Good morning, it's Paul here with the SCVR for Thursday.

We'll do what we can. It's all a bit difficult at the moment, isn't it! Ploughing through results statements is the last thing I want to do at times like this, when we're all worrying about our own shrinking portfolios. Never mind. See the header above for the companies I'll be covering today.

Estimated time of completion - a bit later today, by 3pm.

EDIT: I've just got a text reminding me that they're fitting my apartment with a smart meter, so I won't have any electricity for a couple of hours. This will delay me. Hence revised completion time of 5pm. Sorry about that.

EDIT at 17:30 -today's report is now finished.

Still, we need to keep focused on the fact that times like this do throw up interesting opportunities, as well as causing pain.

Topps Tiles (LON:TPT)

Share price: 59.3p (down 25%, at 10:15)

No. shares: 195.0m

Market cap: £115.6m

Trading update (profit warning)

Topps Tiles Plc is the UK's largest specialist supplier of tiles and associated products, targeting the UK domestic refurbishment and commercial market and serving a retail and trade customer base from 361 nationwide retail stores and four commercial showrooms.

I last reported on TPT's figures here on 8 Jan 2020. Whilst the sales performance for Q1 (Oct-Dec 2019, as it has a Sept 2020 year end) was poor, at -5.4%, the company was able to point to a big improvement within the quarter (LFL sales down -7.2% in the first 8 weeks, bouncing back to -1.4% in the last 5 weeks of Q1). Therefore, weak sales looked like a blip, perhaps caused by the political uncertainty prior to the 13 Dec 2019 election result.

Unfortunately, we're told today that the sales trend has deteriorated again, to -5.5% LFL sales in the 8 weeks to 22 Feb 2020 (Q2 to date). As we know, a decline in sales at high margin retailers, feeds through to a geared impact on profits. It's fairly easy to set up a simple spreadsheet to model this. Consequently;

With most of the period complete, the Group now expects that first half profit will be significantly below the prior year level. As a result, management expect adjusted profit before tax for the 53 weeks ended 3 October 2020 will be materially below the bottom end of the current range of market expectations1.

1 The current range of market expectations for adjusted profit before tax for the 53 weeks ended 3 October 2020 is £13.5m to £14.5m

Many thanks to the company, and its advisers, Citigate Dewe Rogerson, for providing this helpful footnote, which saves us all time in not having to search around for the figures.

The company says it is acting to cut costs, and improve cashflow.

If demand is weak, then it might need to discount prices, to drive sales, hence weak sales often goes hand in hand with weaker margins too. Nothing is said about that today.

Revised forecasts - these have been deeply slashed. This year is now forecast to only make 2.9p adj EPS (down 58% on last year). Forecasts for next year, and the year after that, are barely above 3.0p.

This looks fairly disastrous to me, and I cannot see any reason to hold the share at c.60p, which is a PER of about 20 - arguably far too high, given that the business really seems to be struggling.

I don't think they can explain away a 5.5% fall in LFL sales from macro factors. The real reason is probably competitive pressure.

Balance sheet - looked OK previously, but with much reduced profitability, the bank debt doesn't look so comfortable now. Consequently...

Dividends - although nothing is said today about divis, I think the company would be wise to suspend divis, and focus instead on paying down bank debt. The yield here was the main reason for holding the share, so with that possibly now under threat, or reduced to forecast 1.5p (yielding only 2.5%, if you get anything at all), then the share looks unattractive.

My opinion - this business had seemed resilient until today, but I think the bull case has really gone out of the window with this update.

Nothing is said about coronavirus, but if (as seems likely) people may not want to spend on travel/holidays, then possibly they might decide to do some DIY at home? Topps also mentioned a time lag before the improved housing market feeds through to a possible improvement in H2.

Despite falling 25% today, my feeling is that the share needs to fall considerably more before risk:reward would start to look attractive. People who hold on can only hope that trading improves. If it doesn't, then the next stop could easily be 40p for this share, I suspect.

Last night's StockRank was super-high, so unfortunately we have to remember that StockRanks can't predict profit-warnings. The score is likely to fall considerably now, as price & earnings momentum plunge, and valuation will also become less attractive as the share price has not fallen as much as forecast earnings.

My commiserations to shareholders, we all feel the pain when a profit warning hits. It's just a case of deciding what to do. A knee-jerk reaction to rush out and buy more, looks the wrong decision to me in this case. The share hasn't got cheaper today, it's actually more expensive now, on a forecast earnings basis.

It's now at chart support levels, but will that matter, given the deep cuts to forecasts?

.

John Menzies (LON:MNZS)

Share price: 339p (down c.5%, at 11:42)

No. shares: 84.3m

Market cap: £285.8m

Trading statement (update on impact of COVID-19)

John Menzies plc, the global aviation services business, today provides an update on current trading.

- Cost-cutting in 2019 is delivering results.

- Positive commercial momentum in 2019 has continued into 2020

- Refinanced bank facilities in Jan 2020, of £325m to 2025

- Coronavirus has impacted operations, in Macau, and elsewhere when handling Chinese airlines

- Situation still evolving, limited visibility beyond March 2020 - so difficult to assess full impact

- Current estimate: £6-9m reduction in 2020 profits (assumes virus subsides towards end June)

- Mitigating impact through cost control

Conclusion -

Given the otherwise underlying positive momentum of the business, this headwind is disappointing, but the Group is well positioned to manage it effectively and return to our positive growth trajectory for this year and beyond.

