Good morning, it's Paul here.

Estimated time of completion today: 3pm.

Update at 14:49 - today's report is now finished.

Bregg-zit

It looks as if compromise is in the air.

FWIW, my view is that a last-minute compromise deal, or fudge of some kind, is probably the most likely outcome. That's normal for the EU whenever there's an apparently intractable problem.

As we saw on Friday last week, the merest sniff of a deal, triggered some spectacular large & mid cap rallies. Therefore, if some kind of vaguely acceptable deal is done, as now seems likely, then I imagine we could see a big recovery in bombed-out shares. That's why I've remained fully invested during this tough period - because there could be some significant re-ratings, if the market starts to see the glass half full again. Maybe.

For this reason, I'm drawing up a list of bombed out, but fundamentally sound, companies, with my finger poised over the buy button.

EDIT: please also see the comments section below, where we discuss small caps market despondency, and Woodford, amongst other topics.

Loungers (LON:LGRS)

Share price: 199p (price unchanged today, at 11:28)

No. shares: 92.5m

Market cap: £184.1m

Loungers, the operator of 157 café / bar / restaurants across England and Wales which trade under the Lounge and Cosy Club brands, announces a trading update for the 24 weeks ended 6 October 2019.

This company listed at end Apr 2019.

My sector expert tells me that it's a very good operator. That may be the case, but I find the valuation too high. All too often, companies list on the stock market when the figures are looking great, only to plunge in value once the shine comes off trading.

The other problem is that when brokers float companies like this, they tend to place the stock in lumps with institutions. Resulting in almost no liquidity in the market, post float. A basic error that keeps happening. Why? Because advisers just want to bank the lucrative fees, for as little work as possible. Whereas they should try to distribute plenty of shares to smaller & medium investors (as well as institutional blocks), in order to ensure proper post-float liquidity. This issue really gets up my goat.

LFL sales - in H1 are still excellent at +5.4%. Although that's slightly down on the 6-7% that the company had achieved in the previous 3 years.

There seem to be differing opinions on the strong LFL sales growth at Loungers;

Bull case - it's an excellent, well-run business, so is out-performing competitors & gaining market share.

Bear case - lots of new openings, creates soft first year figures, which are then easily beaten in year 2, as each site becomes more established.

Or, it could be a bit of both?

New site openings - 10 opened in H1, 15 more planned for H2.

This is consistent with previous growth, e.g. (page 16 of Admission Document;

The Group opened 21, 20 and 22 sites in FY16, FY17 and FY18 respectively. The Group opened 25 sites and relocated one site in FY19.

Historically, the group has achieved a high ROI from new sites, e.g. (extract below from page 23 of Admission Document);

New site capital expenditure is tightly controlled and is typically £0.6 million for a Lounge and £1.0 million for a Cosy Club.

The overall cash return on capital invested has remained consistent at circa 34 per cent. in each of FY17, FY18 and the 24 weeks to 7 October 2018.

That's clearly a very heavy capex programme, so it will be interesting to see from the next set of accounts how much is self-funded, and how much from increased debt.

Note that Revolution Bars (LON:RBG) (in which I have a long position) halted its new site opening programme, due to falling ROI on new sites. Although it also had internal problems, which I think it is beginning to recover from. This is however a good example of how the share price dropped by about two-thirds, once the roll-out programme stopped. There must be a similar risk with Loungers, hence why personally I wouldn't touch this share at the current, lofty valuation. It would only take one poor trading update, and you've lost maybe 40% of your money instantly. Why take that risk? Although I suppose you could make that same point about all small caps.

Outlook - this falls short of saying in line with expectations, but is implied (and gives wiggle room, in case expectations are not met);

"We remain confident of delivering another year of positive progress for the Group and are encouraged by the performance of our new openings."

My opinion - this seems a nice business. It targets off-pitch, low rent sites, and then trades all day from them, in a hybrid bar/cafe/restaurant format. I've only done one site visit (to a larger Cozy Club), and was impressed with the decor, food, and quality of staff.

The big question with a roll-out, is whether management can maintain the same quality levels once the business is much larger? As we saw with RBG, the performance of the business hinges on attracting & retaining key staff (area managers, and good site managers). Once the good people leave, then performance can rapidly tail off, due to the operational gearing of c.75% gross margins.

For this reason, I wouldn't want to pay top dollar for a chain like Loungers, which is performing well currently. There's too much downside risk if/when performance tails off.

It's making a 13.5% adj EBITDA margin (down from 13.7% prior year). With relentless pressure on costs, especially staff, it's difficult to see how that margin could be expanded, indeed it could fall.

