Good morning, it's Paul & Jack here with you for Thursday's SCVR.

There's a free Mello Investment Trusts and Funds event from 1pm today and Edmund Shing will be on the panel later - his contributions to the site are greatly appreciated, so I'll be tuning in to see what he has to say. Given all the developments, it could be a good opportunity to meet up and discuss with fellow investors. More detail in David's post. Here's the link to register.

Agenda -

Jack's section:

Macfarlane (LON:MACF) - I hold - strong growth ahead of market expectations, external pressures well-managed, and the valuation remains modest on an adjusted EPS basis. Macfarlane has grown profitably for a long time now, and the business is quite resilient. These good results will likely be lost amid the noise this morning, but all the more reason to put it on the watchlist in my opinion.

Ricardo (LON:RCDO) - looks potentially interesting, with a new CEO and a more sustainable strategy becoming clearer. There has not been a huge deal of equity dilution since the share price fall, so a successful turnaround could lead to good upside. A capital markets event is planned for the Spring, so that will be a good opportunity to get a better grasp of the group’s plans and prospects.

Inchcape (LON:INCH) - too large for the SCVR usually, but worth a look given the potential readacross for smaller peers given recent exceptional market conditions in the used car market.

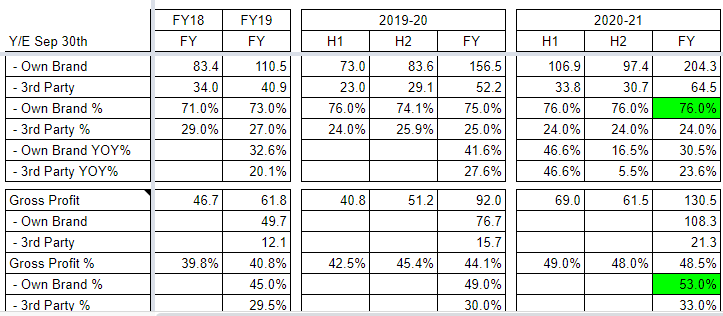

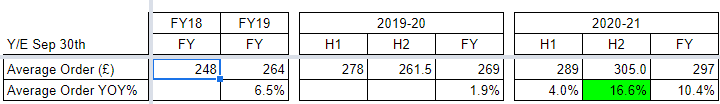

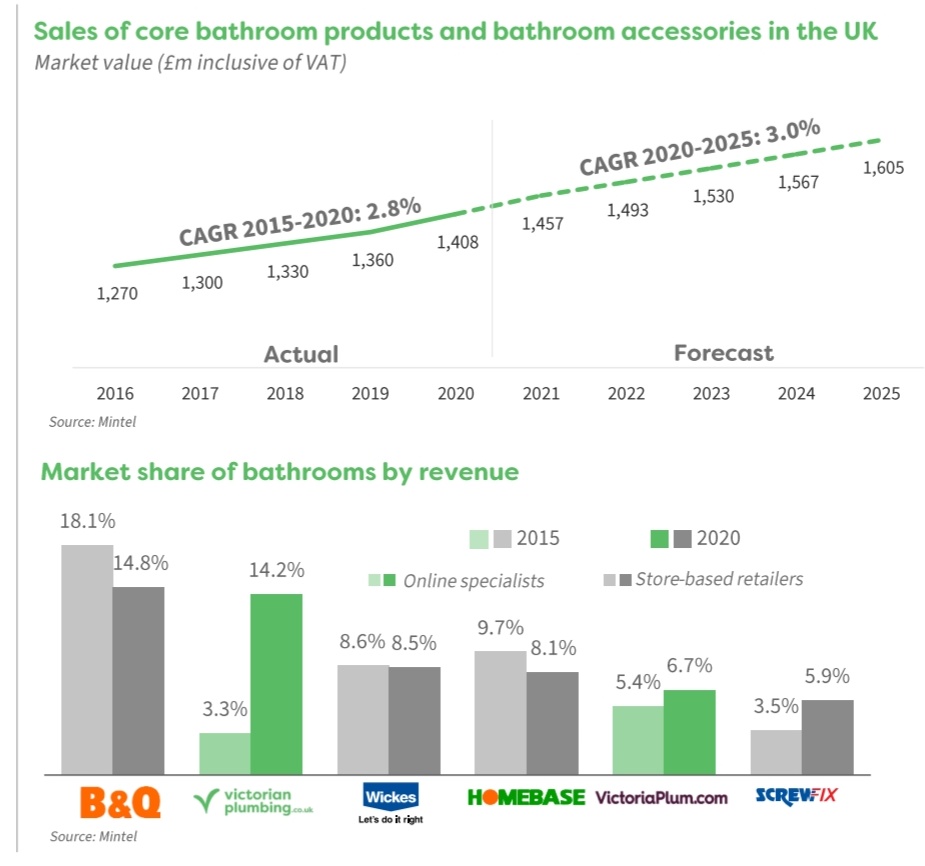

Victorian Plumbing (LON:VIC) - looks like a mild profit warning, with higher costs leading to lower than expected margins. This is a recent IPO and has lost nearly 80% of its market cap in less than a year. Given that the past couple of years have been boosted by lockdowns, I’m unsure what the longer term growth prospects are like here so I don’t see the need to jump in.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future…

.jpg)