Good morning! Paul & Graham are here with you today.

In a sign of the times, both my computers seem to have gone on strike this morning. So I am currently negotiating with them, and waiting to hear what their inflation-busting pay rise demands are. We might have to bring in ACAS! Hopefully a hard reboot might resolve their attitude problems.

Agenda -

Paul's Section:

Kromek (LON:KMK) (£40m) - announces a distribution deal with Smiths (LON:SMIN) . I also look at KMK's last trading update. There seem to be signs of life here, after years of disappointment & fundraises. Looks worth putting on the watch list.

Peel Hunt (LON:PEEL) (£137m) - a trading update that hardly says anything about trading! I have a long ramble below about the city, brokers, fund managers, etc. I'm adding PEEL to my watchlist, but need to do more work on the unusual way profits & ownership seem to be split.

Quiz (LON:QUIZ) (I hold) - decent results, it's back in profit now. Strong balance sheet. Current trading is good. I think this looks a decent recovery situation, and it's cheap.

Graham's Section:

Impax Asset Management (LON:IPX) (£770m) - This environmental asset manager reports a large negative return at its funds, and investors now on balance taking their money out. Analyst forecasts rely on AuM rebounding quickly by the end of September, the financial year-end, and this is unlikely. As such, I expect that Impax will miss its forecasts. But Impax shares have already fallen by 60% and now offer a respectable P/E multiple for anyone happy to take a chance on the company’s long-term prospects.

Redde Northgate (LON:REDD) (£800m) - FY April 2022 results are excellent from this vehicle rental group which also offers a wide range of related services. The big questions are to do with the sustainability of profits, as vehicle rentals costs and resale values have been artificially high (due to the well-documented supply chain issues). The good news for shareholders at the current share price is that the company offers a yield of over 6%, that is very well covered by EPS. As this is a value share where, in my opinion, the dividend yield should be the main attraction, it may have reached a fair price at current levels.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Kromek (LON:KMK)

9.25p (before market opens)

Market cap £40m

Agreement with Smiths Detection Inc

There’s no indication of potential sales from this distribution agreement. However, a little googling reveals that Smiths Detection is part of £5bn market cap Smiths (LON:SMIN) . Hence this deal seems to validate the quality of Kromek’s products, with a credible big name distributor.

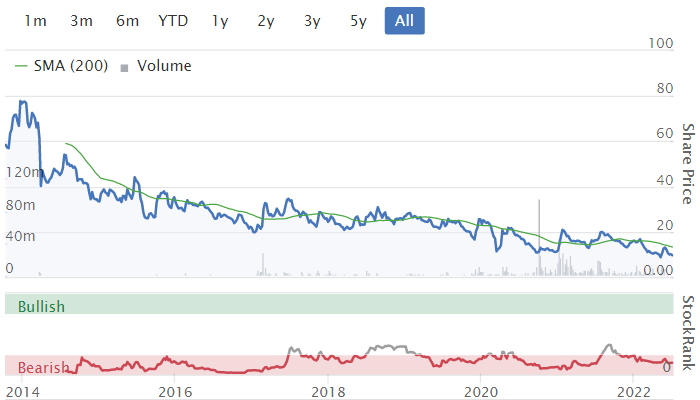

KMK might be gaining traction, after years of disappointing performance, heavy losses, and dilution from repeated fundraisings - the share count goes up every year, and has more than tripled in the last 6 years - this is the main problem with jam tomorrow companies - even if they do succeed, holders have been diluted down to a level where there’s little share price upside. Hence why it’s usually better to sit on the sidelines and wait for a positive inflection point, rather than buy into the story any earlier, as I've discovered to my cost, many times!

We didn’t cover the last trading update , but I’m looking at it now - RNS on 16 May 2022. Order book & visibility sound positive, but supply chain problems delayed completion of £2.9m of orders by the FY 4/2022 year end. Although they’re now being delivered, thus boosting FY 4/2023.

Cash is king in a downturn, and KMK reckons it has enough cash “for the foreseeable future”.

“Substantial revenue growth” is guided for this year, with “excellent visibility” (the highest ever) given that 50% is contracted, and the rest in negotiation, or expected repeat business.

