Good morning! We're back up to full strength today, with Paul & Graham. Yesterday's report was a bit weak, sorry about that, we'll try to catch up today & tomorrow.

All done for today, I can't process any more numbers!

Agenda -

Paul's Section:

J D Wetherspoon (LON:JDW) - pubcos have been battered in the current bear market, for fairly obvious reasons - discretionary spending, when incomes are being squeezed by inflation. JDW's latest update is weak, with higher costs (some discretionary though) reducing profit guidance into a £30m loss. I think mgt can pull levers to restore profits, so this is starting to look like a potentially interesting entry point. Lots of costs are fixed, but not wages of course, a heavy drag on profits. Pubs are mostly freeholds, not revalued since 1999.

Appreciate (LON:APP) [No section below] - The CEO is stepping down, with the Chairman covering until a replacement is found. I listened to a recent webinar from APP, and can’t make my mind up about the shares. The upside case does sound interesting, but overall it left me flat. The outgoing CEO is most noteworthy for being a weak presenter on webinars (sounding robotic) - raising the question, does that really matter? I think it does to an extent - anyone running a company should be excited about it, and able to communicate that, and inspire staff. Although stellar numbers matter more than presentational style. Numbers at APP seem OK, but not stellar by any means. Let’s see what the next CEO plans to do with the company. I'll keep it on the watch list. [No section below].

Loungers (LON:LGRS) - a strikingly better performance than JDW, from this rapidly expanding chain of bar/cafe/restaurants. I skim through the results for y/e April 2022, which look great, albeit boosted by Govt support measures that have since gone. Forecasts for the new year look soft, so little risk of a profit warning. Much more upbeat current trading & outlook than JDW, which makes me ponder how different customer groups are behaving.

McBride (LON:MCB) (£28m) [No section below] - an in line update, but the company remains financially distressed, and is exploring options. Very high risk of dilution/insolvency. Two daft mistakes in the RNS - (1) a pointless footnote re market expectations, that doesn’t give any numbers! (2) quotes net debt of £168m including leases, likely to scare investors, without mentioning the lower bank debt figure! Who writes/reviews these things, scoring such obvious own goals?

On the upside, MCB is “predominantly” passing on cost inflation now, with price rises, hence H2 revs up 13%.

£30m liquidity headroom above minimum stipulated by bank, at end June.

It’s obviously going to need a placing, to refinance. With such a low market cap, a deeply discounted raise looks likely to me, so why get involved now when you face big dilution risk? Institutions can’t get out, we can! [No section below]

Tclarke (LON:CTO) [No section below] - we reviewed the strikingly positive trading update here in May 2022, from this complex electrical/IT contracting group.

Readers have been discussing today's interim numbers. H1 PBT is 5.5m, on revenues of £206m, so a tiny profit margin, with a lot of contract risk. The outlook sounds positive, and revenue expectations for FY 12/2022 are upped to £450m. Order book has grown further to an impressive £586m, plus over £1bn of bid pipeline (only some of which will turn into contracts obviously). There’s not much asset backing, only c.£10m NTAV. Note the £16m pension deficit.

This share has held up very well in the current bear market. It sounds as if the outlook is positive for the time being too. However, investors need to be very careful about buying into cyclical businesses that look cheap, at what could be the top of the earnings cycle. Look back to see what the share price did in 2008 for example, when investment dried up. Remember that big construction projects have long lead times, so a drying up of orders might not manifest itself until well into an economic downturn (if there is one). So it can be a mistake to assume that a company you like is somehow immune from macro factors.

Graham's Section:

finnCap (LON:FCAP) (£32m) - Results for FY March 2022 are good, as expected, from this AIM broker and Nomad with an increasingly diversified range of services. M&A is still of fundamental importance to its results and while FY March 2022 was a great year, and the company achieved record revenues, FY March 2023 is now said to be “very quiet”. That’s the problem with this sector: the good times are good, and the bad times are awful! I argue that P/E multiples should not be applied to these companies, and that value investors should instead try to buy them at a discount to their balance sheet values.

Trustpilot (LON:TRST) (£369m) (-5.5%) [no section below] - this floated at 265p in March 2021. At 89p, this is the sort of discount to the IPO price that gets me interested! Today’s H1 update shows revenues +18% to $73m (+25% at constant currency). The company is still targeting EBITDA breakeven in FY 2024. Unfortunately, the market has become rather impatient with companies so far away from making real earnings (and positive EBITDA would not represent real earnings).

