Good morning, it's Paul here with the SCVR for Thursday.

Today's report is now finished.

As usual, this is initially an empty article, so that subscribers can add your comments about the 7am news releases. Then I'll be writing up the main article, section by section, throughout the morning. Official finish time is 1pm.

Today I will be looking at;

Ao World (LON:AO.) - brief comment on strong revenue growth

Intercede (LON:IGP) (I hold) - more colour given on recent big contract win with US Dept of State

2 car dealers reporting today, so I'll review both - Vertu Motors (LON:VTU) (I hold) and Lookers (LON:LOOK)

Fulham Shore (LON:FUL) - update

Churchill China (LON:CHH) - interim results

Van Elle Holdings (LON:VANL) - Final results - sorry I ran out of time, so didn't look at this in the end.

I probably won't have time to catch up today on a small backlog, because my niece is coming to stay for a week, so I have to get everything organised for her visit. Hence an early start today, and 1pm finish at the latest.

.

Brief comment;

Ao World (LON:AO.)

196p - Mkt cap £925m

Trading Statement - this online electrical retailer has issued an impressive update this morning, in terms of sales. As you would expect, with competitors' physical stores closed, it's done well during lockdown. I'm not sure what growth rate the market is expecting, but this does look impressive;

The trading momentum announced at the time of our preliminary results in July has continued and the significant change in demand for AO's products and services has been maintained. As a result, in the four months ended 31 July 2020 we have recorded strong year-on-year revenue growth in the UK of 58.9% to £401.3m and of 91.5% to €74.3m in Germany1....

The demand for AO's products and services has been sustained since competitor stores started to re-open at the beginning of July. This reaffirms our belief that this is a structural shift in demand where customers have found a better way to shop the electricals category.

Competitors also have websites. of course.

Medium term uncertainty due to covid & Brexit.

Nothing said about profitability, or market expectations - that's the crucial information we need to see!

As also mentioned in results statement on 14 July, covid has also resulted in increased costs

My opinion - this share has always looked wildly over-priced to me. It's really just a low margin distributor of mainly generic products that you can buy anywhere else. The CEO's gushing, over-the-top enthusiasm for such an ordinary business, has always struck me as a bit nauseating. How can anyone get wildly excited about delivering electrical goods?

Pre-covid, growth was unimpressive, e.g. UK LFL growth FY 03/2020 was only +8.2% - not enough to justify the high valuation.

Having said all that, today's update shows superb revenue growth due to covid, and it's encouraging that this has continued after physical stores re-opened. If it meets profit targets (today's update is silent on that, which is very unhelpful), then it might at long last start making a profit.

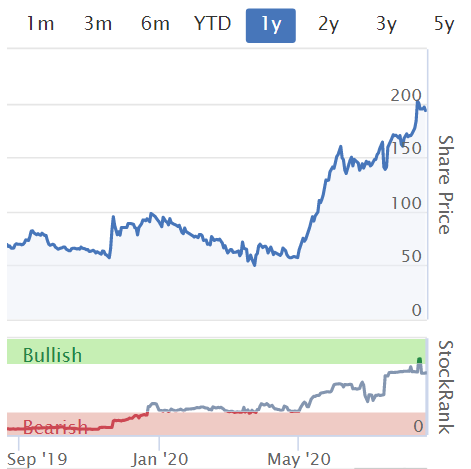

The price is high, but rapid revenue growth means it's starting to look interesting on fundamentals - reflected in a near 4-fold rise in share price since the March low. Well done to holders! Note how the StockRank has soared from deep in the red, to almost in the green, over the last year.

.

.

Incidentally, I've got a new oven arriving on Sunday from AO.com so I'll let you know next week how effervescent the delivery driver is.

.

