

But nowadays, I am much more selective when it comes to return on capital employed (ROCE). I want a company with a high ROCE, or at least with the strong potential for ROCE to improve.

About H&T –H&T serves an important niche where bank lending in the form of credit cards or overdrafts is unavailable or insufficient for the customer’s needs.

The company’s ROCE is good, but it has struggled to break into the double digits in recent years (granted that there were extraordinary circumstances which affected all retail-facing business):

If you scroll back further, H&T did see a period of extremely high ROCE (20%+) in the period from about 2008 – the global financial crisis – when the gold price enjoyed a major rally to all-time highs.

Fierce competition in gold buying and pawnbroking sprang up at that time. Many small operators, and even one or two large operators, went on to suffer when the gold price weakened a few years later.

Thanks to its discipline, H&T never reported a loss. However, the easy profits of earlier years disappeared.

The lower gold price meant that pawnbroking loan amounts had to reduce. There is an ever-present danger of the customer disappearing after the gold price falls, leaving the pawnbroker to suffer a loss even after it liquidates the asset.

Eventually, I decided that I didn’t want to own a quasi-bank with single digit returns, even if it was my favourite quasi-bank in the UK. I can get my gold exposure directly through futures, and enjoy far more certainty over my exact exposure to the yellow metal. It’s just a cleaner solution for the problem I’m trying to solve.

But I still retain a positive view of H&T as a company, and I still expect that it will provide nice exposure for investors to the gold price.

Trading update – this sounds good. I have added the bold:

Demand for pledge lending has continued to gather momentum in the first half of the year. The pawnbroking pledge book at 30 June 2022 was £84.2m (30 June 2021: £48.3m and 31 December 2021: £66.9m) with growth across the Group's customer base and in all geographies. Pledge lending remains at record levels, with incremental growth month on month over the period. Lending volume is currently over 40% above pre-pandemic levels. Average loan sizes, loan to value ratios and redemption rates have been maintained.

The pledge book in December 2019 was £72m. So we have a significant improvement on that level already, and on top of that we have the company making new loans at a much faster rate than it did before.

The trick is to do this safely. As H&T and its former competitors know well, it’s easy to make lots of loans. The difficult bit is getting your money back. This trading update suggests no major change to the risk profile of the loans, as loan sizes, LTVs and repayments are all constant (for now).

Let’s continue with the update. I might as well quote all of this, as it’s short and to the point:

Retail sales have been consistently strong and are in line with expectations.

Gold purchasing has been buoyant, supported by a rising gold price which has driven both volumes and improved margins.

Foreign currency revenues have more than doubled in H1 2022 as international holiday travel returns, with transaction volumes back close to pre-pandemic levels.

Note that H&T can flexibly use its High Street presence to focus on lending or on retailing, as some customers are selling items and others are buying them.

As you can see from the above, the gold price has also been a positive factor, and the return of international travel is boosting FX trading back to normal levels. So lots of good news all round.

Acquisition – the company makes the £4.3m acquisition of an Essex-based watch servicing and repair centre.

H&T expects to need 4,000 watches serviced or repaired this year and is possibly the largest customer of this business, or in any case one of the largest customers. At this scale, perhaps it makes good sense for H&T to have its own watch repair business?

Although I’m not sure about the synergies of mixing pawnbroking with a “care and repair” service:

…the Acquisition will bring watch repair and servicing expertise in-house, enabling H&T to enhance its service offering to customers whilst improving margins. Following the integration of Swiss Time Services and a planned future roll out of a watch "care and repair" service to customers, both revenue and sales margins are expected to increase.

Broker forecasts – the company’s broker now expects “material upward pressure” on its earnings forecasts for 2022. They see the pledge book potentially getting close to £100m by the end of the year, and then for 2023 to provisionally see an even larger percentage increase in earnings, compared to current estimates.

The current estimates are for pre-tax profit of £15.8m in 2023, rising to £21m in 2023.

My view – I have chosen to get my gold exposure via futures contracts, so I don’t plan to buy shares in H&T again. However, I still think it’s a great company, and I don’t understand why its shares continue to trade at a discount to book value (last seen at £136.6m).

To me, it seems too cheap, compared to its size and its growing potential. It has a track record of treating shareholders well with regular dividends, management are sound, and the market positioning is strong with an undisputed number one position in UK pawnbroking.

Some people may prefer Ramsdens Holdings (LON:RFX) but that is a hugely different business with a pledge book of just £7.5m as of March 2022. If you want to invest in a company with a big pledge book, Ramsdens is not offering any competition in that regard.

H&T does face some important risks, which I would list as:

· An FCA review into some loans which should not have been granted to customers. The estimated costs related to this issue are less than £3m. Perhaps these costs will rise, or other issues of a related nature will be found at a future date.

· The possibility of regulatory change in high-cost lending is always a concern for shareholders in this sector.

· The company will be indebted this year. There is an element of financial risk – it’s a lender, after all. H&T has to borrow in order to lend. If shareholders want big profits, they have to accept that H&T needs to access capital in order to do this.

To me, the risks are priced in. If I had not chosen to get my gold exposure elsewhere, and if my old Ford Focus hadn’t packed it in, I’d still be a shareholder here.

.

Augmentum Fintech (LON:AUGM)

· Share price: 112p (+6.4%)

· Market cap: £201m

I’ve never covered this one before. It’s an investment company, which we don’t usually cover in this report.

The reason I’m flagging it to readers is that it reports a NAV per share of 155.2p, up 19% for the year. This NAV is quite a bit higher than the current share price!

It invests in private fintech companies, so the question of NAV is a complicated one.

But there is a cash cushion. As of March 2022, the company had cash of £30m – and it now reports £60.6m, after the takeover of Interactive Investor by £ABDN. Augmentum made an 11x return on this investment.

Risk profile - the fund’s top ten holdings, as of March 2022, accounted for about 80% of the fund’s investments. These companies “have an average of 17 months cash runway or are profitable”.

17 months is not that long, of course. This is venture capital, at the end of the day.

I am familiar with a few investee companies, and only have positive impressions of them. For example, there is Interactive Investor (now sold), the bookkeeping company Dext, the crowdfunding platform seedrs, and the precious metals website BullionVault.

I’m also intrigued by the fact that Augmentum claims to be keenly aware of the danger posed by overstretched fintech valuations. I’ve added the bold:

The latter half of the year was characterised by a lot of new capital chasing fintech assets, valuations reflecting that and a slower rate of deployment from the Company consistent with its measured approach. Fundraise valuations have had large multiples paid in some cases, with 20 times revenue a regular occurrence. By contrast, the average forward revenue multiple of the Company’s top ten investments at 31 March 2022 was approximately 5.3 times.

It follows that, although we have continued to see lots of interesting opportunities, we have declined to participate on terms that others have been prepared to pay. We have a disciplined approach to our investment decisions and a proven investment model. Good companies do not make good investments if pricing does not appropriately reflect the risk.

Augmentum has been taking advantage of the share price discount to NAV by buying back its own shares, and signals that it might sell these shares at a future date, if its shares trade at a premium to NAV. That’s a nice little arbitrage play on investor sentiment.

I don’t have a strong view on Augmentum yet, but thought it was worth flagging to readers given the NAV discount. It may be worth investigating the fund’s approach, and its portfolio, in further detail.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.