As someone who regularly researches company reputations and looks for consumer perspectives, I find Trustpilot a useful tool, so I would love to find an argument that the shares are cheap. The price/sales multiple using next year’s sales forecast is around 2x, so maybe we are getting there (accepting the great uncertainty around future monetisation and profitability of the platform).

Jarvis Securities (LON:JIM) (£68m) (-22%) [no section below] - a dramatic fall in the share price at this discount stockbroker on the back of weak H1 results. Revenues are down 23% as UK investors are trading less and there are fewer IPOs giving Jarvis the chance to earn commission fee income. The share price decline is not matched by the decline in earnings estimates at the company’s broker, who has only slightly reduced the full-year PBT estimate from £7.3m to £7.0m.

Jarvis has a wonderful historic track record of cash generation, high ROCE and shareholder dividends, and I’m always interested to see it trading cheaply. The company has an opportunity to earn higher interest on cash deposits as rates rise, although this is offset by the likelihood that high interest rates will keep share prices depressed and trading volumes very low. In the short-term, it might be a case of swings and roundabouts!

Xaar (LON:XAR) (£149m) (+2%) [no section below] - this company produces advanced printing technologies. It was a high-flying midcap at one point, but has had an extremely volatile share price performance over the years. H1 revenues are £37m, up by 14% organically and 41% in total. Full-year adjusted profits are expected to be in line with expectations (these expectations are minimal: only around £1m). The cash balance has sadly reduced to £12.6m, and this is in line with expectations. Xaar could turn out to be an exciting growth story again; it’s on the racier and more speculative end of the spectrum.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

J D Wetherspoon (LON:JDW)

577p (close last night)

Market cap £744m

I’m staggered that the market cap of this large pubs chain has now fallen to within a whisker of our usual (flexible & arbitrary) £700m upper limit. As you can see from the 3-year chart below, the current share price is now similar to the low point in the original pandemic crash in March 2020. Although note that the market cap is still higher, because the share count went up - it’s now 128.8m versus 107m pre-pandemic.

.

Looking back on the RNS, I see JDW raised £141m (at 900p per share) early on in the pandemic, in April 2020.

When companies need money, they should always do it quickly, rather than hope for the best, and do it at a deep discount once a problem has become an emergency. We’ll be seeing more emergency fundraisings in the near future I believe, so the issue of balance sheet strength, and bank arrangements, should be top of our agenda right now.

This is a pub group, specialising in a simple, value for money offering. So it’s nearly always the place with the cheapest pints, and everything else that entails.

Higher costs mean a larger loss for FY 8/2022 than anticipated. Although some of these cost increases do seem discretionary -

Wetherspoon has invested heavily in labour, repairs and marketing, following the ending of restrictions in February in order to strengthen our position for the financial year beginning 1 August 2022.

Losses for the current financial year (FY22) will therefore be higher than expected at approximately minus £30m on a post-IFRS 16 basis (approximately minus £23m on a pre-IFRS 16 basis).

That’s clearly a poor result, since there have not been any lockdowns in that period. It should be profitable again by now, in my view.

It’s a fairly big profit miss, as the StockReport shows a net profit (after tax remember) of £11.9m, so that would be c.£15m pre-tax. Hence it looks about a £45m profit miss - that’s a lot, especially coming right at the end of the year, when management should have had a more accurate idea of profit, and communicated it to the market via brokers. Hence I am wondering if there’s possibly inadequate financial control/budgeting here?

Current trading comments are interesting for wider read-across -

Q4 (May, Jun, July to date) sales are almost level (minus 0.4%) with pre-pandemic.

Improving trend from Q3 which was minus 4.0%.

Recovery from pandemic slower than expected.

Biggest category (draught beer/cider) is the problem, with sales down 8%. Other categories are up. Best is cocktails, up 19% on pre-pandemic.

“Lloyds” branded pubs are up 6% - they play music (other ‘Spoons pubs don’t) - is this hinting that a change of policy re music might be on the cards?

Outside of London, major city centres are doing better than expected, and are up on pre-pandemic sales - quite surprising to me, and should be encouraging for my sector pick, Revolution Bars (LON:RBG) (I hold).

Labour costs are much higher than pre-pandemic - no surprises there.

JDW is noteworthy for having very good staff retention - managers are long-serving on average, because they are treated well with a generous profit share scheme.

Repairs costs are substantial -

Although repairs were reduced to minimal levels during lockdowns, there has been an element of "catch-up", so repair costs in FY22 will be around £99m compared to £76.9m in FY19.

Most pubs are freeholds - a key, and very positive point -

Wetherspoon has invested £128m in the acquisition of freehold reversions of 48 pubs since FY19, of which it was previously the tenant, bringing the number of freehold pubs to 582, 68.3% of the estate.