Intercede (LON:IGP)

85p (up 4%, at 08:15 - mkt cap £42.7m

(I hold)

Contract Win - Initial Progress Order - this is an update re the contract recently announced - I commented on it here on 30 July 2020. Today we are given more detail;

Initial order for >$1.0m - I like the word "initial" - as this is a "ten year, multi-million dollar contract", then it should produce good revenues & profits. IGP's large contracts tend to be very sticky, and product strong recurring revenues, plus follow on orders, and plenty of consultancy work.

Intercede expects to receive a further order for software licenses and associated development, professional services and support & maintenance within the next few months; a portion of which will be recognised in the current financial year ending 31 March 2021.

As previously announced, the client is the US Department of State (foreign policy, headed by Mike Pompeo) - one of many contracts with the US Govt - reference sites for security software don't come better than this. It's very encouraging to see the IGP is winning new business, for next generation systems. This eliminates the criticism from bears on the share, that it's legacy software. That's clearly wrong.

Forecasts - as mentioned last time, this contract was included in the budget for this year, so it's reassuring, rather than earth-shattering;

The contract was included within the directors' expectations for the current financial year ending 31 March 2021.

My opinion - remains very positive. This has been one of my top holdings since 2018. I see a lot of potential here, but time will tell if mgt are able to deliver the strong growth that seems possible. Recent news has been reassuring. The market cap strikes me as still quite modest, given the upside potential under new management. Very illiquid to buy/sell.

.

.

Vertu Motors (LON:VTU)

Share price: 24.5p (up c.11%, at 09:00)

No. shares: 369.2m

Market cap: £90.5m

This is a chain of car dealers, one of two reporting today.

Key points;

July trading "significantly stronger" than expected - robust recovery in customer demand (I think there must be an element of catch up in this, e.g. for overdue servicing/MoTs. Also a reluctance to use public transport could be boosting demand)

Record month for used car profits - good demand and margins

Aftersales (servicing, repairs) also doing well, and high margins

Fleet market subdued,offset by strong demand elsewhere

Adj profit before tax (PBT) of £7.4m in July (£1.3m boost from furlough grant). All staff will be back at work by end August.

Profit impact of covid is surprisingly small, and now profitable YTD for FY 02/2021;

The Group incurred an adjusted loss before tax of £5.2m in the March to June period and so has now made year to date an adjusted profit before tax of £2.2m.

Overall;

The Group is in a significantly better position than anticipated during the lockdown, both in terms of profitability and cash flow generation....

There's lots more detail in the RNS, which I won't cover here.

My opinion - looking good.

I mentioned here on 14 July that this looks a good time to look at bombed out shares in car dealers, as demand is coming back. That remains my view. Despite all the gloom we hear every day, this seems one of an increasing number of sectors that are seeing encouraging trends, and returning to close to normal. It remains to be seen how sustainable that is, and how much is pent-up demand being released.

Most car dealers have lots of freehold property, so you're getting the balance sheet support from that, in addition to earnings that are now recovering from the covid slump.

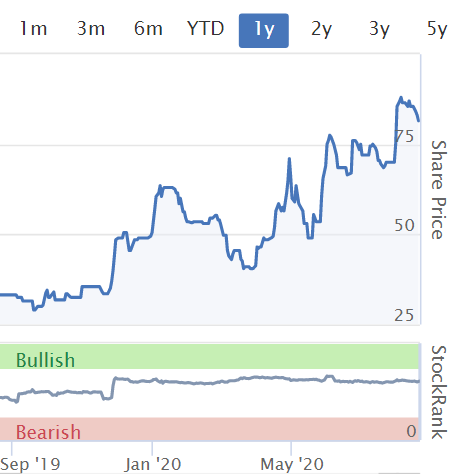

I thought I had a long position in this share, so allowed myself a fleeting warm glow at the rise in share price today, but unfortunately I must have closed the position to meet a margin call, as there are none in my trading account. Never mind. As mentioned before, I like doing the research, but am hopeless at managing my own portfolio! I'm tempted to buy back in, as there's probably quite good upside here, with only a limited bounce so far;

.

