Good morning!

The following section was written by Graham Neary:

Continuing our China theme from yesterday, I note that Apple (US:AAPL) has blamed an "economic deceleration, particularly in Greater China" as its Q1 revenues are expected to come in 8% lower than the forecast it made only two months ago.

There are multiple layers to this story.

As many of you will have heard, the CFO of Apple's Chinese rival, Huawei, is currently on bail in Canada while the US seeks her extradition over alleged dealings with Iran.

This comes as Huawei is now beating Apple into second place in global smartphone sales for the first time.

There can be little doubt that US-China relations have frostened. Zero Hedge reckons that Apple is "indirectly accusing China of boycotting Apple products".

It's a grim situation and Apple's market cap is still so big ($700 billion) that it can seriously affect the US stock indexes, whose sentiment then leaks over to the UK indexes. The NASDAQ is down more than 2% in after-hours trading and FTSE futures look set to open in the red tomorrow.

Maybe not such a good morning after all!

End of Graham's section

The rest of today's report is written by Paul Scott:

Good morning! Haha, I see Graham got the date wrong, and originally put in 2018! I've corrected it now to 2019. Great to see that it's not only me who struggles with date changes.

Graham has passed me the reins. I hope we haven't confused too many people by sharing the report writing today.

Happy New Year to everyone! Let's hope the markets are a little more kind to us in 2019 than they have been in the last few months.

Just to reiterate, neither Graham or myself are traders. We tend to pick stocks we think are good, and take long-term positions in them. From time to time, some of those shares will go wrong. Over time though, the trajectory should be upwards. We're not trying to time the markets, that's not what we do.

I just thought it would be useful to clarify all this, given the comments last week from a reader who helpfully, and kindly, pointed out that my portfolio is not doing terribly well at the moment. With friends like that .... !

On to today's news.

Next (LON:NXT)

Share price: 4,306p (up 3.1% today, at 09:10)

No. shares: 139.7m

Market cap: £6,015.5m

(at the time of writing, I hold a long position in this share)

Given widespread news of terrible trading for retailers in November, the market has beaten up shares in Next, anticipating a profit warning. What a pleasant surprise then, for Next to produce a solid update today. The summary says;

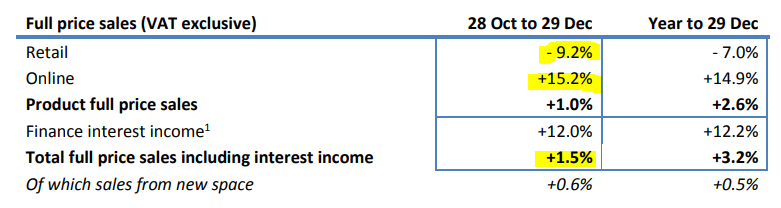

Full price sales for the Christmas trading period (between Sunday 28 October and Saturday 29 December) have been in line with the guidance we gave in September and were up +1.5% on last year.

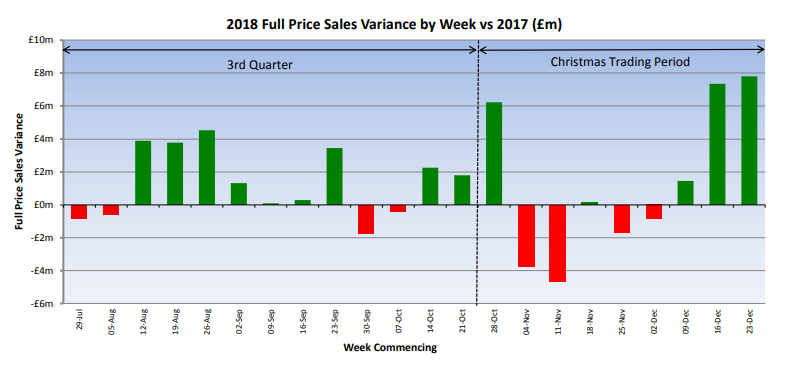

Strong sales in the three weeks prior to Christmas along with a good half-term holiday week at the end of October made up for disappointing sales in November. This is shown in the chart below which sets out our weekly sales performance for the second half of the year to date.

