Good morning, it's Paul here.

Monday's complete report is here.

It's a quiet day for news - please see the header for the shares I'll be covering today.

Estimated time of completion - should be done by 1pm or earlier. Scrub that, I'm running late, as I spent so much time on BMY. Let's make it 3pm revised completion time. Update at 3:20 pm - today's report is now finished.

.

.

Bloomsbury Publishing (LON:BMY)

Share price: 254p (down 2% today, at 08:04)

No. shares: 75.3m

Market cap: £191.3m

Bloomsbury, the leading independent publisher, today announces unaudited results for the six months ended 31 August 2019.

I'm writing this just after the market has opened, so we'll have to wait and see where the share price settles down, as only a few small trades have been printed so far.

There's a nice summary at the top of the results announcement, which is the best format - I wish all companies would do this, providing it's accurate of course!

The Group delivered an encouraging first half and performance is in line with the Board's expectations for the full year. Traditionally, sales of trade titles peak for Christmas and sales of academic titles at the beginning of the academic year in the Autumn. With our strong Consumer list in the second half, our sales are therefore expected to be even more second-half weighted than in previous years.

Seasonality - I recall from looking at BMY's previous interim results, that there's not much point in getting into detailed analysis, because it makes nearly all its profit in H2 each year - e.g. adjusted operating profit was 20% H1, 80% H2.

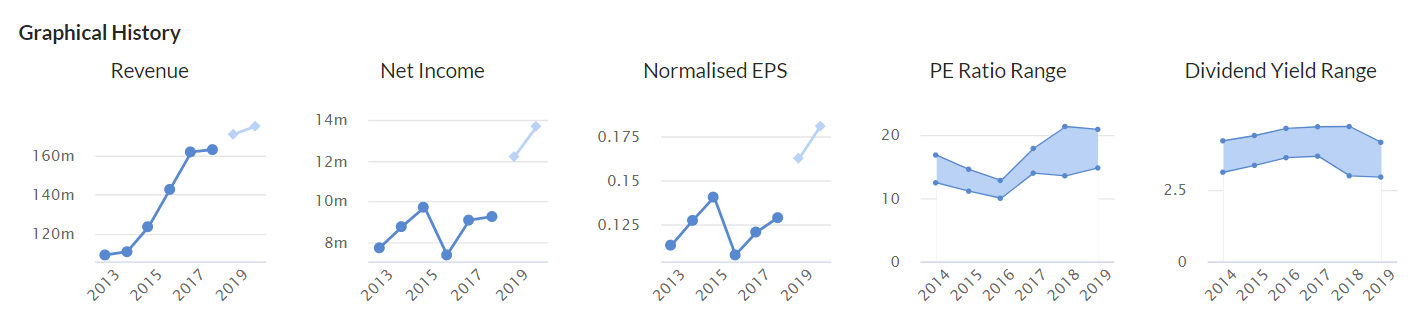

Hence it's the outlook comments for H2 and the full year which really matter, and in this case they're saying performance is heading to be in line with full year expectations. There's always the risk something could go wrong in H2 of course. In this case, I'd say that's a fairly low risk. It's not like this is a software or contracts company, relying on large lumpy orders. Demand seems fairly predictable, evidenced by a fairly stable level of profits, in graph 2 below;

Forecasts show a decent growth in profits this year. As you can see in graph 4 above, the PER band…

.JPG)