My opinion - Kromek is starting to look interesting, after years of disappointing performance.

I wouldn’t pay £40m (market cap) for it though, in a bear market, unless there was much clearer upside on the fundamentals. But one to watch, I reckon.

Another not dissimilar situation is WANdisco (LON:WAND) which has won a flurry of decent contract wins recently, although that’s a much more serious cash burner than Kromek. Occasionally, these jam tomorrow shares do deliver.

Not the most inspiring of floats from 2013 -

.

Peel Hunt (LON:PEEL)

111p (down 2% at 08:19)

Market cap £137m

Today’s update covers Q1 (Apr-Jun) of FY 3/2023.

Peel Hunt is a big name broker, but actually quite a small business, when you look at the numbers.

This description comes from the Note to editors section of today’s update -

Peel Hunt is a leading specialist in UK Investment Banking, ranked number one broker for UK mid- and small-cap companies in Institutional Investor's 2021 Survey…

We have 165 corporate clients (including 34 in the FTSE 350), with an average market capitalisation of approximately £600m. Our award-winning research is distributed to over 1,235 institutions across the UK, Europe and US. Our trading platform makes markets in over 10,000 instruments on over 45 markets and is an increasingly important provider of trade execution services to UK retail platforms and brokers.

I’ve highlighted above the key word which creates a big problem with Peel Hunt - they only distribute their superb research to institutions & high net worth individuals. They actively stop the rest of us from seeing it (unless you pay over £20k p.a., I'm told). The problem I have with that, is that the research draws on privileged access to, and information from, the company's management. It's then distributed to a privileged audience. That's clearly not right, or fair.

Hence they’re a terrible choice of broker for small caps, who need active interest from private investors - something that Peel Hunt (and other big name brokers like Numis) actively avoid. Hence there’s no liquidity in many of these small caps, because they employ a broker that totally ignores the very people they need to attract to buy the shares - private investors. Especially new floats, which are dumped in big blocks with institutions, leaving a negligible post-float market - it’s ludicrous (but lucrative)!

Something needs to change, and I’m encouraged that there are now initiatives to open up floats and fundraisings to private investors too. PrimaryBid seems to be busy. Also, Peel Hunt seems to have realised that they need to get private investors involved with new issues too, to create some liquidity -

We are delighted that leading intermediaries AJ Bell and Hargreaves Lansdown have selected our REX technology platform (www.rexretail.com) to provide their new retail share offer service, further supporting the democratisation of capital markets by enabling their retail customers to participate in IPOs and ABBs.

I saw an announcement from AJ Bell on this a while back, but forgot to mention it here.

On the other hand, we nearly always steer clear of new issues here at the SCVR, because more often than not, they’re over-priced, and/or rubbish. Over the last couple of years in particular, as we suspected here at the time, many floats have been opportunistic - companies that got a big boost from the pandemic, but passed it off as long-term structural growth. Hence so many disastrous drops from newly floated companies, once trading weakened. Although to be fair, macro and stock market conditions have greatly deteriorated in the last year - so plenty of other shares have also collapsed, not just new listings.

Fund managers are bound to be seeing redemptions now too. So that makes at least some of them unlikely to have the cash to support new issues or placings, and might need to dump their more liquid holdings to raise cash for clients pulling out. There was some data on this from Citywire recently, although so far anyway, the total level of redemptions looks quite small. There could be individual funds having worse levels of redemptions within that though. Who would want to be holding smaller funds, that are invested in a load of tech/speculative rubbish, for example? The clients who sell first usually do well, and the people who hang in there could end up holding all the junk that the fund manager can’t sell. These are just my reminiscences from what happened in the TMT boom & bust from 1998-2002. Then 2003 was the best year I can ever remember for small caps, as artificially low share prices began to shoot up from a very low level. But it was a slow & painful process, getting to 2003, and many PIs gave up in despair near the bottom.

I’m wondering if it’s a good or bad thing to let more PIs have access to new issues? The current system, whilst frustrating, does mean we can sit back & wait for them to collapse in price, watch fund managers depress the price as they try to sell into a dead market with no liquidity, then cherry-pick the best ones at bombed out valuations. That’s how I got started in investing, in 2001-2: buying shares that were less than half the companies’ own net cash - usually disastrous floats in 1999-2000 that had dropped typically by 95-99% from their original price. We’re nowhere near that level of discount now of course.