Leased pubs - I also like the sensible changes made here -

In addition, the company has also "regeared" the leases of 15 pubs in this period, usually at lower rents than previously applied, with fixed, five-yearly rent reviews, which are significantly below current inflation rates. Of the company's 270 leasehold pubs, 116 now have fixed rental increases.

Inflation - good arrangements have previously been put in place -

Wetherspoon has contracts for energy supplies until the end of FY23 at fixed prices which predate the current spike in energy costs.

As previously indicated, Wetherspoon has long-term contracts for many bar and food purchases, which will moderate the highly inflationary cost increases which have been widely reported.

Wetherspoon believes that its overall costs will increase by less than the current rate of inflation in FY23.

Interest on borrowings - this looks a stroke of genius, locking in long-term low rates long-term-

As has also been previously indicated, Wetherspoon has fixed the floating rate interest cost of £770m of its bank loans, using swaps, at between 1.02% and 1.61% until November 2031.

That sounds amazing, but I don’t think it’s the total cost of the borrowings, because the last interim report says -

The total cost of the company’s debt, including the banks’ margin was 4.28%.

Tim Martin’s rant - he can’t help himself, can he?! This time, it’s a re-hashed previous rant about unfair tax treatment of pubs vs. supermarkets. He also takes a swipe at competitors boards -

However, surveys by Wetherspoon in the past have demonstrated great fervour for tax equality among individual tenants and free traders.

The lack of vocal support for equality is probably an example of board rooms being out of touch with those on the front line, always a bad sign for any industry.Until there is tax equality between different types of businesses on the High Street, pubs will always be fighting with one hand tied behind their back - and will provide less in the way of jobs or taxes than they otherwise might.

Outlook - is mainly a rant about Govt covid policies, but also includes this -

"Wetherspoon has tried to take a long-term approach to these issues, investing heavily in the workforce, in buildings, in marketing and in contracts with landlords and suppliers, which will hopefully create a solid base for future growth. The company remains cautiously optimistic about future prospects."

Balance sheet - nothing is said about cash or liquidity.

Looking at the last balance sheet, at 23 Jan 2022, it’s adequate, but NTAV is only £296m, a long way short of the current market cap.

Key items to research in more depth are -

Freeholds - in books at £1.1bn (includes long leases), have not been revalued since 1999. So what is current market value compared with book value? We can't assume they've all gone up in value, some might have gone down maybe?

Bank debt - substantial, at £963m, although the freehold assets are more than this. What are the bank covenants, and is there enough headroom? I see from the interim report that banks have been very supportive, and covenants waived until Oct 2022 (for a £1m fee). What happens after that?

I think another placing is a possibility at some stage.

My opinion - I’m in London at the moment, and am pretty shocked at the price of a pint, £5.50 seems to be the new starting point. £6.50 for premium lager, and this is outside the centre, in ordinary pubs.

So in good weather, plenty of people prefer to gather with friends in the parks, and buy supermarket drinks. No wonder Tim Martin is unhappy with that, and he does have a point. Multibuys cost little more than £1 a pint at the supermarket, although you usually have to chill them at home first. Sometimes I find that draught pints are not very good (not fizzy, or cold enough), which certainly makes you wonder why you’re paying 5 or 6 times what a supermarket charges, often combined with surly & indifferent service in London.

I’ll have to mystery shop a ‘Spoons whilst I’m in London, and report back.

It does make me question the overall business model though - in British pubs, people are generally too stand-offish to mingle, and all too often you see people sitting on their own, looking miserable. You can do that on a park bench much cheaper, if you don’t mind being mistaken for a tramp. So why pay £6.50 for a pint?

It also begs the question whether the cost of living squeeze is harming ‘Spoons customers disproportionately? Given that they’re already probably challenged for money (hence seeking out the cheapest, no frills pubs), then it’s safe to assume that JDW’s customers are more likely to be impacted by food & energy inflation, than the middle classes, who don’t tend to drink in JDW pubs. Offsetting that, others might trade down from more expensive pubs, possibly?

It seems clear from this update that JDW needs to raise its prices, to restore profitability. Logically, the cheapest pubs should find it easier to raise prices, and will still be the cheapest in the market, as everyone else is raising prices too.

Cutting to the chase, is this a good time to buy JDW shares? Looking through the sector, other pubcos have also seen plummeting share prices of late. The way I see it, JDW does have a unique market niche, at the affordable end, and its long-term track record is excellent. Therefore, one way or another, profitability is likely to improve, and it looks well set up to withstand inflation & higher interest rates.