There seems hardly any liquidity in the market too, so picking up or selling a position in this share could be tricky.

The upside case is that management are skilled operators, undertaking a fairly rapid roll-out. Therefore, if all goes well, the business could be making substantially larger profits in a few years time. This share is really a punt on whether the roll-out works well - in which case shareholders should make a decent profit, and get a future flow of divis. Or, if the roll-out goes wrong, then there could be nasty downside on the current fairly ambitious valuation.

Tristel (LON:TSTL)

Share price: 301.5p (up 2.7% today, at 12:25)

No. shares: 44.58m

Market cap: £134.4m

Tristel plc (AIM: TSTL), the manufacturer of infection prevention and contamination control products, announces its unaudited results for the year ended 30 June 2019.

The financial highlights section looks good.

- Revenue growth (up 18% to £26.2m)

- Profit margin is high, at 21% adjusted, 18% unadjusted - so a genuinely high margin, not relying on adjustments to flatter it

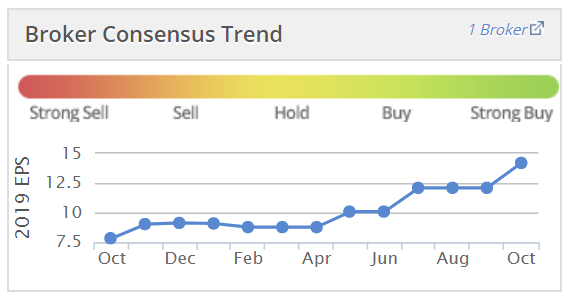

- Adj EPS up 21% to 11.08p - giving a PER of 27.2 - high, so clearly the market is anticipating considerable further profit growth

- Strong balance sheet - including £4.2m net cash - after making 3 small acquisitions

- Dividends - small yield of about 2% , but consistently growing. Historially, the company has topped up the yield with special dividends.

My opinion - the figures look good to me. As regards to what the future holds, I don't feel that any comments from me would add much value. Investors need to make up your own minds - the narrative with today's figures explains the upside potential. A lot of that seems to hinge on breaking into the American market.

Overall, Tristel has delivered a strong track record in the last few years. I suppose investors have to decide whether this business is worth the £134m market cap?

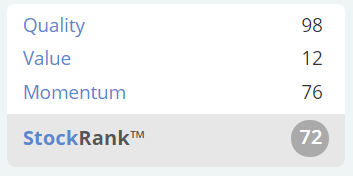

Stockopedia says: very high quality, but expensive;

This year has been brutal for many small caps. Tristel stands out as looking resilient, and bouncing back strongly from share price falls. That suggests to me that it could have scope for another upward move, if it delivers good news in future.

Augean (LON:AUG)

Share price: 134.5p (up 14% today, at 14:16)

No. shares: 104.1m

Market cap: £140.0m

Augean, one of the UK's leading specialist waste management businesses, provides the following trading update.

This is a cracking update;

Due to a strong Group trading performance in the third quarter, the Group's profit for the year to 31 December 2019 is expected to be materially ahead of current published consensus market expectations of an adjusted profit before tax of £16.5m.

I take that as meaning, at least 10% ahead of the £16.5m expectation, so £18.2m+ profit.

What's caused this out-performance?

Results for the year to date have benefitted from a 20% increase in landfill volumes across all waste types, improved landfill pricing by a further 20%, increased radioactive waste profit and a good performance by both the treatment and North Sea businesses.

I thought landfill was supposed to be bad?

Balance sheet - I've checked the most recent one, and it looks OK, with £22.8m net cash as at 30 June 2019.

Due to the nature of the business, it has negligible inventories, so that gives an unusually favourable working capital position overall - i.e. little capital tied up in holding inventories.

Note there is an £8.4m long-term provision of some kind - which is a bit like debt - i.e. it's usually cash out of the door in the future.

Other than that, it all looks fine to me.

Reading through the RNS, there seems to be a possible fine from HMRC of £4.6m, which the company is disputing.

My opinion - I don't really know much about this company, but the figures look great.

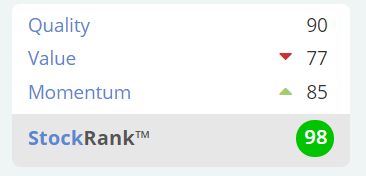

Stockopedia picked up on the strong earnings momentum, one of the reasons why it has a very high StockRank.

I'm curious as to why the company doesn't seem to be paying dividends.

On a brief review today, I see a lot of things to like here, in the numbers. Hence I think Augean looks worthy of a closer look.

I'll leave it there for today. If anything interesting crops up, then I'll put it into tomorrow's placeholder article.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.