Good morning from Paul & Graham!

Agenda -

Paul's Section:

Moonpig (LON:MOON) - from yesterday. It's trading in line with previous guidance. Interesting that it doesn't seem to be having a problem with input cost inflation. The company reckons greetings cards are proven to be resilient in previous downturns, but personally I have my doubts. On closer inspection, and following a large acquisition, the balance sheet now looks over-stretched. I think MOON could have taken on too much bank debt, and overpaid for the acquisition, at the worst point in the cycle (as we go into a likely recession).

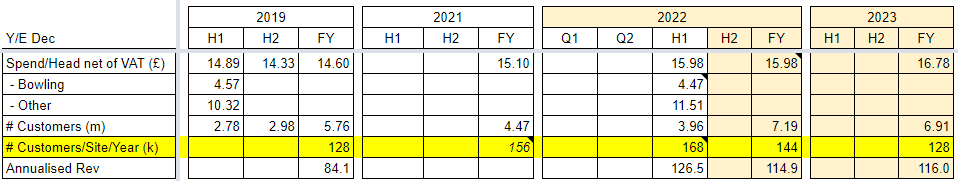

Ten Entertainment (LON:TEG) - impressive interim results. Liberum raises forecast profit for FY 12/2022 and the new forecasts don't look challenging, so I suspect it might out-perform again. Everything looks fine in the numbers, and the PER seems low - providing the "new baseline" of higher sales is maintained. The risk is that we're still seeing an element of pent-up demand, that could subside as consumer incomes are squeezed. On balance, I'm leaning towards a positive view of this share.

WANdisco (LON:WAND) - certainly not a value share, but the strongly rising share price, and a series of big contract wins with the same key customer, does suggest that something interesting might (at long last) be starting here. Continued heavy losses are forecast though.

Cambridge Cognition Holdings (LON:COG) [no section below] - I had a quick look at COG (I hold) shares yesterday, but didn't think there was anything much to say about them. P&L is a bit disappointing, with higher revenues absorbed into higher costs. Balance sheet look fine, as it gets paid cash up-front (at least in part). Order intake & outlook sound good. Probably priced about right for now, but a nice longer-term growth stock, with a strong moat. [no section below].

Graham's Section:

Zoo Digital (LON:ZOO) (£125m) (+11%) [no section below] - we covered this company’s results in July, and I suggested that Zoo finally, at last, had grown into its valuation. Today’s AGM statement and trading update confirm that the company continues to grow at a fantastic pace: H1 revenues +89% to at least $51 million (vs. H1 last year) which also represents growth of 17% sequentially (vs. H2 last year). The company expects “a significant increase in EBITDA, benefitting from operational gearing as…