Good morning from Paul & Graham!

Today's report is now finished.

Sorry we didn't get round to doing everything, it's just too busy at the moment, so we have to prioritise.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Firstly, 3 stragglers from yesterday:

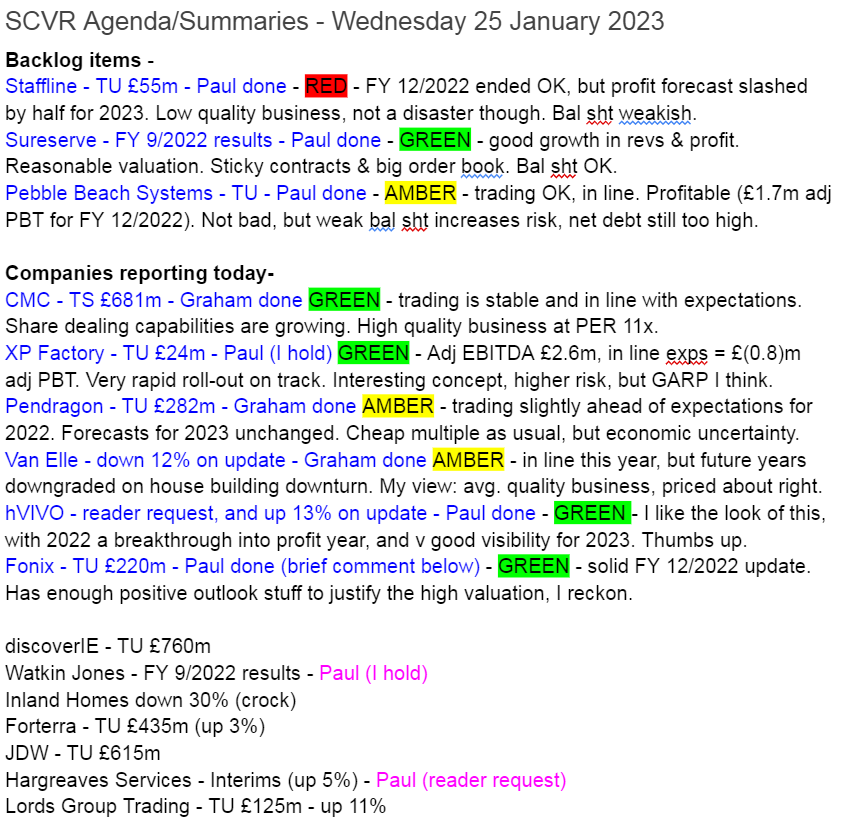

Staffline (LON:STAF)

33p - market cap £55m

Summary: FY12/2022 slightly ahead, cashflow lots ahead, 2023 outlook cautious. Broker slashes 2023 profit forecast by half.

FY 12/2022 underlying operating profit guided at £11.6m (up 13% on 2021), which becomes adj PBT of £9.0m, or 4.7p adj EPS.

Net cash £5.0m (but large working capital, so this could swing about a lot, I reckon - average daily net debt/cash would be more meaningful to report the true picture).

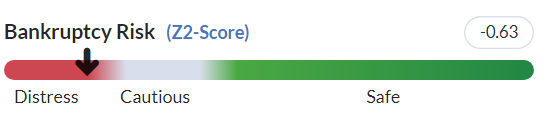

Claims balance sheet is strong, which it isn’t (so how can I trust anything else they say?) - last reported NTAV was negative at £(2)m. Zeus appointed to join Liberum as joint broker - why? Fundraising maybe? Altman agrees with me, not STAF management, with a Z-score that is alerting us to a weak balance sheet -

All was looking reasonably good, until I read broker update today - FY 12/2023 forecast slashed by almost half! (from 5.8p adj EPS to 3.1p) - a tiny sliver of profit, PBT margin is under…