Maybe the city wants to get PIs involved in new issues now, because they’ve run out of gullible fund managers to sell over-priced companies to?! They didn’t show any interest at all in “democratisation of capital markets” in the past, when the big fees were rolling in. Quite the opposite, a lot of the city is set up to exclude PIs, despite us being the people who create the market liquidity in small caps. Unbelievably short-sighted, but it allows fees to be earned quickly & easily, which is what the city is really all about, as my friends in the city freely admit after a couple of pints!

Trading update - very thin details are provided today, just this -

Revenue for the first quarter ended 30 June 2022 was £22.8m as a result of continuing low levels of market wide capital markets activity.

It doesn’t even provide a prior year comparative number, nor any indication of profits or market expectations. This strikes me as very poor communications, which surprises me as MHP are normally very good (the PR). But ultimately, it’s the client who decides what they want to say to the market. PEEL likes to withhold its research output from us, and it looks like it also doesn’t want to tell us much about how it’s trading!

There’s a limited track record as a listed company, but the last interims showed that revenues were £71.4m for the half year to 9/2022. Halve that to get to a quarter, and the comparative is £35.7m. Hence Q1 this year being £22.8m implies c.36% drop in Q1 this year, but that’s only an estimate, because we don’t know what the Q1:Q2 split is, I’ve just assumed it’s equal. There might be more of an Q1 weighting, as Q2 would include the summer months, when people are on holiday? If that's right, then I suspect the downturn could be more than 36% this year.

It was highly profitable in H1 LY, making £21.6m pro forma PBT, on £71.4m revenues.

That’s likely to reduce this year, as markets & hence fees, go quiet.

Admin costs are about two thirds staff, which is flexible, since bonuses move up & down, and headcount tends to be trimmed in downturns.

Looking at PEEL’s FY 3/2022 results, it was highly profitable at £51.1m, but then paid £9.9m “Members’ remuneration charged as an expense”, so it looks like one of these hybrid type companies, where the key people in the business who drive profits, get a chunk of that, then the rest goes to outside shareholders. As long as it’s clearly disclosed, which this seems to be, then I don’t have a problem with this type of arrangement, designed to lock in the big fee earning individuals & their personal contacts.

Although the split here looks remarkably weighted to insiders - I can’t recall ever seeing a non-controlling interests line that is bigger than the owners of the company! This suggests there must be a subsidiary which makes most of the profit, but is only partially owned by the group. A very unusual arrangement -

.

Therefore I think these numbers would need to be very carefully scrutinised before buying this share, as the structure looks so unusual.

This reminds me a bit of the structure at Frp Advisory (LON:FRP) which is also odd. Although when I investigated that one, it turned out to be fine, as the EPS numbers included partner profit share costs.

Balance sheet - is good, at about £100m NTAV. Note that the £77m cash pile is offset by £27m long term loans, and £21.8m "due to members" within current liabilities, so I see this as £28.2m adjusted net cash. Debtors & creditors are huge numbers too, but they offset, indicating a high level of activity in the trading parts of the business, I imagine. These large balance sheet numbers probably turn into cashflows within days, so nothing to worry about.

Overall though, there is good net asset backing to the share price.

My opinion - as Graham says below, in his section on Impax, the time to buy good quality companies in the city, is when markets are quiet, profits low, and share prices bombed out. Then you have a likely big winner, with patience, once market conditions return.

The downside risk is that the best people (staff and clients) might leave in the downturns, so previous profits can’t necessarily be recovered.

The remuneration arrangements are often complicated, with several layers, so that all needs checking carefully.

Sometimes these type of companies pay out massive dividends - e.g. Cenkos Securities (LON:CNKS) was a great cash cow for staff and shareholders in its glory days, when Woodford was cornerstoning many of its floats.

PEEL shares could be interesting, I’ll keep this one the watchlist, and do more digging on it when time permits.

.

.

Quiz (LON:QUIZ) (I hold)

10.4p

Market cap £13m

It’s a tiny market cap, but readers keep badgering me to cover it, so here goes.