Hence for long-term investors, I reckon it might be one to add to the potential buys list, after having done more thorough research yourselves - particularly on the bank borrowings & covenants. Another placing can’t be ruled out.

Note that Tim Martin sold £60m of shares in 2020 & early 2021. Although he still owns c.22%. He could buy them back now at half the price he sold at.

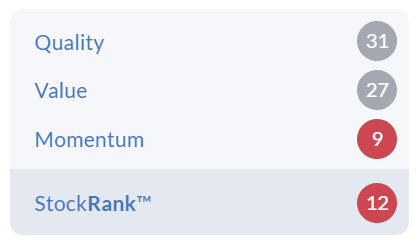

I'm surprised the StockRank is so low, but I suppose the computers don't realise there's been a pandemic, so just focus on the move from profit into losses.

.

Loungers (LON:LGRS)

188p

Market cap £194m

This is for an unusual 52 week year end of 17 April 2022.

We’ve covered Loungers here before, it’s an impressive self-funding roll-out of all-day bar/cafe/restaurants. My sector expert tells me that management are top notch.

Loungers is opening about 30 new sites per year. No doubt landlords will be offering them excellent property deals, so this is paradoxically a great time to be expanding, when others are struggling, and good sites are available. Although the CEO of Revolution Bars (LON:RBG) (I hold) recently said there is now more competition for good sites.

We’re pushed for time today, so I will just give some abbreviated notes from my skim of the results statement issued yesterday -

Revenues £237.3m

Lots of different EBITDA measures presented, which I’m ignoring, as they don’t reflect reality for me.

Profit before tax of £21.6m looks good - especially compared with JDW above, which is reporting a loss for a year end that is only 3 months different from LGRS.

17.0p diluted EPS - a PER of about 11, which looks superficially cheap.

Profit boosted by £4.5m Govt support measures. Plus there was reduced VAT on food, and reduced business rates (benefit not quantified).

Broker forecasts are for much lower profits in FY as Govt support measures have ended - good, we want soft targets, as there’s less risk of a profit warning. EPS falling to 9.4p is broker consensus. That’s a PER of about 20 - but I think it’s likely to beat this earnings forecast, so the actual PER could end up being lower.

Roll-out of 32 sites per annum is planned - an ambitious, expanding business. Self-funding too, so shouldn’t be any more dilution from share issues.

Share-based payments to mgt are possibly over-generous, at £3.2m this year, and £2.0m last year.

Current trading - in stark contrast to Wetherspoons above, LGRS says it has seen “no change in customer behaviour”, and its LFL sales are strongly up, +14.2% excluding the reduced VAT benefit, against pre-pandemic comps.

Wetherspoons is only just level with pre-pandemic, so as LGRS says, LGRS is out-performing the industry by +15%. I would just temper that by saying that, as many of its sites are newish, they’re probably still on the gradual build up of trade that I would expect from a new site, as it builds the customer base. Then that would expect to level off, once a site is mature, then go into decline, as it becomes tatty & requires an expensive refurb. It’s important to remember that (typically 5-year) cycle, which flatters performance in the first half, and drags on performance in the second half.

Also, different bar/restaurant formats come in & out of fashion over time.

JDW’s more mature estate is possibly struggling because of this factor, maybe?

Balance sheet - is pretty thin, because LGRS operates using leasehold properties.

NAV is £134m, but it’s mostly intangibles of £113m, so removing them gives NTAV of £21m.

So no asset backing, and increased risk from rent reviews in future eroding profits, but also little to no bank lending to worry about in a downturn, which is probably more important right now.

Cashflow - distorted by IFRS 16, but also there seems an unusual & large rise in trade creditors, that looks a one-off benefit, which might even unwind next year?

So I wouldn’t assume that the exceptionally good cashflow is necessarily going to continue at that level. Still, it’s wiped out the bank debt, so is rather nice.

My opinion - comparing JDW’s weak performance, with LGRS strength, confirms my view that current macro conditions at the moment are not the usual “squeezed middle”, which we hear the press go on about. Inflation tends to hurt lower income people the most.

It seems to me that people in work, are getting pay rises + bonuses which enable them to keep up with the cost of living - recent ONS data put it at c.7%. That’s enough, once you make a few downward tweaks to spending, to maintain pace with inflation, and continue the discretionary spending which you enjoy the most. That’s where I think we are right now, which could change in future of course. Recent GDP data was a bit better than expected too. So people are still spending, if goods/services are value for money, and enjoyable.