.

Lookers (LON:LOOK)

Share price: suspended at 21p on 1 July, due to accounts being late

Update on 2019 Accounts - a further delay in publication, beyond anticipated end August 2020. More problems accounting discovered.

The Board continues to believe that the likely magnitude of the potential restatements referred to above will not prevent 2019 from remaining profitable at the underlying profit before tax level.

What is the "likely magnitude" then? We're not told. The above means nothing, if all the accounting corrections are put through as exceptionals, and/or prior year adjustments

The Company remains in close dialogue with its banking partners.

I bet it does.

Trading update - a separate announcement, which reads well. June & July trading strong. Selling off freeholds to raise cash - this could save the day, freehold property can be a life-saver for companies that get into trouble. Big reduction in staffing, through 1,400 redundancies.

Loss-making in H1;

The Group expects to report a material underlying PBT loss for H1, after receiving c£29m from the Government's Job Retention Scheme.

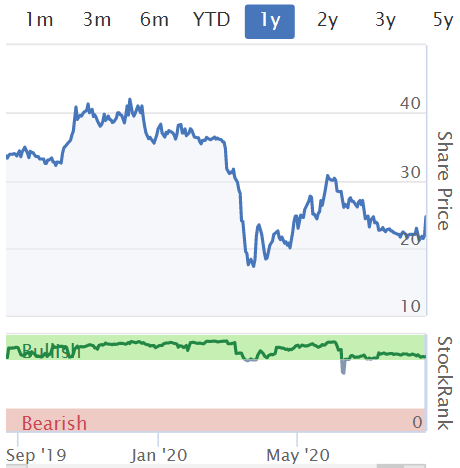

My opinion - as it's suspended, shareholders can only wait, and hope for the best. The risk is that it's sold off, to enable the bank to recover its money, leaving equity holders potentially with little to nothing.

EDIT: having another think about this, there doesn't necessarily seem immediate risk here, because net debt has reduced so much due to stretching creditors like VAT/payroll taxes. Net debt at 30 June 2020 was only £13.5m (LY: £74.3m). That's not panic stations by any means, especially with a property portfolio of over £300m. So I'm probably worrying too much about solvency. It says that refinancing options will be explored in Q4 2020, which suggests to me that the existing banks might not be keen to continue lending. End of edit.

That may or may not happen, I'm just saying it's a risk. With the shares suspended, nobody can buy or sell anyway, so let's move on.

I think it's usually best to sell on the opening bell whenever accounting problems emerge. In many cases, the first announcement is the thin end of a much larger wedge. People had plenty of time to sell LOOK before it was suspended.

.

Fulham Shore (LON:FUL)

Share price: 10.0p (up 18%, at 12:29)

No. shares: 573.6m + 36m placing shares = 609.6m

Market cap: £61.0m

Completion of banking facilities & trading update

This is a chain of casual dining restaurants, mostly Franco Manca pizzerias, and The Real Greek.

I covered its refinancing recently, here on 6 Aug 2020. Despite liking the business a lot, I baulked at paying 6.75p, and now look a complete numpty given that it's risen nearly 50% in just 2 weeks! Never mind. I can only pay what seems a reasonable price for me. If other people want to pay more, that's up to them. The focus in these reports is analysing the fundamentals, not trying to predict short term market sentiment - I'll leave that to the traders amongst you, who are better at it than me.

Equity fundraise of £2.25m has completed, just a formality, as we already knew all about it.

Bank facilities - enlarged (very large for size of company) bank facilities of £25.75m have also now "become unconditional in all respects". It's interesting to note that this is;

...as a result of the Directors' participation in the Fundraise

That's quite significant to me. It sounds like the bank is basing some of its confidence in the business on the Directors dipping into their own pockets (already large shareholders). That means that outside shareholders are benefiting from the Directors willingness to put in more of their own money. I see that as a big positive.

Trading Update - no figures given, but trading in August has been "markedly up" due to the Govt "Eat Out to Help Out" scheme, with the second week of August being "one of its highest" turnover weeks, despite some restaurants still being closed.

Nearly all sites will have reopened shortly, with 3 central London sites remaining closed.

Landlords/rents - agreements with 40% of landlords to defer, reduce, or waive rents. The trouble is, that covers such a wide range of scenarios, that it's largely useless information. We need figures, not waffle. Why would other landlords offer rent concessions, now that they know the company has refinanced? That can be a drawback for listed companies.

I remain concerned that FUL will be at a considerable disadvantage, since many competitors are doing CVAs/pre-pack admins, hence achieving much lower rents, and jettisoning all their loss-making sites. Whereas FUL has to struggle on with its existing leases, some of which will now be too highly rented.

Other restaurants going bust will often, paradoxically, create new, refreshed, more profitable competitors, as closed sites then re-open under new owners - who will be benefiting from cheap rents, and long rent-free periods, on new leases. Although FUL can also grab a slice of that, by opening new sites, which is mentioned in the last update from 6 August, including possibly some former Carluccios in prime sites, which would not otherwise be available. Hence part of the attraction of FUL now, is that it's got the bank facilities to expand when good quality sites are plentiful, and unusually cheap.

My opinion - no change really. I missed a 50% rise, but certainly wouldn't chase the price up at this level.

As Tasty (LON:TAST) said the other day, August is doing great because of staycations, the VAT cut, and EOtHO. However, Tasty also said it is "extremely cautious" about trading in September. I suspect the Govt could extend the EOtHO scheme, as it's worked so well, and is probably a profit-maker for the Government. After all, giving away £10 per diner in subsidy, is probably paid back in additional payroll taxes, from all these restaurants bringing back staff from furlough. Like all these temporary support measures, it's difficult to see how they can be withdrawn.

At this stage re covid, I wouldn't want to be buying shares in restaurants, since once it's cold, and people are indoors again, then who knows what might happen re new lockdowns, etc? Or, if you think the vaccines could be around in early 2021, then that might be a risk worth taking, if shares are cheap? The trouble is, FUL isn't cheap, so risk:reward doesn't feel right to me at 10p per share.

.

Churchill China (LON:CHH)

1050p (down 2%, at 13:03) - mkt cap £116m

Churchill China plc (AIM: CHH), the manufacturer of innovative performance ceramic products serving hospitality markets worldwide, is pleased to announce its interim results for the six months ended 30 June 2020.

The forecasts on Stocko look old, as they haven't shown any reduction over the covid period, hence we need to disregard the forward-looking valuation metrics. Or, look at them as what would have probably happened, if covid hadn't occurred, thus a potentially useful indicator of valuation in the future.

Interim results - largely meaningless, as this covers the lockdown period. Overall though, not too bad - it eked out a small £0.5m profit, down from £4.2m in H1 LY.

Outlook - markets recovering, but slowly by the looks of it. Expecting production to be 70% of 2019 levels shortly, a new base level. Cutting staffing. No guidance given.

Balance sheet - it's striking how far receivables have fallen, indicating business must be very slow.

Very strong balance sheet overall, so I have no concerns over solvency. Plenty of cash, although that's likely to fall in H2, as receivables (hopefully) build up again, as sales increase.

My opinion - I reckon the breakeven-ish H1 result probably flatters underlying performance, if we were to strip out the benefit of furlough payments.

Also, I'm concerned that markets don't seem to be recovering enough, or quickly, unlike some other sectors that we've seen strong rebounds from.

Therefore, this share looks as if it might need patience. The hospitality sector is really struggling as we know. Give it a couple of years though, and business could be back to pre-covid levels, who knows? I imagine this share might gradually recover over the next few years, so it could make a reasonable entry point now for people with a longer term perspective?

.

That's it for today, I didn't have time to look at VANL in the end, sorry about that.

See you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.