PR headline -

Strong revenue recovery and return to profitability

This is FY 3/2022, which was impacted in months 1 & 2 by covid restrictions. So a full, clean year, should be better than this.

Revenues £78.4m

Gross profit is notably stronger, at a commendable 60.3% for the year - demonstrating also that QUIZ has been successful in passing on higher costs of production/freight.

Returned to profit, at £0.8m PBT (benefits from some Govt support, but that offsets weak trading in the covid impacted Apr & May 2021).

Ignore EPS, as it’s boosted by a negative tax charge (due to recognition of b/fwd tax losses).

Balance sheet is good - with net cash of £4.4m.

Net cash rose to £8.3m post year end, but some of this rise is a favourable blip in timing of payment runs, and VAT.

Bank facility enlarged to £3.5m, runs annually, and has no covenants. Not really needed, but gives handy extra headroom.

Focusing on own website sales (higher margin than via 3rd parties), up 66%

Positive contributions from stores, which were restructured in a pre-pack admin during pandemic, and are I think all on turnover rents (a huge plus, as it de-risks stores by setting rent at an agreed % of turnover).

62 physical stores in UK, 6 in RoI, plus 69 concessions (stores within a store).

Physical stores make a positive contribution, loss-making sites ditched in the restructuring.

Current trading very good - Q1 (Apr-Jun 2022) saw revenues £27.3m, up 62% vs last year (last period impacted by covid).

Store LFL sales are now consistent with pre-covid (but rents much lower).

Expecting to resume new store openings, 6-7 per year, targeting turnover rents, but landlords prefer conventional leases for good sites.

Lease lengths average only 15 months - trying to get longer leases on the best performing sites.

Supply chain still disrupted, so now order & ship goods earlier. Hence no impact on availability.

Stepping up marketing now, as demand is good for special occasionwear - events, parties, weddings, etc.

Customers want newness - so fresh product is selling well, good for margins. Holidaywear is selling well.

Balance sheet is good, NAV £18.7m, less £2.8m intangibles = NTAV £15.9m (above the market cap!)

Free cashflow good, at £2.9m.

Going concern note looks fine to me. No issues with solvency risk or dilution. Turnover rents are ideal in a downturn too, as rent drops if turnover drops.

Stores (as opposed to online) are doing better than mgt expected.

Panmures forecasting £95m revenues, £2m profit for this year FY 3/2023.

Management sound delighted to be through a very rough patch re pandemic, business now functioning normally, and focus is back on growth, not firefighting.

New stores - interesting to note that online sales jump about 20% in area around new stores. Increasingly seeing online & physical stores working together - e.g. IT being upgraded to allow goods sold online to be returned & dispatched from stores - will help manage stock better, e.g. if warehouse has run out, an online sale can be fulfilled from a store which has that item in stock.

Customer returns rate online is creeping up again. Probably inevitable that the sector moves to charging for returns, maybe via an admin charge that’s deducted off the refund?

Chinese supply has improved since Chinese New Year, not too disrupted now.

My opinion - this is all very encouraging I think.

FY 3/2023 has got off to a flying start, so I hope to see QUIZ beat expectations.

Do remember to adjust the EPS for negative or low tax charges (Panmures should have done this in their forecasts, but I’ve not seen the actual note).

Mgt sound totally committed to the company, and the listing. Top brass are said to be workaholics, and don’t want to retire! I think the ultimate long-term plan would be to sell the company, but only at a much higher valuation.

In a bear market, the shares probably won’t go anywhere for now, but the fundamentals are improving nicely, so all good for longer-term investors.

.

.

Graham’s Section:

Impax Asset Management (LON:IPX)

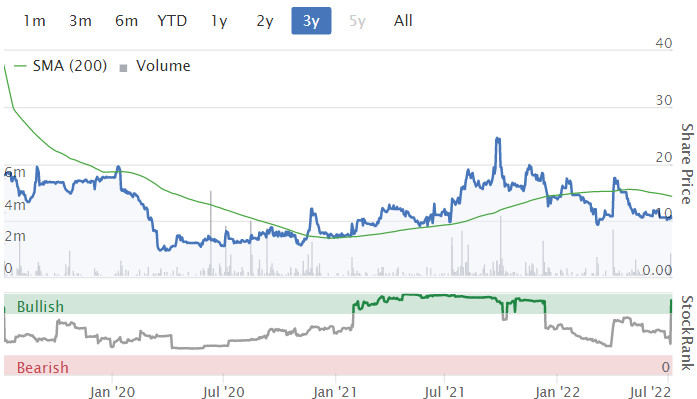

· Share price: 581p

· Market cap: £770m

I last covered this one in late 2019, when the share price was 290p and assets under management were £15.7 billion.

