Morning all,

There is a strong supply of updates, so I hope you'll help me with a few suggestions in terms of what to cover today!

Yesterday featured great results from Creightons (LON:CRL), which is now 6% of my portfolio. I am tempted to add more of it, but 6% feels heavy enough for this micro-cap.

I am increasingly bullish on the UK market, seeing as it remains so weak. It's down another 1% today, and Stockopedia's median forecast P/E ratio for UK stocks (one of my favourite macro indicators) is just 12x. That number tells me there must be plenty of value opportunities, and I've been trying to find fresh candidates for the portfolio.

In addition to Rightmove (LON:RMV) (added earlier this month), I've also added B.P. Marsh & Partners (LON:BPM), the insurance investment vehicle, to my portfolio. I'd like to be more active in the insurance space - there are plenty of interesting and overlooked candidates in the sector. For example, the FTSE 250 component Lancashire Holdings (LON:LRE) is completely ignored by most investors.

Anyway, given my view on equities, I'm nudging up my portfolio allocation and becoming more and more "risk-on". My portfolio is now 82% equities, 14% bonds and 4% cash.

For the Howard Marks fans in the audience, I'd recommend this YouTube video published last week by his company.

It's a 25-minute interview outlining his overall views on macro topics. He is quite cautious about the 10-year US "recovery", thinking that we must be closer to the end of the good times than the beginning. But he also acknowledges that US equities have been growing into their expensive valuations over the past year (the stock market hasn't budged while earnings have been growing very fast).

Other points from the interview:

- Private assets have more attractive pricing than public assets. All publicly-traded assets are expensive.

- The crypto boom is mostly based on people hoping to find greater fools to sell their coins to (but I would note that hardcore crypto advocates don't fall into this trap).

- ETFs may provide the illusion of liquidity where the underlying holdings are illiquid, e.g. junk bond ETFs. He asks the question: if junk bonds are illiquid, then where does the liquidity of their ETFs come from? He warns us that this liquidity is going to prove illusory in a time of crisis. (I would agree and would suggest that these ETFs will trade a discount to official NAV in a time of crisis. I hold IS SHRT DUR HY CRP BD USD (DIST) ETF (LON:SDHG).)

Now let's take a look at some company updates.

Today I am looking at:

- Fireangel Safety Technology (LON: FA.)

- CMC Markets (LON:CMCX)

- Mothercare (LON:MTC)

- Wynnstay (LON:WYN)

- Keller (LON:KLR)

Fireangel Safety Technology (LON:FA.)

- Share price: 33.5p (-25%)

- No. of shares: 46 million

- Market cap: £15 million

The saga of disappointment at Fireangel/Sprue Aegis continues. Some of you will remember when the share price was north of 300p.

This profit warning is related to a delay and higher short-term costs of production at FA's manufacturing partner.

This is a new partner, after the relationship with the previous one ended in disaster.

There was also a delay in core product sales recovering to "acceptable" levels. So results for 2018 will be materially below expectations.

New legislation in Scotland in H1 2019 is expected to increase demand. Fair enough. UK and German sales have recovered to some extent and so we get some reassurance for the 2019 result:

"A number of other large connected proposition tenders and legislation driven opportunities are now expected to make a positive impact during the first half of 2019 thereby underpinning the Board's expected recovery to profitability in line with market expectations."

My view

If what the update says is true, then today's 25% sell-off is overdone.

The problem is that there have been so many false dawns. It's worrying that a fire alarm company can be so accident-prone!

We also need to bring the right amount of scepticism toward its plan to shift from the traditional hardware-based business model to the "connected homes" provider it wants to be.

I'm not motivated to study it in any great detail, as I'm not convinced that it has an enduring competitive advantage and I have no faith that it will execute its plans.

The balance sheet has equity of £25 million (June 2018) but £18 million of this is intangible. So it's still too soon to rush in for a value investing opportunity, I fear.

CMC Markets (LON:CMCX)

- Share price: 115p (-3%)

- No. of shares: 291 million

- Market cap: £336 million

A mixed bag of headlines for CMC, the spread betting/CFD provider. Its arch-rival IG Group (LON:IGG) remains an important holding for me.

Key points:

- H1 operating profit has collapsed by 74% to £8 million. This is caused by the operational leverage inherent in needing to pay for c. £60 million of operating expenses.

- More meaningfully, net trading income fell by 18% to £70.6 million. The company is trading in line with guidance for a c. 20% reduction in CFD/spreadbet net revenue.

Times have been tough for spread bet firms with range-bound markets and the new ESMA regulations on leverage (since August).

While it's still too early to determine exactly how retail clients will react to these rules, CMC says "the most common behaviour to date has been for clients to continue trading but with lower exposure and trading activity".

Expenses rose by 6%. This is understandable seeing as new business lines are being opened, particularly in Australia.

My view

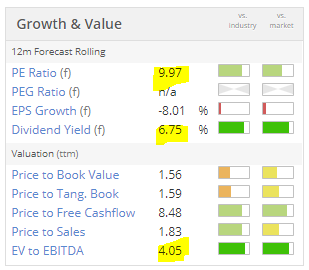

I view this share as underpriced. It has many of the same attractive financial characteristics as IG Group in terms of cash generation, return on capital and a strong balance sheet. It also has a Value Rank of 91, and you can hopefully see why:

For me personally, I have enough exposure to this sector already, so I don't feel I need any more. On top of that, I like to buy the #1 company in any segment rather than the #2 or #3. But I do admire CMC, and I agree with Stockopedia that it's underpriced.

It passes five screens, although one of these is a short-selling screen based on earnings downgrades.