Where things are really starting to hurt, are for the “squeezed bottom” (very topical, given recent events in Westminster!). Low income people - that’s where inflation is hitting the hardest, already in double digits for people who spend a high percentage of income on food, and utilities. They’re more likely to be JDW customers, than LGRS customers, I suggest.

Overall then, I think LGRS looks a very good long-term investment, providing management can cope with opening so many new sites each year, without losing control.

Although in valuation terms, it’s not looking cheap, even after a big downward move. The forward PER of 20 certainly requires an earnings beat, to be justified.

It’s going on my possible buys list though, but maybe no immediate rush to dive in?

.

Graham’s Section:

finnCap (LON:FCAP)

Share price: 18p (pre-market)

Market cap: £32m

Many of you are familiar with this one - it claims to be the largest Nomad (nominated advisor) and No. 1 broker on AIM.

Its share price has approximately halved this year, in advance of today’s full-year results.

The problem with these small investment banks is that they have some of the lowest-quality earnings that any company can have:

- Lumpy revenues, from corporate clients. Sometimes one or two big deals can make or break the results for a year.

- Labour-intensive. If the chief rainmakers leave the company, it loses most or least much of its value. If they leave and set up a rival company, it’s a disaster!

- Economically cyclical. In bad years, both equity trading volumes and M&A opportunities dry up, and only skilled management can prevent these companies from making a loss - usually by cancelling bonuses and letting people go.

Personally, I would hesitate before even assigning a P/E multiple to these companies. When earnings are so volatile and unpredictable, I think it becomes a meaningless statistic.

If you look back at my Cenkos Securities (LON:CNKS) commentary in 2019, for example, you’ll find that I was mostly interested in that company’s net asset value (which was mostly cash and liquid assets). If I can buy one of these companies at a discount to cash and easily liquidated assets, then I think it has the potential to be a value investment. But I’m not willing to value them based on their earnings for any given year.

That’s enough of a preamble. Let’s see what Finncap achieved in FY March 2022, and quickly move on to a conclusion:

- Revenues +13% to £52.5m

- Cavendish (private M&A) revenues +101% to £24.3m

- Capital Markets revenue minus 18% to £28.3m

- Net income £6.5m (previous year: £7.0m)

Market share for AIM deals greater than £5m was 11% - excellent.

Finncap is now very active in private M&A, and has ambitions to build a professional services division (it recently bought 50% of a “sustainability” consultancy).

The diversification strategy does arguably reduce some aspects of risk for shareholders, but it also increases complexity for anyone analysing Finncap.

Furthermore, I think it’s hard to argue that the addition of these new businesses brings any radical improvement to the quality of earnings. But I’ll try to keep an open mind in this regard, and see how the strategy evolves.

Unfortunately, despite the record revenue performance in FY 2022, profits did not improve. The company comments on higher employee costs:

Administrative costs increased by 17% over FY21 reflecting higher employee compensation arising from the Group's strong financial performance in particular in the M&A division where competition for professionals remains intense. Staff costs (excluding share based payments) as a percentage of revenue were 61% - broadly in line with FY21 and within our 58-62% guidance range. Our staff costs percentage remains in line with or below much of our peer group.

Non-staff costs rose too, as the company invested in a new office, giving “substantial scope for expansion”.

It’s hard to imagine much further expansion in the short-term, however, in the current conditions. Finncap says that it will “selectively” invest in people, for the medium-term, but there is little doubt that short-term prospects in the current financial year are poor:

The current financial year has been complicated by the tragic conflict in Ukraine and rising macro risk including rising inflation, high energy prices, concerns over food prices and the consequent impact on consumer confidence in key markets. This has significantly impacted the level of ECM activity, IPOs and equity issuance across all market participants.

Equity issuance through our Capital Markets division has been very low but we continue to execute plc M&A mandates. Sales and trading activity has remained broadly stable.

In contrast, the private M&A market and our team's M&A performance has been strong and we have closed several private M&A transactions post year end…

As a result of market conditions, we expect revenue and financial performance to be substantially lower than in FY22.

Balance sheet - for March 2022, before a £2m acquisition, we get the following:

- Net assets £33.1m

- Net tangible assets £19.1m

- Net current assets (NCAV) £4.8m

My view: Below net tangible assets (c. £19m), I think this is a value investment.

That may seem ludicrous, given £6.5m in net profits just reported. Surely the company is worth more than three times trailing net income?

However, I would point to the lack of repeatability of trailing net income, how long it will take Finncap to pay out its market cap in dividends, and the possible changes in the M&A/capital market landscape by the time that happens.

Shareholders might still do extremely well from current levels, but I think it’s best to have a cushion in tangible assets (ideally liquid tangible assets) before getting involved in this sector.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.