Good morning, it's Paul & Jack here with the SCVR for Wednesday.

Timing - there's not much news today, and I have an investor lunch to attend, so we'll be finished by mid-morning today.

Agenda -

Paul's Section:

Tandem (LON:TND) - trading update for Jan-May 2021, says revenues up 24% vs LY, and profit "considerably ahead". No outlook guidance, and no broker coverage, so we're in the dark. Cost/margin pressures & supply chain problems mentioned, but nothing is quantified.

Insurance sector - FCA ruling on "price walking"

Bigdish (LON:DISH) - operational update on its new meat-free food startup. I've decided to drop coverage, as it's too small & speculative now.

Brickability (LON:BRCK) - big Director selling. Plus a primary placing to fund a significant sized acquisition.

Jack's Section:

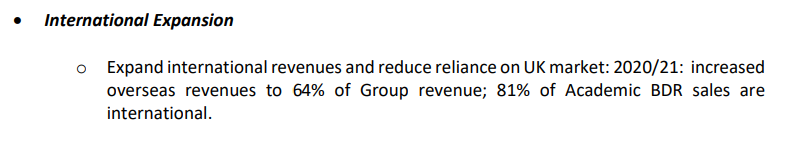

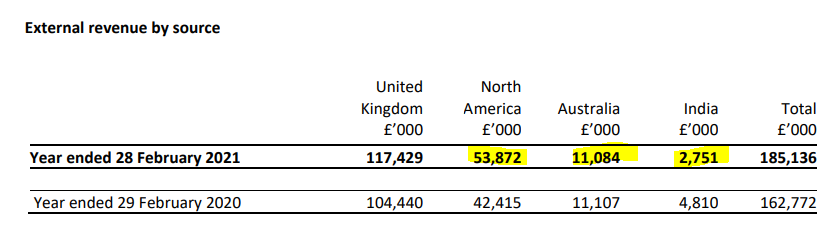

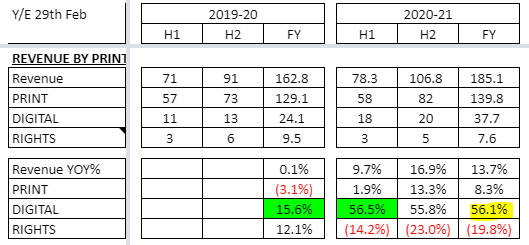

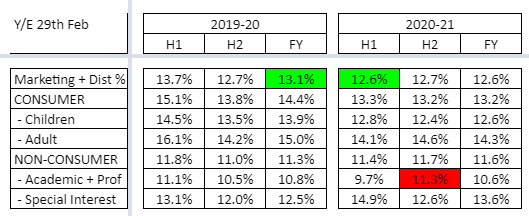

Bloomsbury Publishing (LON:BMY) - third profit upgrade of the year, with momentum carrying on into the new year and expectations revised upwards.

Hargreaves Services (LON:HSP) - transformation continues here but a good run sees the shares priced at around net asset value

.

Paul's Section

Tandem (LON:TND)

665p (pre market open) - mkt cap £35m

This share has had a remarkable run since the covid low in March 2020, rising nearly 6-fold.

The current financial year is FY 12/2021.

Tandem Group plc (AIM: TND), designers, developers, distributors and retailers of sports, leisure and mobility equipment, announces a trading update, arrangements for the 2021 AGM and Board change.

Trading has “remained robust” -

… Group revenue to 31 May 2021 was approximately 24% ahead of the same period last year.

Profitability was also considerably ahead of the prior year augmented by our cost base not yet returning to pre-COVID levels.

- Tougher prior year comparatives, from lockdown 1 (which boosted Tandem) - see update on 28 May 2020, which said bicycle sales were up 77% on 2019

- Bicycle sales this year are up 21% on 2020 - impressive against tough comparatives

- Ebike revenues up 112% - clearly a strong growth area

- B2B division (which I think must be sales to UK retailers) revenues up 32% on last year, for Jan-May 2021 - impressive

- Ben Sayers golf business doing very well - revenue more than doubled vs LY, and order book strong (“well ahead” of last year)

Supply chain problems -

One of…