Mothercare (LON:MTC)

- Share price: 16.4p (-7%)

- No. of shares: 342 million

- Market cap: £56 million

This struggling retailer had a fundraising at 19p and a CVA earlier this year. Let's catch up to date with trading to early October:

- UK like-for-like sales down 11%. "Wider market uncertainty" (?) is blamed, along with negative media coverage around the refinancing.

- Total revenue down 13%, adjusted EBITDA down 60% to £5 million

- Pre-tax loss of £14.4 million (H1 last year: pre-tax loss of £16.8 million)

- net debt £21.5 million

Key points about the transformation plan/CVA:

- fewer than 80 stores left by April 2019

- 32 of the remaining stores will have leases expiring within three years (that's still nearly 50 stores beyond three years - doesn't seem very encouraging to me).

- Head Office to be made leaner. Dreaded "consultation exercise" with employees.

- £19 million p.a. cost savings to be exceeded.

My view

Perhaps some clever financial modelling could forecast that this company is going to get back into profit before long. But does anybody think that the Mothercare brand is of much value to consumers? Do parents really want to pay more for goods in a Mothercare shop, instead of getting a similar item at a cheaper price elsewhere?

Another way of looking at it would be: if Mothercare didn't exist, would anybody want to create it? I think the answer is no, at least not in its current form. If someone wanted to create a premium brand in this niche from scratch, they would almost certainly make it an online-only brand, and not bother with any physical stores.

When it comes to Mothercare's UK online sales, trends are negative there, too. While negative press coverage may have contributed to that, an 8% fall is still very disheartening.

Even if the restructuring gets the company a positive performance for a couple of years, I don't see it surviving in its current form for the long-term and I expect that existing leases will continue to drag on performance.

Away from the UK, the international operations are doing much better, using a Franchise model. If there is a bullish case to be made for the stock, maybe it rests on the international business.

It has staved off bankruptcy for the short-term so congratulations to it for that. And good luck to shareholders. At the end of the day, I just don't see a lot of value in the brand. So I'd steer clear unless the enterprise value (currently c. £80 million) looked very cheap against prospective earnings.

Mello London / ShareSoc MasterClass

Just a few days left until Mello London and the ShareSoc Masterclass. I'm looking forward to meeting many of you at these events over Monday and Tuesday.

Of course not everyone can make it due to work commitments, geography, etc. but they should be good fun and insightful/educational for everyone.

The Masterclass will include Professor Glen Arnold, Maynard Paton, Leon Boros (and me!), and will be chaired by Gareth Evans (founder and MD of Progressive Equity Research). You'll have lots of time to ask us difficult questions and see us debate various things. And it's for a good cause - it helps to fund ShareSoc's activities throughout the year.

The main event will include presentations by our very own Paul Scott and Ed Croft, Glen Arnold, Lord Lee, Keith Ashworth-Lord, Gervais Williams, and loads of company CEOs. It's Mecca for investors, basically.

Also, if you're around on Sunday evening, there will be dinner and a quiz with Lord Lee. What more could you ask for!

Wynnstay (LON:WYN)

- Share price: 411p (+2%)

- No. of shares:

- Market price:

The Board of Wynnstay, the agricultural supplies group, is pleased to provide the following update on trading for the financial year ended 31 October 2018.

Agricultural supplies... now I know why this name is unfamiliar to me.

Let's see what it does.

Agriculture

- Feeds - animal nutrition.

- Fertiliser

- Seeds

- Agrochemicals

Specialist Retail

- Rural retail outlets

I immediately know that this isn't something I'm going to be spending a huge amount of time - not my area of expertise, and in any case it looks fully commoditised.

There is good news: the company is trading ahead of current market forecasts. Agricultural output prices are up, boosting the mood for Wynnstay's customer base. Dry summer weather also helped to increase the demand for feed products.

Checking the archives, Paul said last year last year that he thought a P/E ratio of c. 9x would be appropriate for this company (the share price then was 572p).

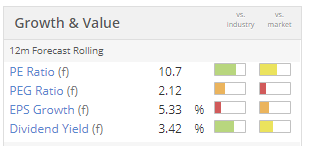

With the share price now at 411p and earnings having improved, the P/E ratio has reduced to 10.7x.

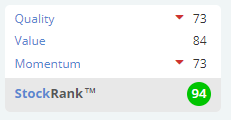

It's not for me purely for sector reasons. It could be of interest to those with sector expertise or using a StockRank strategy:

Keller (LON:KLR)

- Share price: 603p (-3%)

- No. of shares: 72 million

- Market cap: £434 million

Things at Keller are proceeding in line with expectations.

What does it do?

Our products are used across the construction sector in infrastructure, industrial, commercial residential and environmental projects.

You can go here for a list of its areas of expertise. Today's update informs us that it is abandoning certain activities in Singapore and Malaysia.

It had net debt in June of some £367 million, following an acquisition. So the enterprise value is £800 million.

There is or has been some customer or project concentration:

In EMEA, our businesses have performed in line with expectations, demonstrating year on year profitable growth, excluding the reducing beneficial effect from the significant projects in the Middle East and the Caspian

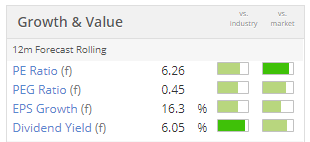

I don't get involved in this type of business - construction/engineering support services. But again, as with Wynnstay, I can see some attractions. It is "cheap".

The quality score is not too impressive, e.g. operating margin was only 5.8% last year. So I will leave this one for others to research in greater detail.

All done for today, thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.