It has been an amazing performer and has grown wonderfully, taking advantage of the trend for environmentally-focused investing.

Assets under management are now £34.5 billion, though this is down from £41.4 billion at the end of December 2021.

That’s a 16.6% drop in AuM over six months, and the company can no longer bring itself to mention the quarterly percentage decrease in the RNS (companies are always much more eager to disclose percentages when they are positive).

In the first three months of this calendar year, net flows were still positive, although they had reduced, i.e. investors were still putting more money into Impax than they were taking out.

In the most recent quarter, however, net flows have turned negative, so it’s difficult to polish these numbers. You have both a large negative return from funds, and investors taking their money out:

Chief Executive Ian Simm notes that there is no change in the political commitment to environmentalism:

"Although we saw modest net outflows during the quarter, notably in June, asset owners, regulators and policymakers continue to signal commitment to advancing the transition to a more sustainable economy. Against this backdrop, we have continued to take steps to build the business in order to fulfil our medium-to-long term potential."

My view

I still have a positive view on the prospects here, because I can’t see an imminent change in the trend for environmentally-themed investing.

However, there is a risk, as I discussed when covering Liontrust Asset Management (LON:LIO) , that “sustainable” and “environmental” investing might be less fashionable, after a very severe bear market.

After a very severe bear market, many investors give up (both retail and institutional), and those who are left might be very focused on their returns and on getting rich, and eschew having a grander mission. It could take some time for mission-focused investing to become popular again.

But this point is a general one and is not specific to Impax.

Looking specifically at Impax, I’ve checked out the top holdings at Impax Environmental Markets (LON:IEM) , its listed investment trust.

I’m pleased to report that its top holdings do not have bad StockRanks - shares with bad StockRanks can sometimes do extremely well, but I wouldn’t want to own a portfolio consisting entirely of them!

I’ve calculated the average StockRank of the top 10 holdings at IEM, and it comes out at 74.

These are the holdings, in case you are interested:

Their above-average rankings confirm something I already suspected: that Impax, while sticking to its environmental mandate, is also good at finding stocks with at least reasonable prospects.

From my perspective, this increases the probability that even if environmental investing in general were to suffer, that Impax could emerge strongly from such a period.

Forecasts

The most recent net income forecast for the current year that I can find is £51.3m, although this relies on AuM recovering to £40.5bn by September, the financial year-end.

As I don’t see AuM recovering that quickly, I would expect Impax to miss this forecast.

Barring a disaster, the current P/E multiple is still going to be less than 20x. So these shares might still offer some value for patient investors who believe in the long-term trajectory of the company.

I would also note that Impax shares are down by 60% since their high seven months ago. I’d much, much prefer to buy shares in a fund manager in these depressed conditions, rather than in the light-hearted conditions that prevailed seven months ago!

.

Redde Northgate (LON:REDD)

- Share price: 333p

- Market cap: £800m

This company announced finals yesterday, but Paul and I didn’t get around to covering it. Given the reader interest in it, we are happy to circle back and take a look!

There were some well-informed reader comments on the stock - see yesterday’s SCVR.

Redd is a van rental and vehicle credit hire group, although it doesn’t sell itself like that. See here for its complete list of businesses in the group – it also includes van sales, accident repair, and personal injury advice.

As I wrote about Redde in the distant past, the first thing I’d look for with this share would be a cheap valuation.

Almost by definition, it isn’t the type of business where there are sustainable competitive advantages and above-average returns on capital. So investors should expect a cheap PE ratio and a big dividend yield, covered by earnings, to make it worth their while. They are currently getting that:

The annual dividends amount to 21p or 6.4% on the current share price.

That is good, though not spectacular. There are a dozen companies in the FTSE-100 with a yield of over 6%, and I’d feel safer with most of them than I would with Redde. But still, anything over 6% is not to be sniffed at.

Redde’s dividends are covered very well by earnings: there’s EPS of 41p for FY April 2022, up from 26.6p in FY April 2021.

Let’s look at the results for FY April 2022 in more detail:

· Revenue +12% to £1,244m

· Excluding vehicle sales, revenue is up 24%, “due to increased customer activity across all business units supporting both volume growth and price improvements, plus new customer wins”.

As for profits:

· EBIT +80% to £150.8m, due to “higher revenues and margin improvement, helped by underlying strength in rental margins, post-Covid-19 activity recovery”, etc.

· Adjusted EBIT +53% to £167.9m

· I’m pleased to see the company report its own ROCE, which comes in at 13.9% - partially due to the “strong disposal values”, i.e. high resale values for used vehicles.

Balance sheet

Excluding leases, the net debt is £582.5m, which on its face is large against Redde’s profitability and market cap.

However, the company has an enormous balance sheet with lots of assets (vehicles). Redde’s “Property, plant and equipment” is an enormous £1.16 billion.

There are net assets of £947m. Even if you subtract all intangibles from that, you are still left with £680m.

When buying a value share, you ideally want to get it at a discount to net assets. Redde’s shares do currently offer that, at £800m, but are not yet at a discount to net tangible assets.

The reason you want a discount is to provide a margin of safety, should the assets turn out to be worth less than their recorded values (more on that in a moment).

My initial impressions are that Redde’s balance sheet is ok, given the large net tangible asset position. The lenders will be able to sleep at night, while the equity holders do have some moving parts to think about.

Vehicle values

Redde has benefited from the shortage of both new and used vehicles, juicing its profits to levels that otherwise would not have been possible. The shortage doesn’t just boost resale values - it means that Redde can charge more, and that customers have to use Redde’s vehicles for longer:

High rental demand and reduced vehicle supply positively impacted both residual values and lengthened hire durations; macro supply chain challenges expected to continue throughout FY2023

The effects have been so strange that Redde now needs to change the rate at which it depreciates vehicles in the new financial year:

Carrying book value of earlier purchased cohorts of fleet vehicles have depreciated below current strong resale values; action taken to stop or reduce depreciation from FY2023 on these cohorts until disposal.

This is telling us that Redde’s book value is unrealistically low, as it could sell a portion of its vehicles at higher prices than their recorded values. As a result, the company needs to stop depreciating them at their normal rates.

Outlook

The outlook statement doesn’t give too much away, but it does confirm that the new financial year (FY April 2023) has gone well so far, and there are positive noises around revenue, due to “long term contract wins already secured but yet to commence”.

More revenue gains are forecast, according to Stocko:

There’s also a statement that “demand remains high for the Group’s rental offering and as a result, the business expects to retain more of its van fleet this year while limiting disposals…”. This sounds like the right move - why sell them and buy even more vans at inflated prices, when it can simply keep the ones it’s already got!

My view

I’ve never experienced a vehicle shortage before, so I’m not sure what will happen next.

In the stock market or the property market, a shortage (very high prices) is normally followed by a glut i.e. a bust).

Can this happen in the vehicle market? When supply chains normalise, will vast quantities of vehicles be dumped onto the market? Or will the high prices be sustainable on a semi-permanent basis?

My instincts are that vehicle prices will not be able to keep pace with general inflation, i.e. that vehicle prices will fall in real terms, although they may rise nominally. Rental prices, too, are unsustainable and will have to normalise.

This should, sooner or later, lead to a normalisation of Redde’s profits (in real terms).

In a worst-case scenario, there would be a swift depreciation of the fleet, and a very sharp reduction in rental prices. I suppose that’s a risk the company has always faced.

On a more positive note, Redde appears to be growing its customer base well and continues to reduce its reliance on particular customers. It’s a more diversified company now, which does reduce the risk profile and is important, given the use of leverage.

Overall, my view is that Redde’s shares are not far from their fair value. Uncertainty around the sustainability of profits is balanced by growth from customer wins and a nice, cheap valuation.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.