As you can see, Next had a poor November, but made up the shortfall in December;

A vitally important point to remember here, is that the above shows retail and online combined. Next has an unusually high proportion of its sales online (more than from its physical stores). This is critical to its resilience.

The way I look at it, Next is demonstrating that it is successfully holding onto its customer base. They just prefer buying online these days. It has a well-publicised plan to gradually close down unprofitable stores as leases expire. Big rent reductions are being sought on lease renewals, otherwise the store is handed back to the landlord.

I'm struggling to think of any other conventional retailer which is managing the shift online so well. I think this share looks attractively cheap at the moment (forward PER of just under 10). I am surprised today's solid update hasn't triggered a bigger share price recovery yet.

Retailers which have a lower proportion of sales online than Next, are likely to be struggling big time. Just look at the breakdown of sales from Next, and how big the fall in store sales has been (which it has recouped through its online operation);

Guidance - the current year profit guidance has barely changed - it's now £723m, instead of previously £727m. I think that's a remarkably resilient performance (thanks to online growth), in retail conditions which have widely been considered dire.

EPS guidance for this year, is now 435.2p, up 4.4% on last year. How many other retailers are reporting rising profit right now? The PER is just below 10.

Remember that Next doesn't really have any debt either - because its customer loan book is larger than its external debt.

My opinion - as regulars know, I've long been a fan of this business. The transition to online sales is going smoothly, and in my view the current lowly valuation does not reflect that.

Generally, I see 2019 and beyond being a time of retail carnage. Large numbers of shops will have to close, as leases expire, and weaker-financed chains go bust. Sad though this is, the reality is that so many UK shoppers prefer to shop online, that we simply have far too many traditional shops. There's nothing wrong with aggregate demand, indeed retail sales in total are growing at a healthy pace.

Next will not only survive, but I think it could prosper, as weaker competitors go bust. That frees up more customers for Next. In the meantime, it can slash its rental costs, as leases renew or lapse.

The massive cashflows continue, and are used to fund a 4% dividend, plus large share buybacks (which increase EPS each year, and feed through to bigger divis too).

For these reasons, I see the £43 level as being a decent entry point, taking a longer-term view. This is a remarkably resilient business, as has been proved by today's update.

The sell-off from £62 to £40 in the last 6 months seems to have been unjustified on fundamentals, hence why I see this as a buying opportunity;

There could be read-across from today's Next update, to online retailers. So perhaps the massive sell-off in ASOS (LON:ASC) and a lesser sell-off in Boohoo (LON:BOO) might attract buying attention?

Vectura (LON:VEC)

Share price: 78.2p (up 10.8% today, at 09:57)

No. shares: 665.4m

Market cap: £520.3m

Not my area of expertise this, but thought I'd flag what looks like a positive update from this drugs company, in case readers are interested.

Some of the product names ring a bell with me - I think Vectura is the new incarnation of what used to be a company called Skyepharma.

Today it says;

Vectura Group plc (LSE: VEC) ("Vectura" or "the Group") today announces an unaudited 2018 pre-close trading update.

The Group expects revenue to be in line with, and EBITDA to be materially above, current market consensus expectations.

Vectura will report its preliminary results for the year ended 31 December 2018 on Tuesday 26 March 2019.

More detail is given in the announcement.

My opinion - none, as it's not a sector I have any knowledge of.

FinnCap

Maiden interim results have been published here. This mainly smaller caps broker floated recently, in early Dec 2018.

I like FinnCap a lot, because they have a proactive approach towards linking private investors with smaller companies. Myself and investor friends have met many companies at FinnCap's offices over the years, which is extremely helpful of them.

FinnCap compare very favourably with the aloof, sniffy approach of some other brokers, who actively try to prevent private investors meeting company managements & receiving research. Who the hell do they think are going to buy the shares, create the market liquidity & set the share price then?! It's no wonder so many small caps have so little liquidity, as their brokers are asleep at the wheel all too often.

Therefore, I wish FinnCap well in their recent transition to becoming a listed company themselves.

Listed companies with less proactive brokers should be asking searching questions about what exactly they are getting for the fees?

Costain (LON:COST) is up 6% on an in line with expectations update today.

Low margin contracting type companies don't interest me at all.

That's it from us today - there's nothing else of interest, as you would expect in this quiet end of week. The fun should start properly next week.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.