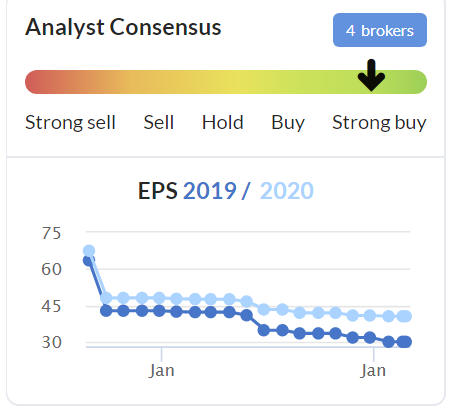

I think it's very helpful for companies to quantify the profit impact, as has been done here. Investors have rewarded this clarity with just a 5% share price fall today. Although as you can see below, the market had already heavily discounted this known issue before today;

.

Note also that this share was in a long-term downtrend before the coronavirus issue surfaced.

Two questions arise;

1) Is coronavirus going to be petering out towards the end of Q2? Who knows? But if it's not, then another profit warning here would be likely.

2) How significant is £6-9m reduction in 2020 profits? I can't find any detailed forecasts, but Stockopedia gives us £27m post-tax, which at 19% tax, becomes £33.3m PBT. Assuming that's correct, the £6-9m would represent between 18-27% of 2020 profits - quick a hefty chunk. But it's a one-off factor, that would be quickly forgiven I think, assuming the optimistic scenario of the virus subsiding, does actually happen.

Just in case that broker's consensus is calculated on a different basis to the company's own reporting, which often happens, I'm looking at last year's accounts, FY 12/2018, which show adjusted PBT of £44.1m, but lots of adjustments, which lower statutory profit to £12.5m (on continuing operations).

Balance sheet - this is the problem. I've flagged many times here, that MNZS has a weak balance sheet, which is very much what you don't want when there's some kind of crisis. Last reported at 30 June 2019, NAV was £85.5m. Removing the £175.2m of intangibles, takes us to a negative NTAV of -£89.7m.

The remaining balance sheet comprises heavy fixed assets (all those trucks & baggage handling equipment that we see at airports, with the Menzies name on them), funded by heavy bank debt. There's also a whacking great receivables book, of £266.2m. My worries there are that the business is clearly under-capitalised, and overly indebted. Plus, if airlines start going bust, then MNZS may not be able to recover some receivables.

Plus it's at risk of further disruption from coronavirus.

My opinion - I don't see this as a good investment to start with. With the added losses & risk relating to coronavirus, then I really wouldn't want to try bottom-fishing here, it looks far too risky for me.

Debt is far too high for me, and a prolonged coronavirus impact could lead to covenant breaches. Sure, the banks would probably waive those, but it could conceivably end up with shareholders being asked to stump up more capital, in an equity fundraising. That would likely be from a position of weakness, hence possibly at a low price.

The dividend yield of nearly 6% also looks precarious to me. Very heavily indebted companies really should not be paying big divis. This could be cut if conditions worsen, possibly.

Also note that brokers forecasts were already slashed deeply, before coronavirus surfaced.

I think there are much better, less risky places to bottom-fish right now. than this share.

.

Macfarlane (LON:MACF)

Share price: 96.4p (down 3.6%, at 15:54)

No. shares: 157.8m

Market cap: £152.1m

This is a packaging group.

Macfarlane Group PLC achieved sales of £225.4m in 2019, (2018: £217.3m) a 4% increase on 2018, with 2019 profit before tax growing to £12.0m (2018: £10.9m), 10% ahead of 2018.

This marks the tenth consecutive year of profit growth. The performance in 2019 was in line with market expectations and was achieved against a well-publicised backdrop of economic uncertainty resulting in weaker demand.

Balance sheet - is mainly goodwill & intangibles, so it's been acquisitive. Strip that out, and NTAV is only £6.6m - adequate but not strong.

Current trading - sounds OK -

2020 has started well and profitability in the year to date is ahead of the same period in 2019.

My opinion - looks a reasonably good company, at a reasonable price. The forward PER looks good value, at 11.5

Stockopedia likes it;

.

Amino Technologies (LON:AMO)

Share price: 128.5p (down 4.1%, at 16:23)

No. shares: 76.0m

Market cap: £97.7m

Amino Technologies plc, the global provider of media and entertainment technology solutions, announces its preliminary results for the year ended 30 November 2019.

This company reports in US dollars.

Revenues are down 13.2% to $77.2m, but margins are up, so adj operating profit is down 9% to $10.2m

Current trading and outlook

· Solid order book and sales pipeline visibility for FY20

· Confident of further significant growth in software and services revenues in the year ahead

Dividends - have been a stand-out feature of this share, with generous payouts for quite a few years now. Given the weak balance sheet (see below) I wouldn't put an reliance on generous divis necessarily continuing.

Balance sheet - used to be strong, but they spent the cash pile on acquisitions. So now it's weakish.

NTAV is negative, at -$9.3m

My opinion - neutral.

That's all I have time for today.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.