Good morning, it's Paul & Graham here.

Agenda -

Paul's section:

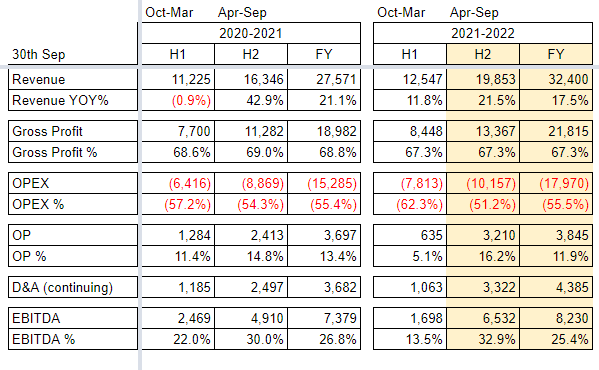

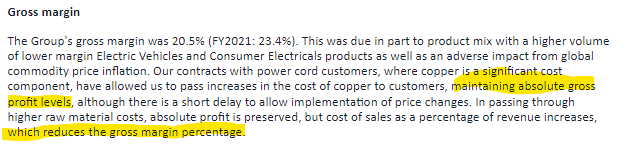

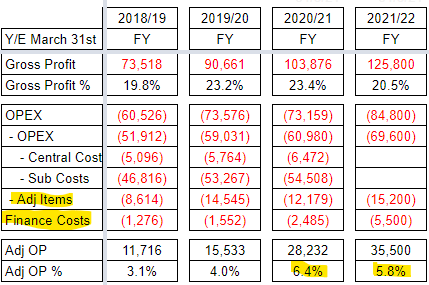

Volex (LON:VLX) (£379m) (I hold) results for FY 3/2022 look strong, and the valuation modest. Outlook comments are also surprisingly perky, with a strong start to FY 3/2023 indicated, with high demand & orders. Inflation is being passed through to customers. There's lots to like here, it's one of my favourite value/GARP shares at the moment. Patient, long-term investors should do very well on this, I reckon - with both earnings growth, and a higher PER possible once markets are through this current bear phase.

Naked Wines (LON:WINE) (£146m) - FY 3/2022 results don't look good - it's not making any profits, and growth has stalled, including forecast growth for this new year. Balance sheet is OK, but there is a cautious going concern statement. I'm worried that some customers might cancel wine subscription services, so WINE could be running to stand still. Not an attractive share at all, in my view.

iEnergizer (LON:IBPO) - readers flagged up sparkling results from this IT/outsourcing group. It looks highly profitable, and reasonably priced. But the CEO owns 83%. It's also up for sale at the moment, in bid talks. An intriguing situation for sure.

Graham's section:

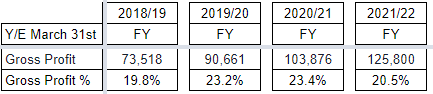

Liontrust Asset Management (LON:LIO) (£610m) - Final Results yesterday showed an excellent performance in FY March 2022. However, the share price has been sliding lower for months as general investor sentiment has soured and Liontrust funds, with significant exposure to richly-valued US shares, have underperformed. The LIO share price decline has brought it arguably into value territory.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR…